$1 Billion Floods SOL & XRP Futures ETFs—Are Spot ETFs the Next Crypto Gold Rush?

Crypto's institutional invasion hits warp speed—futures-based SOL and XRP ETFs just vacuumed up $1 billion in capital since launch. Wall Street's hedging its bets, but retail's still waiting for the main event.

When do the spot ETFs land?

The futures ETF surge proves demand isn't vaporware—even if the products are just synthetic exposure wrapped in Wall Street's usual fee-laden packaging. Now regulators face mounting pressure to approve the real deal.

Solana and XRP join Bitcoin and Ethereum in the big leagues. The trillion-dollar question: Will spot ETFs trigger the next liquidity tsunami, or just let TradFi take another bite of crypto's upside while dumping risk on retail?

SOL & XRP Futures ETFs Hit New Milestone

In an August 9 post on the X platform, the president of The ETF Store, Nate Geraci, revealed that the futures-based solana and XRP ETFs have attracted over $1 billion in capital since launch. These crypto-linked investment products started trading in the United States about five months ago—around March (for SOL ETF) and April (for XRP).

For context, futures-based exchange-traded funds are a type of investment product that holds the futures contracts of an asset. A futures contract is a financial instrument that allows an investor to buy an asset at a predetermined price on a predetermined date.

In March 2025, Volatility Shares launched the first-ever Solana exchange-traded funds in the United States. The firm rolled out two products at the time: Volatility Shares’ Solana fund, which replicates the performance of Solana futures, and the 2x SOL ETF that offers double-leveraged exposure.

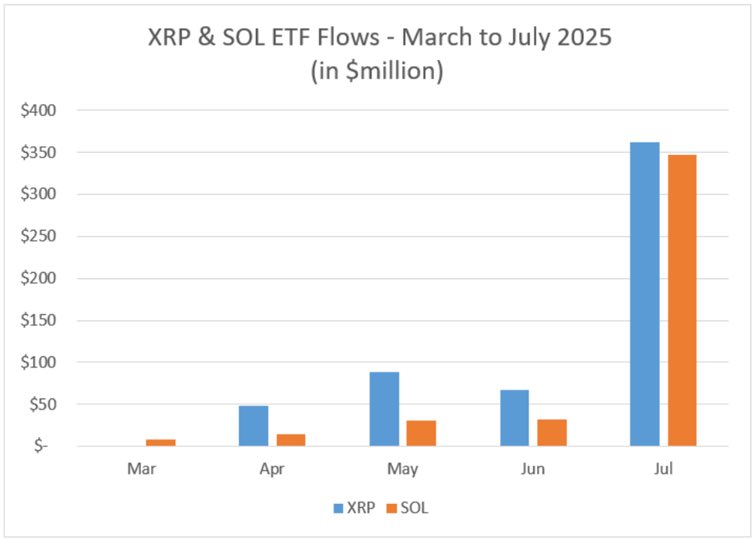

While Teucrium launched the first US-based XRP ETF (a 2x Leveraged fund) in April, Volatility Shares offered the first non-leveraged futures-based XRP exchange-traded fund in May. As shown in the chart below, both the SOL and XRP ETFs had posted only modest monthly performances up until July—where they each posted approximately $350 million in capital inflows.

Geraci noted that these figures include REX-Osprey’s Solana staking exchange-traded fund, which boasts up to $150 million in assets under management. According to the ETF expert, this performance proves that there will be demand for spot SOL and XRP ETFs.

Expert Doubles Down On BlackRock’s Application For SOL And XRP ETFs

It is worth mentioning that a slew of applications from various asset managers are awaiting approval from the United States Securities and Exchange Commission (SEC) to launch Solana and XRP ETFs. As reported by Bitcoinist, BlackRock has indicated that it currently has no plans to join the race for spot Solana and XRP ETFs.

In a second post on X, Geraci reiterated his belief that BlackRock would be looking to expand its crypto ETF portfolio. “And I’m being told BlackRock doesn’t want a piece of this?” the ETF expert said, referring to the attention being enjoyed by the future-based version of the XRP exchange-traded fund.

Featured image from Pexels, chart from TradingView