Bitcoin Price Forecast 2025-2040: Expert Analysis of Technical Indicators and Institutional Adoption

- What Does Bitcoin's Current Technical Setup Reveal?

- How Is Institutional Adoption Shaping Bitcoin's Future?

- What Does the Pi Cycle Top Indicator Suggest About Bitcoin's Future?

- How Are Legislative Developments Impacting Bitcoin Adoption?

- What Are the Key Factors Influencing Bitcoin's Price Trajectory?

- Bitcoin Price Predictions: 2025-2040 Outlook

- Frequently Asked Questions

As we approach mid-2025, bitcoin continues to captivate investors with its volatile yet promising trajectory. This comprehensive analysis examines BTC's current technical setup, institutional adoption trends, and long-term price projections through 2040. We'll explore MicroStrategy's aggressive accumulation strategy, the Pi Cycle Top Indicator's surprising 2027 peak prediction, and how legislative developments like Senator Lummis's mortgage bill could reshape Bitcoin's role in traditional finance. With BTC currently consolidating near $118,000, understanding these multifaceted dynamics becomes crucial for informed investment decisions.

What Does Bitcoin's Current Technical Setup Reveal?

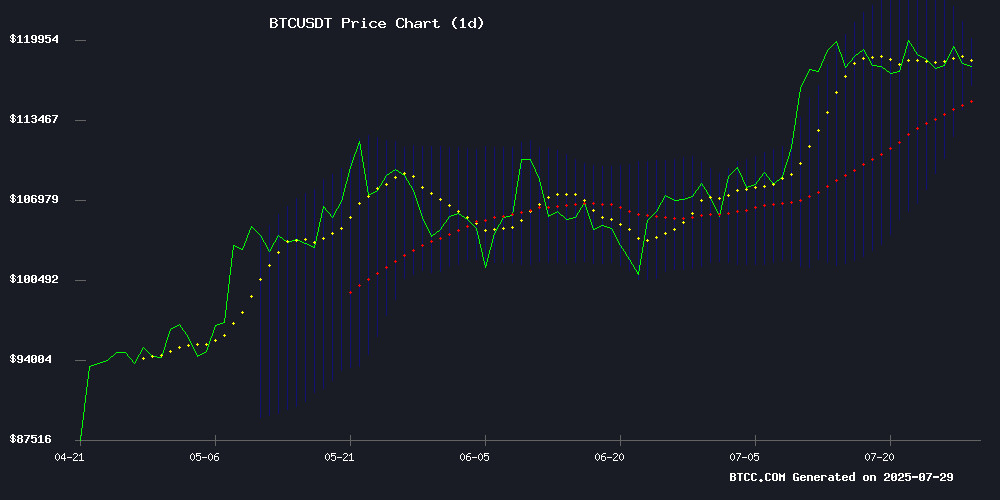

According to TradingView data analyzed by the BTCC team, Bitcoin presents a fascinating technical picture as of July 2025. The cryptocurrency trades slightly below its 20-day moving average at 118,181 USDT, currently hovering around 117,701 USDT. This positioning suggests a period of consolidation following recent gains.

The MACD histogram shows bullish divergence building (-1295 vs signal line -3336), while Bollinger Bands indicate immediate support at 116,283 USDT and resistance at 120,078 USDT. This technical configuration implies BTC is digesting its recent upward movement, with traders watching for a sustained break above the 20MA as potential confirmation of renewed bullish momentum.

Source: BTCC Trading Platform

How Is Institutional Adoption Shaping Bitcoin's Future?

The institutional Bitcoin landscape has reached unprecedented levels in 2025. MicroStrategy, now rebranded as Strategy, has cemented its position as the world's largest corporate Bitcoin holder after completing a $2.521 billion IPO specifically designed to acquire more BTC. The company purchased 21,021 Bitcoin at an average price of $117,256, bringing its total holdings to a staggering 628,791 BTC worth approximately $46.08 billion.

Michael Saylor, Strategy's CEO, has doubled down on his bullish stance, recently describing Bitcoin as humanity's closest approximation to a "Digital Divine Bank." This theological framing reflects growing institutional recognition of Bitcoin's store-of-value properties amid global economic uncertainty.

