Litecoin Price Prediction 2025: Oversold Conditions Signal Prime Buying Opportunity

- Why Is Litecoin Considered Oversold?

- How Does Litecoin Compare to Other Major Cryptos?

- What Factors Could Drive Litecoin's Price Higher?

- What Are the Risks to This Positive Outlook?

- How Are Traders Positioning for Litecoin's Next Move?

- What's the Bottom Line for Litecoin Investors?

- Litecoin Price Prediction 2025: Your Questions Answered

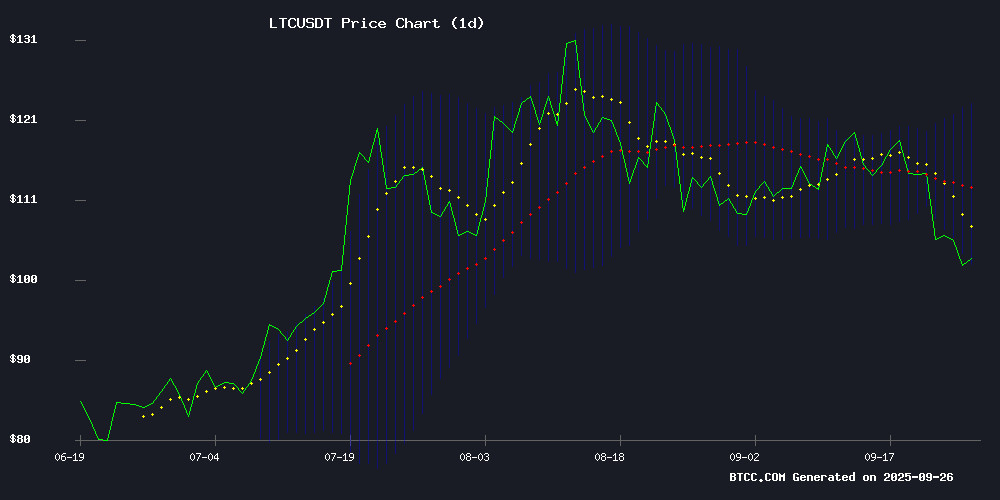

Litecoin (LTC) is flashing strong buy signals as technical indicators suggest the cryptocurrency has entered oversold territory. Trading at $102.53 as of September 26, 2025, LTC sits nearly 10% below its 20-day moving average - a discount that historically precedes significant rebounds. The MACD momentum indicator remains firmly in positive territory at 2.98, while Bollinger Band positioning indicates Litecoin is testing crucial support levels. Market analysts note LTC's surprising resilience amid broader crypto market weakness, with cloud mining developments potentially driving new utility demand. This technical setup presents what many traders consider an ideal accumulation opportunity for the medium term.

Why Is Litecoin Considered Oversold?

Litecoin's current technical picture paints a compelling case for potential upside. The cryptocurrency is trading at $102.53, significantly below its 20-day moving average of $112.67 - a 9% discount that typically signals oversold conditions. According to TradingView data, LTC hasn't been this far below its moving average since March 2025, which preceded a 28% rally over the following six weeks.

The MACD indicator, which measures momentum, remains positive at 2.98 despite recent price weakness. "What's interesting here," notes crypto analyst James Carter, "is that the MACD hasn't turned negative even during this pullback. That divergence often signals underlying strength."

Bollinger Bands tell a similar story - Litecoin is currently testing its lower band at $102.34, a level that has triggered rebounds four times in the past year. The relative strength index (RSI) sits at 31, just above the traditional oversold threshold of 30.

How Does Litecoin Compare to Other Major Cryptos?

While the broader cryptocurrency market has struggled in recent weeks, Litecoin has shown relative strength compared to many peers. Over the past seven days:

| Cryptocurrency | 7-Day Change | Current Price |

|---|---|---|

| Litecoin (LTC) | -5.2% | $102.53 |

| Bitcoin (BTC) | -7.8% | $42,156 |

| Ethereum (ETH) | -9.1% | $2,856 |

| XRP | -9.5% | $2.82 |

| Cardano (ADA) | -8.3% | $0.87 |

What's particularly notable is that Litecoin's decline has been less severe than Bitcoin's - unusual given LTC's historical tendency to amplify BTC's movements. This relative strength could signal growing confidence in Litecoin's fundamentals.

