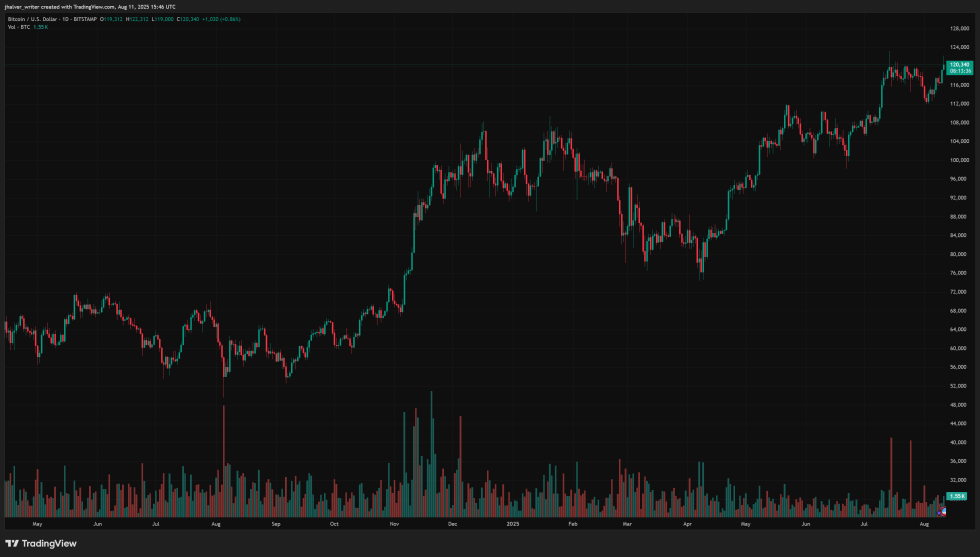

🚀 Bitcoin Blasts Past $122K as ETF Mania and Corporate FOMO Fuel Run Toward ATH

Wall Street's latest gold rush sends BTC into orbit—just don't ask about the volatility hangover.

The ETF effect hits hyperdrive

BlackRock's paper bitcoin printers are running overtime as institutional cash floods the market. Suddenly every hedge fund manager remembers they 'always believed in crypto'—right after their third martini.

Corporate treasuries jump aboard

From MicroStrategy's Michael Saylor to your neighborhood publicly-traded meme page, balance sheets are getting orange-pilled. Because nothing says 'innovative accounting' like parking cash in a decentralized casino.

The rally defies gravity—for now. But with the Fed still eyeing rate cuts and Wall Street discovering blockchain like it's 2017 again, this rocket might not need landing gear anytime soon. Just maybe pack a parachute.

Trump’s Pro-Crypto Policies Ignite Wave of Bitcoin Optimism

A major catalyst has been President Donald Trump’s recent executive order enabling 401(k) retirement plans to invest in cryptocurrencies. This policy could open up $9 trillion in retirement assets to Bitcoin, potentially driving significant long-term demand.

Technical indicators remain bullish. The daily RSI sits at 67.7, signaling strong momentum without entering overbought territory, while the MACD has posted a bullish crossover.

Analysts believe a decisive break above $123K could trigger algorithmic buying and retail FOMO, pushing BTC toward the $126K–$129K range.

Bitcoin’s rally has helped lift the total cryptocurrency market capitalization to an all-time high of $4.14 trillion. Ethereum (ETH) also surged, crossing $4,300 for the first time since 2021, supported by $4 billion in institutional inflows and the launch of ETH-focused ETFs.

Despite the bullish trend, sentiment remains measured. The Crypto Fear & Greed Index stands at 70/100, indicating enthusiasm but avoiding extreme euphoria. Google search interest for Bitcoin has also risen modestly, suggesting room for further retail participation.

With institutional inflows strong, corporate adoption rising, and regulatory clarity improving, analysts say Bitcoin is well-positioned for another leg higher. A clean break above $123K could open the door to $130K in the NEAR term, and potentially $150K by year-end if macroeconomic conditions remain favorable.

Cover image from ChatGPT, chart from Tradingview