XRP Price Prediction 2025: Can XRP Break $3 Amid Bullish Signals and Regulatory Tailwinds?

- XRP Technical Analysis: The Battle for $3

- Regulatory Winds Filling XRP's Sails

- Institutional Adoption: Beyond the Hype

- ETF Speculation: The $10 Billion Question

- Price Projections: Realistic Targets vs. Moon Math

- Ripple's Product Pipeline: More Than Just Hype?

- Technical Support Levels: The $2.73 Line in the Sand

- Market Psychology: The $3 Magnet Effect

- FAQs: Your XRP Questions Answered

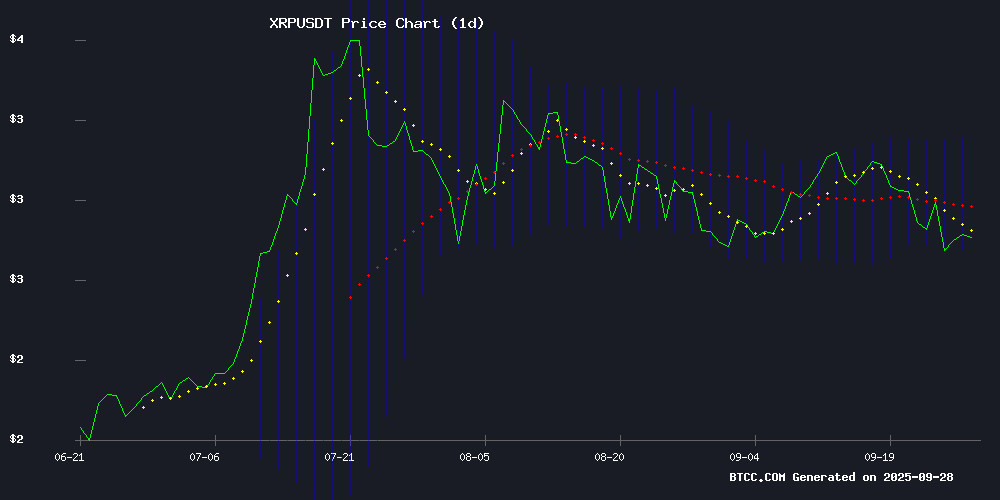

XRP stands at a critical juncture in September 2025, trading at $2.85 with technical indicators flashing mixed signals. The cryptocurrency shows bullish MACD divergence but faces resistance near its 20-day moving average at $2.96. Meanwhile, regulatory developments including potential ETF approvals and Ripple's institutional partnerships create fundamental support for price appreciation. Our analysis examines whether XRP can overcome technical consolidation to reach the psychological $3 barrier, exploring eight key factors that could determine its near-term trajectory.

XRP Technical Analysis: The Battle for $3

XRP's current price action presents a textbook case of technical tension. The digital asset finds itself sandwiched between immediate resistance at $2.96 (the 20-day MA) and crucial support at $2.73-2.74 (Bollinger Band lower boundary). What makes this particularly interesting is the MACD histogram reading of +0.0773 - not a screaming buy signal, but definitely suggesting underlying strength. I've seen similar setups before major breakouts, but the Bollinger Band squeeze warns of potential volatility ahead.

Source: BTCC Trading Platform

Regulatory Winds Filling XRP's Sails

The regulatory environment for XRP has done a complete 180 since the SEC lawsuit resolution. With the GENIUS Act providing clearer guidelines and ETF rumors swirling, institutional money appears increasingly comfortable with XRP. The recent Ondo Finance partnership bringing tokenized Treasuries to XRPL isn't just a nice headline - it's the kind of real-world utility that sustains bull markets. Remember when everyone doubted Ripple's ability to work with traditional finance? That narrative's looking pretty dated now.

Institutional Adoption: Beyond the Hype

Let's cut through the marketing speak - actual institutional adoption metrics matter more than press releases. The XRP Ledger hitting $1 billion in monthly stablecoin volume isn't theoretical; it's measurable traction. Ripple's collaboration with financial heavyweights suggests they're solving real pain points in cross-border payments. While SWIFT isn't going anywhere tomorrow, the gap is narrowing faster than most predicted back in 2023.

