Ethereum Price Prediction 2025: Can ETH Overcome Market Volatility to Hit $5,000?

- What's the Current Technical Picture for Ethereum?

- How Are Institutional Players Positioning Themselves?

- What Historical Patterns Suggest About October's Potential

- How Do Layer 2 Developments Impact ETH's Valuation?

- What Are the Key Price Levels to Watch?

- Can Ethereum Really Reach $33,000 as Some Predict?

- What's the Bottom Line for ETH's $5,000 Prospects?

- Ethereum Price Prediction 2025: Your Questions Answered

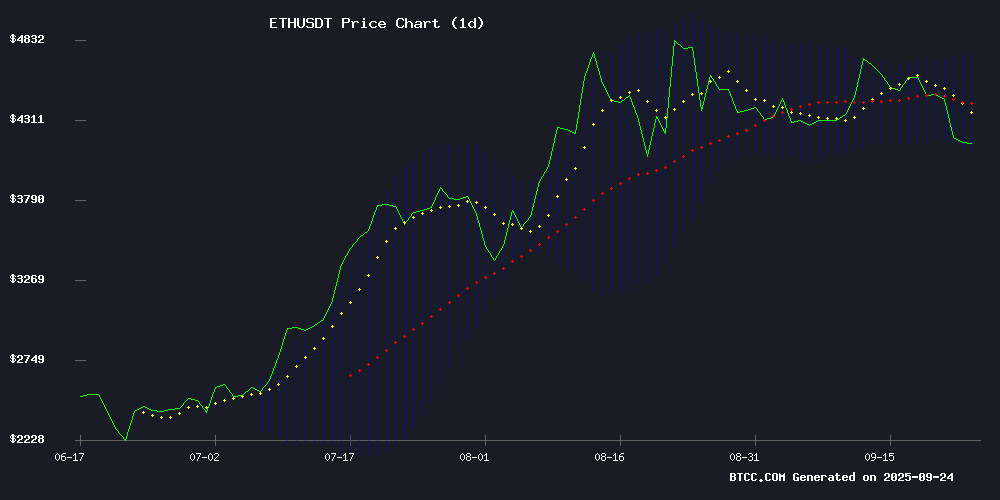

As ethereum battles bearish pressure in September 2025, traders are questioning whether ETH can stage a comeback to reach the psychological $5,000 milestone. Currently trading at $4,183.71, Ethereum faces multiple challenges including a $490 million liquidation wave, institutional accumulation worth $1 billion, and critical technical tests at the $4,100 support level. This analysis combines on-chain data from CoinMarketCap, trading patterns from TradingView, and insights from market analysts to examine ETH's potential path to $5,000 amid conflicting market signals.

What's the Current Technical Picture for Ethereum?

Ethereum's technical setup presents a mixed bag as of September 24, 2025. The price sits below both the 20-day ($4,421.94) and 100-hour moving averages, with the MACD showing negative values (-5.24 histogram) confirming bearish momentum. Bollinger Bands place immediate resistance at $4,741.32 and support at $4,102.56 - levels that have become the new battleground for ETH traders.

Source: BTCC Market Data

The symmetrical triangle breakdown from last week dashed hopes of an immediate push toward $4,600, while the rising wedge pattern breakout now faces its make-or-break retest at $4,100. "ETH needs to reclaim the $4,421 level to signal a potential reversal," notes a BTCC market analyst. Failure to hold $4,100 could see a test of the 100-day MA at $3,880, potentially triggering another 15% drop.

How Are Institutional Players Positioning Themselves?

The institutional landscape shows fascinating contradictions. While ETF redemptions hit $76 million in 24 hours (including BlackRock's $15.1 million ETH sell-off), whale wallets have accumulated $1 billion in long positions during the dip. ETHZilla Corporation's $350 million L2 investment signals long-term confidence, even as market makers like Wintermute execute aggressive repositioning on exchanges.

| Institutional Activity | Impact |

|---|---|

| $1B whale accumulation | Bullish long-term signal |

| $490M liquidations | Short-term volatility |

| ETHZilla's $350M L2 fund | Ecosystem development |

This institutional tug-of-war creates what traders call a "compressed spring" scenario - when opposing forces create pent-up energy that eventually releases in a strong move. The question is which direction that MOVE will take.

What Historical Patterns Suggest About October's Potential

Ethereum's historical October performance offers cautious optimism. Since its launch, ETH has delivered median returns of 0.5% in October, with average gains of 4.7%. While not spectacular, this typically sets the stage for stronger Q4 performance - November's median return jumps to 8.3% historically.

