Can Stellar Price Reach $2 in the Next 15 Days?

Stellar (XLM)Can XLM price really surge to $2

Stellar Price Prediction: Is XLM Gearing Up for a Breakout or Breakdown?

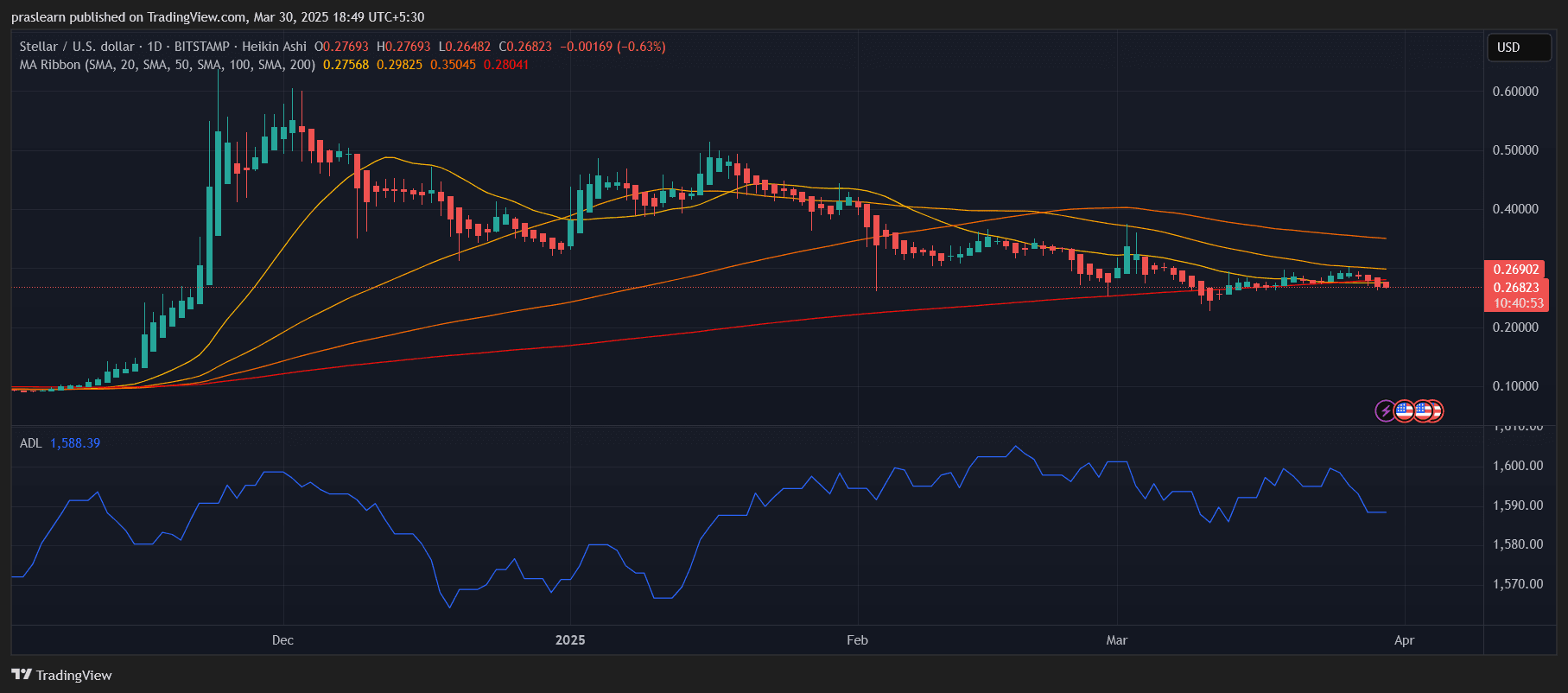

The chart shows Stellar forming a gradual downtrend after its euphoric rally in December 2024, where it briefly peaked near. Since then, the momentum has slowed considerably. The recent candles are Heikin Ashi, which helps smooth out price action and clearly highlights prevailing trends. Right now, we’re seeing mostly small-bodied candles—signs of market indecision and low volatility.

One critical observation is the compression of price action below the. The 200-day SMA lies below the current price, acting as a longer-term support at, which XLM price is now dancing around. This suggests. However, the inability to break above even the 20-SMA athighlights the current weakness in buyer momentum.

What Do the Indicators Say?

The chart includes two critical technical tools:

- MA Ribbon (20, 50, 100, 200 SMA): The moving average ribbon is clearly bearishly stacked—with shorter-term SMAs below longer-term ones, confirming a bearish phase. The price is currently stuck below all key short-term MAs, meaning there’s significant overhead resistance. A bullish breakout would require XLM to first reclaim $0.28, then break above $0.30–$0.35 to reestablish a bullish trajectory.

- Accumulation/Distribution Line (ADL): The ADL currently stands at 1588.39 and shows slight downward slope—indicating that distribution (selling pressure) still dominates over accumulation.There hasn’t been a strong surge in volume that would typically precede a bullish breakout, suggesting smart money hasn’t stepped in yet.

Together, these indicators paint a picture of a, where bulls and bears are in equilibrium—but that could change fast with a news catalyst or Bitcoin-led rally.

Is $2 Realistic in 15 Days?

Let’s be clear: a move fromwould represent a—an extreme and unlikely outcome unless aoccurs, such as:

- A major Stellar adoption announcement

- Integration into a global payments platform

- A broader altcoin season supercycle led by Bitcoin’s parabolic rally

Historically, Stellar is capable of sharp vertical moves during speculative bull runs, but we’re not currently in that environment. For XLM price to break $2, it would need to, including, in rapid succession—all without being rejected. That’s a tall order with current indicators showing low volume, bearish MA alignment, and weak accumulation.

What Price Levels Should You Watch?

If you’re trading or investing in XLM, keep your eyes on the following levels:

- Support: $0.26 (critical short-term support), $0.24 (January low), $0.20 (psychological base)

- Resistance: $0.275 (20-SMA), $0.30 (major resistance), $0.35 (trend reversal confirmation)

A bullish scenario would involve a clean break above $0.30 with volume confirmation, followed by retesting it as support. Awould see XLM lose $0.26 and fall back toward $0.24 or lower.

Stellar Price Prediction: Moonshot or Mirage?

While the crypto market is known for its unpredictability , the technicals don’t support a $2 price target within 15 days for Stellar—at least not without an unexpected explosive trigger. The trend is currently sideways-to-bearish, with multiple moving average resistances capping upside momentum and no strong signs of smart money accumulation.

However, if broader market sentiment improves and XLM price manages to break above $0.35 with volume, a short-term rally toward $0.50–$0.60 is within reach. Until then, traders should stay cautious and watch for breakout signals before betting on a moonshot.