However, not all institutional stories are positive. Bakkt Holdings saw its stock plummet 40% following a $75 million public offering aimed at transforming into a pure-play Bitcoin infrastructure company. This mixed institutional landscape creates fascinating tension in Bitcoin's price discovery process.

What Does the Pi Cycle Top Indicator Suggest About Bitcoin's Future?

Market analyst Mark Moss has highlighted the Pi Cycle Top indicator's surprising prediction for Bitcoin's current market cycle. Contrary to widespread expectations of a late-2024 peak, this historically accurate tool now forecasts a Q1 2027 cycle top with a potential $395,000 BTC price target.

The Pi Cycle model has perfectly called Bitcoin's previous cycle peaks in 2013, 2017, and 2021. Its current extended timeline aligns with observations by Rekt Capital, who noted recent Bitcoin rallies might signal cycle elongation. This development suggests the current bull run could extend nearly three years beyond typical expectations based on historical intervals.

How Are Legislative Developments Impacting Bitcoin Adoption?

U.S. Senator Cynthia Lummis (R-WY) has introduced the groundbreaking 21st Century Mortgage Act, which could significantly impact Bitcoin's mainstream adoption. The bill WOULD require Fannie Mae and Freddie Mac to consider bitcoin holdings when evaluating single-family home loan applications—without requiring conversion to fiat currency.

This legislative MOVE acknowledges Bitcoin's growing role in modern wealth-building strategies, particularly among younger Americans. By treating Bitcoin as legitimate collateral, the policy bridges decentralized finance with traditional real estate markets—two sectors that have historically operated in separate spheres.

What Are the Key Factors Influencing Bitcoin's Price Trajectory?

Several critical factors are currently shaping Bitcoin's price action:

- Institutional Activity: While Strategy's massive accumulation provides strong support, Bakkt's struggles remind us that institutional adoption isn't uniform.

- Technical Indicators: The current consolidation near key moving averages suggests potential for movement in either direction.

- Macroeconomic Conditions: Federal Reserve policies and global economic uncertainty continue to impact cryptocurrency markets.

- On-Chain Metrics: Recent data shows cooling activity with daily active addresses dipping from 725,000 to 708,000 and transfer volume down 23.1%.

Bitcoin Price Predictions: 2025-2040 Outlook

Based on current technicals, institutional trends, and historical patterns, here are potential bitcoin price ranges through 2040:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | 85,000-150,000 | ETF flows, halving aftermath |

| 2030 | 300,000-500,000 | Institutional adoption, scarcity premium |

| 2035 | 750,000-1.2M | Global reserve asset status |

| 2040 | 1.5M-3M+ | Network effect maturity |

Frequently Asked Questions

What is Bitcoin's current technical outlook?

As of July 2025, Bitcoin shows mixed technical signals. While trading slightly below its 20-day moving average suggests near-term consolidation, bullish MACD divergence indicates potential upward momentum. Key levels to watch include support at 116,283 USDT and resistance at 120,078 USDT.

How significant is MicroStrategy's Bitcoin accumulation?

MicroStrategy (now Strategy) has become the world's largest corporate Bitcoin holder with 628,791 BTC worth approximately $46.08 billion. Their recent $2.521 billion IPO specifically for Bitcoin acquisition demonstrates unprecedented institutional commitment to BTC as a treasury asset.

What does the Pi Cycle Top Indicator predict for Bitcoin?

The PI Cycle Top Indicator, which accurately called previous Bitcoin peaks, now forecasts a Q1 2027 cycle top with a potential $395,000 price target. This contradicts earlier expectations of a 2024 peak and suggests the current bull market might extend longer than historical patterns would indicate.

How might Senator Lummis's mortgage bill impact Bitcoin?

The 21st Century Mortgage Act could significantly boost Bitcoin adoption by allowing it to be considered as collateral for home loans without conversion to fiat. This legislative recognition bridges traditional finance and cryptocurrency, potentially accelerating mainstream acceptance.

What are the key risks to Bitcoin's price outlook?

Potential risks include regulatory changes, macroeconomic instability, technological challenges, and competition from other cryptocurrencies. The recent 40% drop in Bakkt's stock following its Bitcoin-focused offering also highlights that institutional adoption isn't without its challenges.