The current setup mirrors 2021's pattern where ETH consolidated in September before launching its final bull market push. However, macroeconomic conditions differ significantly, with 2025's higher interest rates creating headwinds absent in previous cycles. "October tends to be an appetizer before Ethereum's traditional Q4 feast," observes a crypto market historian, "but this year's macroeconomic context changes the recipe."

How Do Layer 2 Developments Impact ETH's Valuation?

The LAYER 2 ecosystem continues evolving despite centralization debates. Vitalik Buterin's defense of Base against centralization criticism highlights Ethereum's ongoing scaling challenges. While Base's non-custodial design protects user funds, its centralized sequencer creates regulatory questions that could impact institutional adoption.

Meanwhile, ETHZilla's restructured financing (0% interest until 2026 on $156.5 million of debt) demonstrates creative capital management in the L2 space. Their $500 million portfolio of yield-bearing assets provides ammunition for strategic deployments that could boost Ethereum's utility - and ultimately its price.

What Are the Key Price Levels to Watch?

Traders should monitor these critical technical levels in coming weeks:

- $4,100-4,125: Current support zone holding as of September 24

- $4,280-4,315: First resistance (50% Fib retracement from recent swing)

- $4,421: 20-day MA and psychological level

- $4,741: Upper Bollinger Band resistance

- $5,000: Psychological target requiring 19.5% rise from current price

The $4,100 support test remains most immediate. A daily close below could trigger stops toward $3,880, while holding might setup a retest of $4,400 resistance. "It's a classic battle between technical traders and fundamental believers," quips one derivatives trader.

Can Ethereum Really Reach $33,000 as Some Predict?

While Egrag Crypto's $33,000 prediction by 2025 makes headlines, current market conditions suggest more modest targets. The Descending Broadening Wedge formation cited in the prediction WOULD require breaking multiple all-time highs in a compressed timeframe - unlikely without massive institutional inflows or ETF approvals.

Vitalik Buterin's "Google Moment" analogy for Ethereum in finance remains compelling long-term, but 2025's regulatory environment and macroeconomic pressures create significant roadblocks. More realistic bull cases suggest $6,500-8,000 if ETH can break its current range, with $5,000 acting as a psychological magnet on the way.

What's the Bottom Line for ETH's $5,000 Prospects?

Ethereum's path to $5,000 in 2025 faces substantial but not insurmountable hurdles. The current technical setup leans bearish short-term, while institutional activity shows conflicting signals. Key factors that could propel ETH higher include:

- Successful $4,100 support hold leading to technical reversal

- Institutional accumulation overcoming liquidation pressures

- Positive regulatory developments for L2 solutions

- Broader crypto market recovery led by Bitcoin

As always in crypto markets, volatility remains the only certainty. Traders should watch the $4,100-4,400 range for clues about ETH's next major move. While $5,000 seems ambitious in the immediate term, Ethereum's strong fundamentals and historical Q4 performance suggest the possibility remains alive - if market conditions align.

This article does not constitute investment advice.

Ethereum Price Prediction 2025: Your Questions Answered

What is Ethereum's current price and technical outlook?

As of September 24, 2025, Ethereum trades at $4,183.71, below key moving averages with bearish MACD momentum. Immediate resistance sits at $4,741.32 (Bollinger Band) while support holds at $4,102.56.

How likely is Ethereum to reach $5,000 in 2025?

ETH would need a 19.5% rally from current levels, requiring it to overcome multiple resistance zones and reverse current bearish momentum. While possible, market conditions suggest this may take several weeks or months to achieve.

What are the biggest risks to Ethereum's price?

Key risks include: breakdown below $4,100 support, continued institutional outflows, regulatory pressure on L2 solutions, and broader crypto market weakness.

Why are analysts comparing Ethereum to Google?

Vitalik Buterin suggests Ethereum could dominate decentralized finance similarly to Google's search engine dominance, calling low-risk DeFi ETH's potential "Google Moment."

How significant were recent Ethereum liquidations?

The $490 million liquidation wave on September 23 marked Ethereum's largest leverage flush since 2021, creating short-term pressure but potentially setting up a healthier market structure.

What makes October important for Ethereum traders?

Historically, October acts as a transition month between weak September and strong November performance, with median returns of 0.5% setting up potential Q4 rallies.