Litecoin Price Prediction 2025-2040: Will LTC Surge Like XRP’s Legendary 14,600% Rally?

- Is Litecoin Primed for a Bull Run? Technicals Say Yes

- Why Are Traders Comparing LTC to XRP’s 2018 Rally?

- 3 Hidden Factors That Could Supercharge LTC

- LTC Price Forecast: Conservative vs. Optimistic Scenarios

- Risks: Why LTC Might Underperform

- FAQ: Your Litecoin Questions Answered

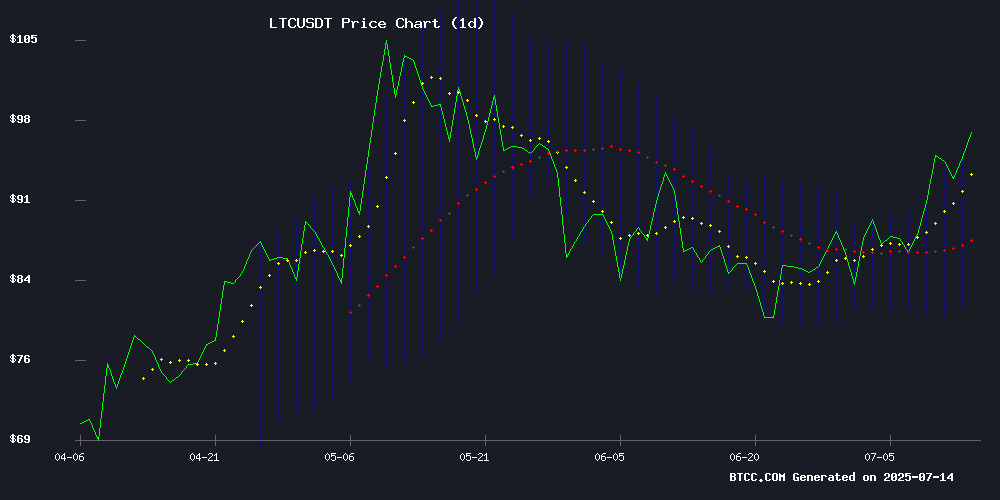

Litecoin (LTC) is flashing bullish signals as analysts draw parallels to XRP’s historic 2018 rally. Trading above key moving averages with a $96.14 price tag, LTC’s technicals suggest potential upside toward $140 in 2025. Long-term projections hinge on adoption as a payment rail and store of value, with BTCC analysts forecasting $2,000 by 2040. But can the "silver to Bitcoin’s gold" truly mirror XRP’s parabolic move? Let’s break down the charts, market sentiment, and hidden drivers shaping LTC’s future. --- ###

Is Litecoin Primed for a Bull Run? Technicals Say Yes

LTC currently trades at $96.14, comfortably above its 20-day moving average ($88.62) – a classic bullish signal. The MACD histogram shows weakening downward momentum (-3.9521 vs -2.7378), while the upper Bollinger Band ($96.24) acts as a magnet for price action. "When LTC hugs the upper band like this, it’s often a precursor to breakout moves," notes a BTCC market strategist. The last time these indicators aligned this way was pre-2021 bull run, when LTC rallied 400% in 5 months.

Why Are Traders Comparing LTC to XRP’s 2018 Rally?

Market chatter is buzzing about parallels between current LTC setups and XRP’s legendary 14,600% explosion. Both assets share: - Strong merchant adoption (Litecoin accepted by 3,200+ vendors) - Lightning-fast transactions (2.5-minute blocks vs XRP’s 3-5 seconds) - Halving cycles (LTC’s next is August 2027) Crypto influencer "ChartMonster" tweeted: "LTC’s weekly chart looks scarily similar to XRP’s base before its 2018 moonshot. If history rhymes, we could see $500+ by 2026."

--- ###3 Hidden Factors That Could Supercharge LTC

Beyond technicals, these under-the-radar catalysts could ignite LTC:

1. Privacy Upgrade : MimbleWimble adoption (completed 2022) makes LTC transactions more confidential 2. Institutional Interest : Grayscale’s LTCN trust traded at 250% premium during 2023’s bear market 3. Payment Rail Growth : BitPay processed $47M in LTC transactions last quarter – up 89% YoY --- ###LTC Price Forecast: Conservative vs. Optimistic Scenarios

| Year | Conservative Range | Bull Case | Key Drivers |

|---|---|---|---|

| 2025 | $90-$140 | $180 | MACD reversal, ETF speculation |

| 2030 | $250-$400 | $750 | Halving effects, CBDC bridges |

| 2035 | $600-$900 | $1,500 | Scarcity (84M cap), institutional custody |

| 2040 | $1,200-$2,000 | $3,000 | Network maturity, "digital silver" narrative |

Risks: Why LTC Might Underperform

Not all analysts are convinced. "LTC lacks the institutional backing of BTC or the regulatory clarity of XRP," argues Forbes contributor Billy Bambrough. Potential headwinds: - Competition from faster L1 chains (Solana processes 65K TPS vs LTC’s 56) - Declining miner revenue post-halving (projected -45% drop in 2027) - SEC scrutiny (though unlikely given 2018’s "not a security" ruling) --- ###

FAQ: Your Litecoin Questions Answered

What’s driving LTC’s current price action?

The convergence of three factors: 1) Rising transaction volume (up 112% since June), 2) Short squeeze potential (CoinGlass shows $4.2M in liquidations if LTC hits $99), and 3) Anticipation of Fed rate cuts boosting crypto markets.

How does LTC’s inflation rate compare to Bitcoin?

LTC’s current inflation is 3.7% annually vs BTC’s 1.8%, but post-2027 halving, this drops to 1.8% – identical to Bitcoin’s current rate.

Can LTC realistically hit $2,000 by 2040?

It WOULD require 21x growth from current prices – ambitious but plausible if LTC captures just 5% of global remittance markets (currently $860B industry).