Bitmine’s $6.6B Ethereum Treasury Shockwave: New #2 Crypto Giant Emerges

Move over MicroStrategy—there's a new alpha whale in crypto treasury waters.

Bitmine just bulldozed its way into second place among corporate crypto holdings, amassing a staggering $6.6 billion Ethereum war chest that's rewriting corporate finance playbooks.

The Treasury Arms Race Heats Up

While traditional CFOs still debate Bitcoin ETFs, Bitmine's aggressive accumulation strategy screams conviction—or sheer madness, depending which Wall Street boomer you ask.

Their Ethereum position now represents one of the largest corporate bets on smart contract platforms worldwide, effectively turning their balance sheet into a defi-powered rocket ship.

Institutions Are Watching—And Sweating

This isn't just portfolio diversification; it's a middle finger to cash-heavy treasuries yielding negative real returns after inflation.

Meanwhile, legacy finance analysts scramble to update their discounted cash flow models to account for... well, digital magic internet money that actually appreciates.

One thing's clear: when companies start holding billions in crypto, maybe the 'rat poison squared' crowd should check their own toxic asset portfolios first.

BitMine Becomes The Leading Ethereum Treasury

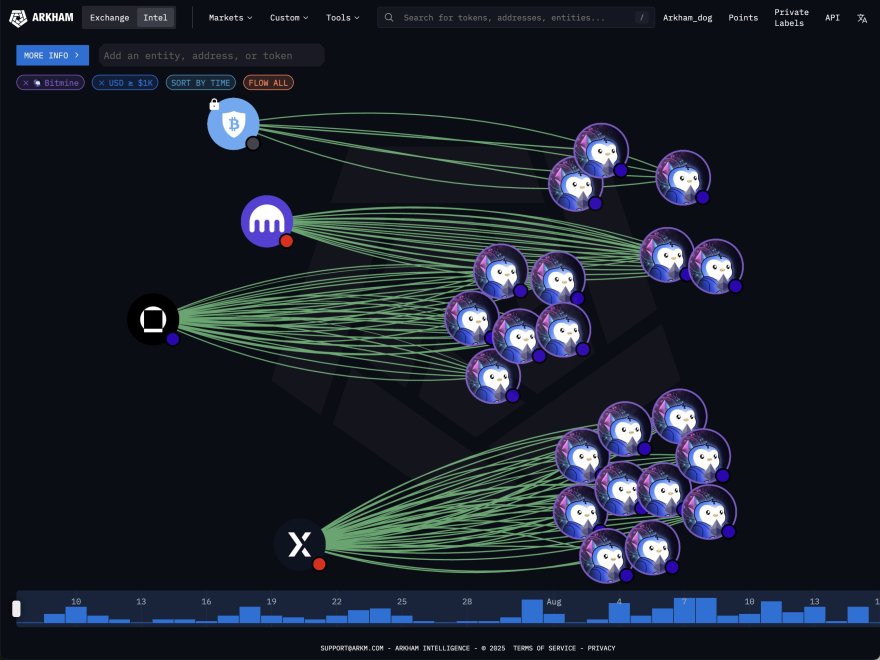

BitMine has cemented its position as the largest Ethereum treasury in the world, now holding over $6.6 billion worth of ETH, up from $4.9 billion just last week. This rapid increase highlights the company’s aggressive accumulation strategy and its conviction in Ethereum’s long-term value. The treasury currently accounts for 1.52 million ETH, making BitMine the undisputed leader in Ethereum corporate holdings.

Globally, BitMine now ranks as the second crypto treasury company overall, second only to Michael Saylor’s Strategy, which dominates Bitcoin holdings. This milestone underscores the shifting landscape of institutional crypto adoption, where Ethereum is increasingly being recognized as more than just the leading smart contract platform — it is becoming a core reserve asset.

Notably, BitMine now holds more ETH than Sharplink Gaming, The Ether Machine, and The Ethereum Foundation combined. This marks a turning point in the treasury race, where corporations are no longer competing on bitcoin alone but are diversifying into Ethereum at unprecedented levels.

This growing trend is likely to continue as ETH gains momentum, supported by strong institutional demand, ETF inflows, and broader adoption across decentralized finance and real-world asset tokenization. Analysts believe that if BitMine maintains its current pace, its treasury strategy could reshape how companies manage long-term reserves in the digital economy.

ETH Facing Critical Test

Ethereum is currently trading NEAR $4,310 after a sharp retrace from its recent peak above $4,790. The chart highlights that ETH has entered a consolidation phase after weeks of strong bullish momentum, with price now testing key support levels.

The 50-day moving average is trending upward and currently sits near $3,560, well below current price levels, signaling that the broader bullish structure remains intact. Meanwhile, the 100-day and 200-day moving averages at $3,048 and $2,575, respectively, also confirm strong long-term support. This alignment suggests that despite the pullback, Ethereum’s broader trend is still positioned for growth.

If ETH manages to hold this level, a rebound back toward resistance at $4,600–$4,800 is likely in the short term. However, a breakdown below support could open the door for a deeper retrace toward $3,800. The coming sessions will be key to determining direction.

Featured image from Dall-E, chart from TradingView