Bitcoin Investors Cash In: Record Realized Profits Flood Market Amid Bullish Rebound

Profit-taking hits fever pitch as BTC holders seize the rally.

### The Great Bitcoin Cash-Out

Wallets are flashing green across the board—long-term holders finally unloading stacks after weathering crypto winter. On-chain data shows the highest realized profit spikes since the 2021 bull run.

### Paper Hands or Smart Money?

Retail traders aren’t the only ones booking gains. Whale clusters suggest institutional players are quietly rotating positions—because nothing says 'mature asset class' like hedge funds doing the same panic-selling as Reddit traders.

### The Bull Trap Paradox

Every sell order fuels the FOMO. With spot ETF inflows still strong and the halving supply crunch looming, this 'pullback' might just be rocket fuel. Or the smartest exit since Mt. Gox creditors started getting paid.

Realized Bitcoin Profits Climb Sharply

With bitcoin reclaiming key resistance levels, investors are seeing a noticeable upswing in gains from their positions. Glassnode, a leading on-chain data analytics platform, has reported a surge in BTC’s realized profits, signaling a shift in its market dynamics.

Related Reading: Bitcoin On-Chain Alert: Profit-Taking Intensifies As Net Realized Profits See Sharp Increase

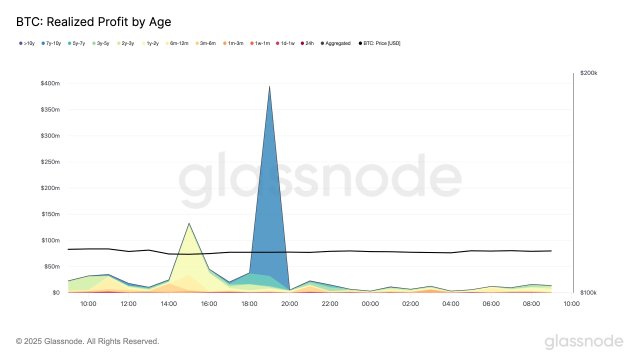

On-chain data shared by Glassnode shows that Bitcoin holders realized more than $1 billion in profit within a 24-hour period. The increase in realized gains is indicative of a resurgence of optimism in the cryptocurrency market, as both institutional and retail players are seizing the chance to lock in profits following volatile times.

Analyzing the realized profits by age, it was observed that Bitcoin holders from 7 to 10 years old were the top earners, as these key investors begin to capitalize on recent price movements. During the period, these investors, often considered as ancient holders, amassed gains of over $362 million, representing about 35.8% of the overall realized profits.

According to the on-chain platform, these substantial profits amassed by these cohorts are a rare event that may reflect internal transfers or true exits. The pattern indicates increased activity on the blockchain.

Glassnode further noted that BTC holders with a holding period of 1 to 2 years also experienced a profit following recent price spikes. These investors, classified as long-term holders, saw $93 million, also marking notable profit realization.

Large And Small BTC Investors On A Buying Spree

In another X post, Glassnode has outlined a bullish behavior among Bitcoin investors towards the crypto king, both large and small holders. During recent market dips, these investors displayed robust interest in BTC, reflecting growing trust in its long and short-term prospects.

Related Reading: Old Bitcoin Wallets Reactivate: Untouched BTC Movements Close In On 2024 Peak

According to the data, the average amount held by retail investors and ultra-large holders has increased over the last 15 days. The ultra-large holders here represent wallet addresses holding at least 10,000 BTC, while retail investors represent wallet addresses holding below 1 BTC.

Glassnode noted that the accumulation points to early dip-buying during the most recent adjustment. However, the signal is trailing, showing behavior that has been smoothed over a period of 15 days.

At the time of writing, BTC was trading at $114,911, demonstrating a nearly 1% increase in the last 24 hours. Meanwhile, investors’ sentiment is slowly turning bearish as evidenced by its trading volume, which has dropped by over 5% in the past day.