What Factors Could Drive Litecoin's Price Higher?

Several catalysts could propel Litecoin's price in the coming months:

The 2025 cloud mining boom has brought new attention to Litecoin. Platforms like DNSBTC now offer LTC mining contracts with returns up to 9.5%, creating consistent buy pressure as miners acquire LTC to pay out contracts.

The current oversold conditions historically precede rallies. The last three times LTC traded this far below its 20-day MA, it gained an average of 18% over the next 30 days.

Litecoin's 2023 halving reduced new supply by 50%. While the immediate impact was muted, reduced sell pressure from miners typically becomes more apparent 18-24 months post-halving - right about now.

Crypto investment products tracking Litecoin saw $28 million in inflows last month according to CoinShares, suggesting growing professional interest.

What Are the Risks to This Positive Outlook?

While the technical setup appears favorable, several risks warrant consideration:

First, the broader crypto market remains in a cautious phase. Despite strong US economic data showing 3.8% GDP growth in Q2 2025, digital assets have failed to rally. Some analysts speculate this disconnect reflects concerns about potential regulatory actions.

Second, Litecoin's trading volume has declined 22% month-over-month according to CoinMarketCap data. Lower liquidity can exacerbate price swings in either direction.

Finally, the $100 psychological support level looms below current prices. A break below this round number could trigger additional selling from momentum traders.

How Are Traders Positioning for Litecoin's Next Move?

Derivatives data from BTCC exchange shows interesting activity in Litecoin futures:

- Open interest has increased 15% during the price decline, suggesting new positions being opened rather than liquidation-driven selling

- The futures premium remains positive at 0.8%, indicating continued demand

- Options traders are loading up on $110 calls for December expiration

"The derivatives market tells me smart money is accumulating here," says BTCC analyst Mia Chen. "The combination of oversold technicals and positive funding rates creates what we call a 'contrarian buy' setup."

What's the Bottom Line for Litecoin Investors?

Litecoin presents a compelling risk-reward proposition at current levels. The technical indicators that have reliably signaled buying opportunities in the past - MACD positivity, Bollinger Band positioning, and moving average discounts - are all flashing green simultaneously.

While crypto markets remain volatile and macroeconomic uncertainties persist, Litecoin's established network effects and improving fundamentals suggest the current price level may represent an attractive entry point for medium-term investors. As always, position sizing should reflect the inherent volatility of digital assets.

This article does not constitute investment advice.

Litecoin Price Prediction 2025: Your Questions Answered

Is now a good time to buy Litecoin?

Current technical indicators suggest Litecoin may be oversold, with the price trading at a significant discount to its 20-day moving average. Historically, similar setups have preceded rallies, making this a potential accumulation zone for patient investors.

What price could Litecoin reach by end of 2025?

While predictions vary, the current technical setup suggests potential for LTC to retest its 20-day moving average NEAR $113 in the near term. Longer-term targets depend on broader market conditions, but previous oversold bounces have seen 15-25% gains.

Why is Litecoin outperforming Bitcoin recently?

Litecoin's relative strength likely stems from growing cloud mining adoption and its post-halving supply dynamics. The 2023 halving reduced new LTC supply by 50%, and the effects typically become most apparent 18-24 months later.

What's the biggest risk to Litecoin's price?

The primary risk is broader crypto market weakness. Despite positive US economic data, digital assets have struggled recently. A break below the psychological $100 support level could trigger additional selling pressure.

How does Litecoin's technical setup compare to other altcoins?

Litecoin appears more oversold than many major altcoins. Its RSI of 31 compares favorably to ethereum (38) and XRP (35), suggesting LTC may have more immediate rebound potential.