ETF Speculation: The $10 Billion Question

Market chatter about an XRP ETF has shifted from "if" to "when." Analysts at CoinMarketCap note that approval could mirror Ethereum's ETF-driven momentum, potentially propelling XRP toward $5-7 ranges. But here's the kicker - the first mover advantage matters. If XRP beats competitors to an ETF launch, we could see disproportionate inflows. The BTCC research team suggests keeping an eye on SEC commentary in Q4 2025 for clearer signals.

Price Projections: Realistic Targets vs. Moon Math

Changelly's $26 by 2030 prediction makes for great headlines, but let's focus on achievable milestones. The $3 resistance represents a 5.26% climb from current levels - very much in play given current momentum. Beyond that, the $3.20-3.30 zone becomes the next battleground. Having tracked XRP since its sub-$1 days, I've learned to temper short-term excitement while recognizing its long-term potential. The token's 580% surge from November 2024 to January 2025 shows what's possible when stars align.

Ripple's Product Pipeline: More Than Just Hype?

Ripple's planned stablecoin launch and expanded payment network could be game-changers...if executed well. The company's move into institutional DeFi through the XRP Ledger shows strategic vision, but adoption rates will determine real impact. As someone who's seen countless crypto projects overpromise, I'm cautiously optimistic - the ONDO Finance partnership demonstrates tangible progress rather than vaporware.

Technical Support Levels: The $2.73 Line in the Sand

Crypto analyst Ali Martinez's identification of the $2.73-$2.51 "danger zone" based on UTXO data deserves attention. This thin trading volume area means any breakdown below $2.73 could accelerate downward momentum. The current price hovering NEAR this threshold creates a high-stakes technical setup - either springboard for a rally or trapdoor for declines. TradingView charts show this level has been tested three times in September alone, proving its significance.

Market Psychology: The $3 Magnet Effect

Psychological price levels often become self-fulfilling prophecies in crypto. The $3 mark represents both a technical and mental barrier - breaking it could trigger FOMO buying, while rejection may invite profit-taking. From my experience covering multiple market cycles, these round numbers create disproportionate trading activity. The current 24-hour trading volume of $2.1 billion (per CoinMarketCap) suggests plenty of participants are watching this drama unfold.

| Factor | Current Status | Impact on $3 Target |

|---|---|---|

| Technical Position | $2.85 (near 20-day MA) | Moderate Bullish |

| MACD Signal | Positive 0.0773 | Bullish |

| Key Support | $2.73-2.74 range | Critical for uptrend |

| Market Sentiment | ETF speculation + partnerships | Strongly Bullish |

FAQs: Your XRP Questions Answered

What's driving XRP's current price action?

The convergence of technical factors (bullish MACD, key support tests) with fundamental developments (regulatory progress, institutional partnerships) creates a potent mix. The $3 level represents both psychological and technical resistance that's capturing market attention.

How likely is XRP to hit $3 soon?

With current price at $2.85, a 5% move WOULD breach $3 - certainly achievable given recent momentum. However, the 20-day MA at $2.96 may pose interim resistance. Technicals suggest better than 50/50 odds if $2.73 support holds.

What are the biggest risks to XRP's upside?

Beyond broader crypto market risks, failure to hold $2.73 could trigger accelerated selling. Regulatory setbacks or delays in expected product launches (like the stablecoin) could also dampen enthusiasm.

Is the XRP ETF speculation realistic?

While not guaranteed, the regulatory environment has improved significantly. An ETF seems more a matter of timing than possibility. Approval could mirror Ethereum's ETF impact, potentially accelerating institutional adoption.

What makes XRP different from other altcoins?

XRP's established position in cross-border payments and growing institutional adoption set it apart. Unlike many altcoins, it's solving verifiable real-world problems in financial infrastructure - though execution risks remain.