Norway’s $1.4T Wealth Fund Quietly Amasses $860M Bitcoin Stake—Without Owning a Single Coin

Oil money meets digital gold—just don't call it a direct investment.

The world's largest sovereign wealth fund—Norway's $1.4T behemoth—now has skin in the crypto game. Through a web of tech stock holdings, it's riding Bitcoin's coattails to the tune of $860M. Not bad for an institution that still publicly scoffs at 'speculative assets.'

Indirect exposure, direct profits

While Oslo's bureaucrats debate whether to officially bless Bitcoin, their fund managers found a loophole: loading up on Bitcoin-adjacent equities. MicroStrategy shares? Check. Crypto-mining stocks? Naturally. Even Coinbase holdings—because why touch the asset when you can profit from its volatility?

The ultimate hedge fund flex

This is passive-aggressive investing at its finest—getting crypto upside while maintaining plausible deniability at parliamentary hearings. Meanwhile, retail traders get margin-called holding actual BTC. The irony? Norway's oil-funded piggybank now benefits more from Satoshi's invention than most Bitcoin maximalists.

Finance's open secret: Everyone wants crypto exposure—just not the paperwork.

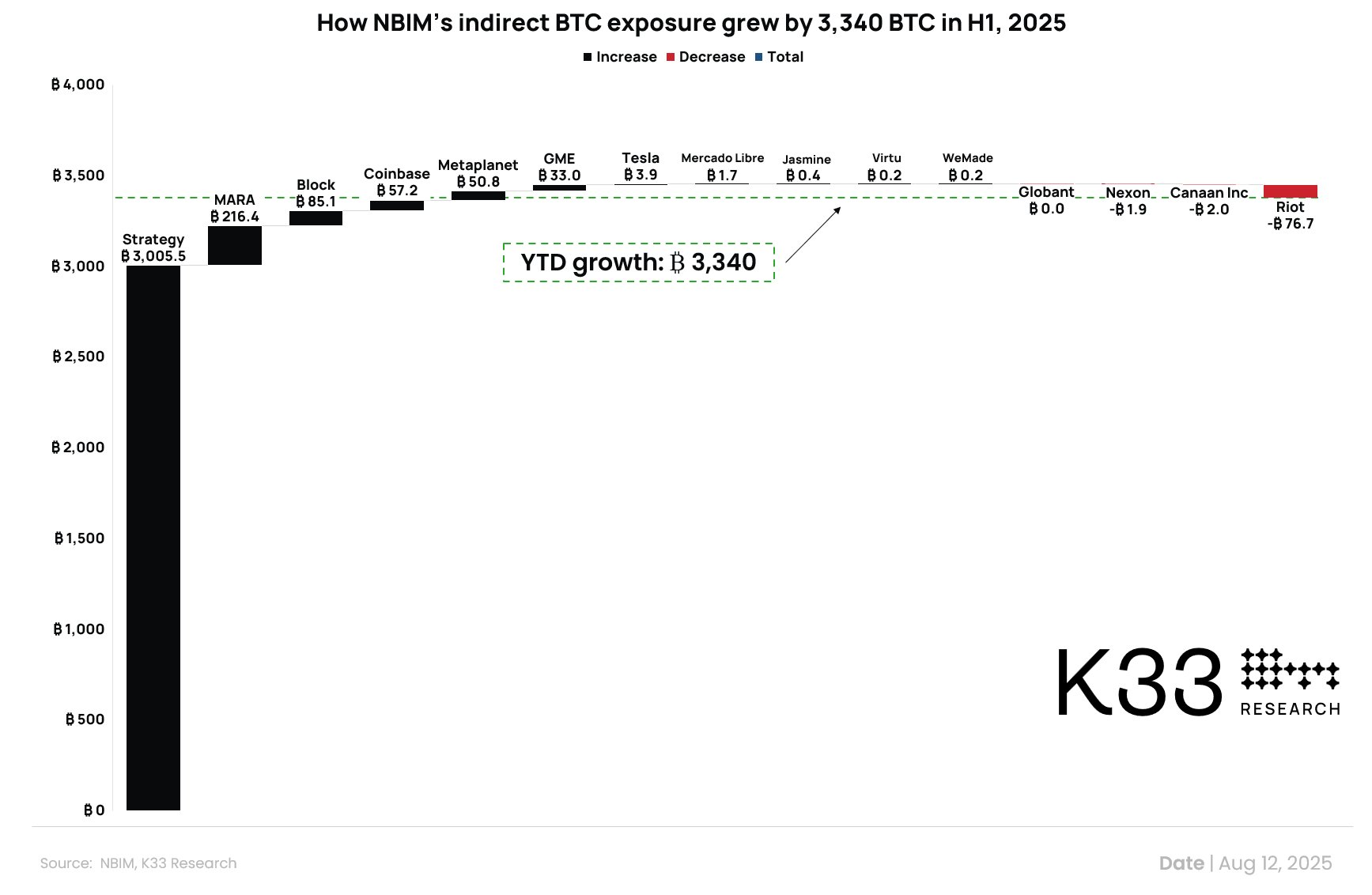

Growth Driven by Strategy Holdings and Corporate BTC Accumulation

The most significant contributor to NBIM’s increased Bitcoin exposure is its stake in business intelligence and corporate BTC treasury firm Strategy.

NBIM’s ownership in the company ROSE to 1.05% of its shares, valued at $1.18 billion at the end of June, up from 0.72% ($514 million) at the end of 2024. Strategy itself expanded its BTC holdings by 145,945 BTC in the first half of 2025, which added 3,340 BTC to NBIM’s indirect exposure over the same period.

Additional exposure came from holdings in other public companies with sizeable Bitcoin reserves. Firms such as Block, Coinbase, MARA, and Metaplanet have increased or maintained significant BTC balances, further contributing to the upward trend.

Lunde pointed out that per capita, NBIM’s Bitcoin exposure now amounts to roughly 1,387 Norwegian kroner, or about $138, for each Norwegian citizen.

Broader Market Context and Currency Considerations

Lunde emphasized that this growing indirect exposure aligns with a wider market pattern: any investor with a diversified equity portfolio today is likely to have some exposure to Bitcoin through corporate holdings.

He expects this trend to strengthen as more companies allocate to BTC as part of their treasury strategies. “Odds are high that any index investor or broadly diversified investor currently holds a modest BTC exposure through proxies,” Lunde said, adding that the phenomenon is likely to accelerate over time.

The report also placed the fund’s Bitcoin exposure within the context of BTC’s recent market performance. In US dollar terms, BTC reached an all-time high of more than $123,000 in July, up 11.9% from its January 20 level.

However, gains are less pronounced in other currencies, with BTC up only 1.5% against the US dollar index and still below January highs in euros. According to Lunde, €105,600 remains a key resistance level for BTC in euro terms, highlighting the role of currency fluctuations in assessing Bitcoin’s price performance globally.

NBIM’s growing indirect stake in Bitcoin demonstrates how exposure to the asset class can expand organically within large, diversified portfolios. Whether driven by deliberate allocation or as a byproduct of equity investments, the trend reflects Bitcoin’s deepening presence in global financial markets.

Featured image created with DALL-E, Chart from TradingView