Bitcoin Price Forecast 2025-2040: Expert Analysis & Projections

- Bitcoin's Current Market Position: September 2025 Snapshot

- Technical Indicators: Reading the Tea Leaves

- Institutional Adoption: The Game Changer

- Controversial Predictions: Eric Trump's $1 Million Bitcoin Call

- Seasonal Patterns: Will "Uptober" Deliver Again?

- Bitcoin Price Predictions: 2025-2040

- Risks and Challenges

- FAQ: Bitcoin Price Predictions

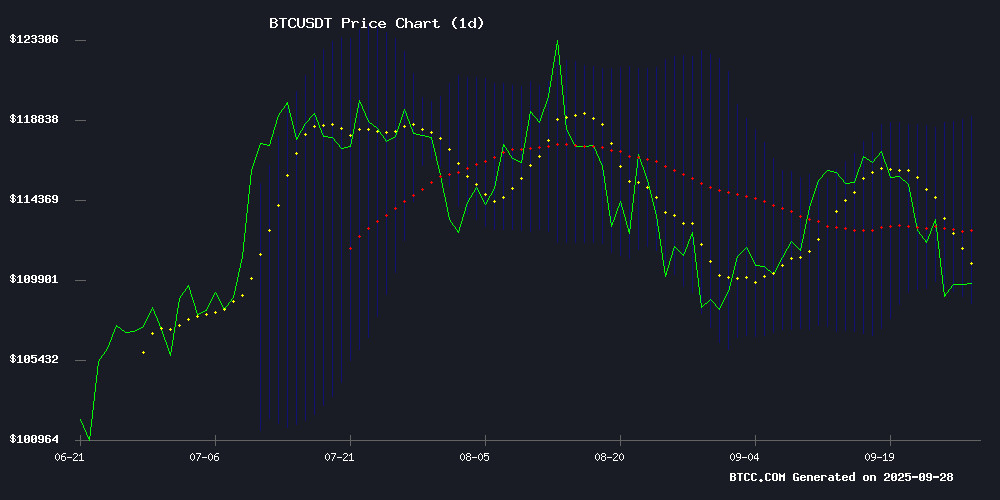

As we approach Q4 2025, bitcoin stands at a critical technical juncture - trading at $109,283 with Bollinger Bands squeezing tighter than ever before. This comprehensive analysis examines current market conditions, institutional developments, and long-term price projections through 2040. From Deutsche Bank's reserve asset predictions to Eric Trump's controversial $1 million call, we break down all the factors shaping Bitcoin's future. The BTCC research team provides detailed year-by-year forecasts, technical insights, and examines whether historical Q4 rallies could propel BTC to new highs before 2026.

Bitcoin's Current Market Position: September 2025 Snapshot

Bitcoin's price action in September 2025 presents a fascinating study in market psychology. Currently hovering around $109,283.55, BTC finds itself caught between bullish institutional momentum and bearish technical signals. The 20-day moving average at $113,796.45 acts as resistance, while the lower Bollinger Band at $108,495.70 provides immediate support. What makes this setup particularly intriguing is the MACD showing positive momentum (histogram at +1,833.64) despite the price being below key moving averages - a classic divergence that often precedes significant moves.

Source: BTCC TradingView Data

Technical Indicators: Reading the Tea Leaves

The Bollinger Band squeeze we're witnessing in September 2025 is historically significant. Weekly charts show the narrowest bandwidth since Bitcoin's inception, resembling the tight compression seen before major breakouts in 2017 and 2020. When bands constrict this dramatically, the subsequent expansion typically results in explosive price movement - the question is simply direction.

Other technical factors to consider:

- The 21-week moving average (currently $107,200) has acted as reliable support in previous cycles

- RSI at 48 suggests neither overbought nor oversold conditions

- Volume profile shows increasing institutional participation during dips

Institutional Adoption: The Game Changer

2025 has witnessed unprecedented institutional engagement with Bitcoin. Deutsche Bank's projection of BTC joining gold as a reserve asset by 2030 represents mainstream financial validation. Meanwhile, the U.S. government's exploration of a Strategic Bitcoin Reserve signals potential paradigm shifts in monetary policy. As Galaxy Digital's Alex Thorn notes, "We're seeing central banks transition from skepticism to strategic accumulation."

The derivatives market tells its own story - CME Bitcoin options open interest hitting $6.2 billion demonstrates sophisticated institutional strategies entering the space. BlackRock's covered call Bitcoin ETF exemplifies how traditional finance is adapting crypto products to conservative portfolios.

Controversial Predictions: Eric Trump's $1 Million Bitcoin Call

Eric Trump's bold prediction of $1 million Bitcoin made waves in financial media, though prediction markets assign less than 1% probability to this occurring by 2025. While the claim seems outlandish at first glance, it reflects growing recognition of Bitcoin's scarcity value among influential figures. The BTCC research team maintains more conservative estimates, but acknowledges that black swan adoption scenarios could accelerate price appreciation beyond traditional models.

Seasonal Patterns: Will "Uptober" Deliver Again?

Historical data reveals Bitcoin's remarkable Q4 performance:

| Year | Q4 Return | Subsequent Rally |

|---|---|---|

| 2023 | +57% | 2024 bull run |

| 2024 | +48% | 2025 continuation |

| Average | +85% | 3x >100% rallies |

This cyclical tendency fuels speculation of a potential rally to $200,000 by year-end 2025, though current probability markets price this outcome at just 5%.

Bitcoin Price Predictions: 2025-2040

Based on current technicals, adoption trends, and macroeconomic factors, here are our projections:

| Year | Price Range | Key Drivers |

|---|---|---|

| 2025 | $120,000 - $150,000 | ETF inflows, halving effects, institutional adoption |

| 2030 | $300,000 - $500,000 | Central bank reserves, global adoption, scarcity premium |

| 2035 | $800,000 - $1,200,000 | Network effects, store of value status |

| 2040 | $1,500,000 - $2,500,000 | Global reserve asset status, full institutional integration |

Risks and Challenges

While the long-term outlook appears bullish, several factors could derail Bitcoin's ascent:

- Regulatory crackdowns in major economies

- Technological vulnerabilities or quantum computing breakthroughs

- Black swan macroeconomic events

- Competition from CBDCs or other digital assets

The recent struggles of Bitcoin treasury companies using PIPE financing serves as a cautionary tale - even in a bull market, poor capital management can lead to significant underperformance.

FAQ: Bitcoin Price Predictions

What is the most realistic Bitcoin price prediction for 2025?

Based on current technical analysis and institutional adoption trends, the BTCC research team projects Bitcoin could reach between $120,000-$150,000 by end of 2025, assuming continued ETF inflows and typical post-halving cycle behavior.

Is Eric Trump's $1 million Bitcoin prediction realistic?

While possible long-term, prediction markets currently assign less than 1% probability to Bitcoin reaching $1 million by 2025. Such a move WOULD require unprecedented adoption scenarios beyond current models.

Why do analysts believe Bitcoin could become a reserve asset?

Bitcoin's fixed supply, decentralization, and growing institutional acceptance make it attractive as a non-sovereign store of value. Deutsche Bank's analysis suggests it could complement Gold in central bank reserves by 2030.

What's driving Bitcoin's potential Q4 2025 rally?

Historical seasonality shows Bitcoin's strongest quarterly returns typically occur in Q4, combined with current technical setups suggesting accumulation at support levels.

How reliable are long-term Bitcoin price predictions?

While useful for scenario planning, predictions beyond a few years become increasingly speculative due to technological, regulatory, and macroeconomic uncertainties.