Bitcoin Hits ATH Yet Q2 2025 Trading Volume Stagnates – What’s Really Going On?

Bitcoin's latest all-time high (ATH) failed to move the needle where it counts—Q2 2025's average daily trading volume flatlined. Here's why the hype didn't translate into action.

The ATH Mirage: Price peaks don’t always equal market momentum. While Bitcoin smashed records, traders stayed sidelined—proving once again that crypto markets love drama more than volume.

Institutional Cold Feet? Wall Street’s crypto ETFs might be raking in assets, but the big players aren’t flipping coins like retail degens. Another case of ‘buy the rumor, hold forever.’

The Cynic’s Take: If a Bitcoin ATH falls in a forest and no volume hears it… did it even happen? (Spoiler: Your bagholder friends will say yes.)

Bitcoin Record Highs Fail To Boost Daily Trading Volume

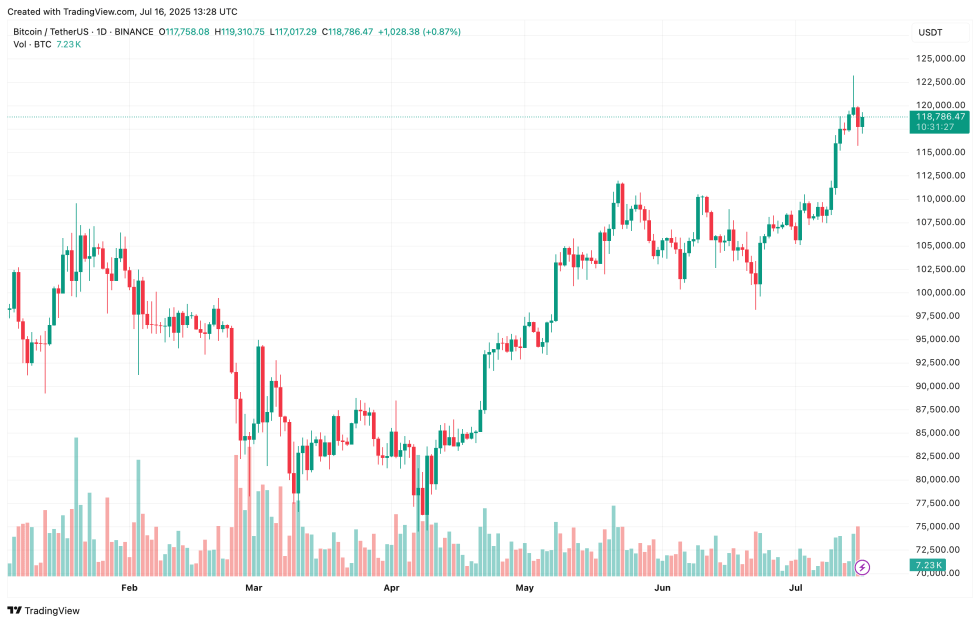

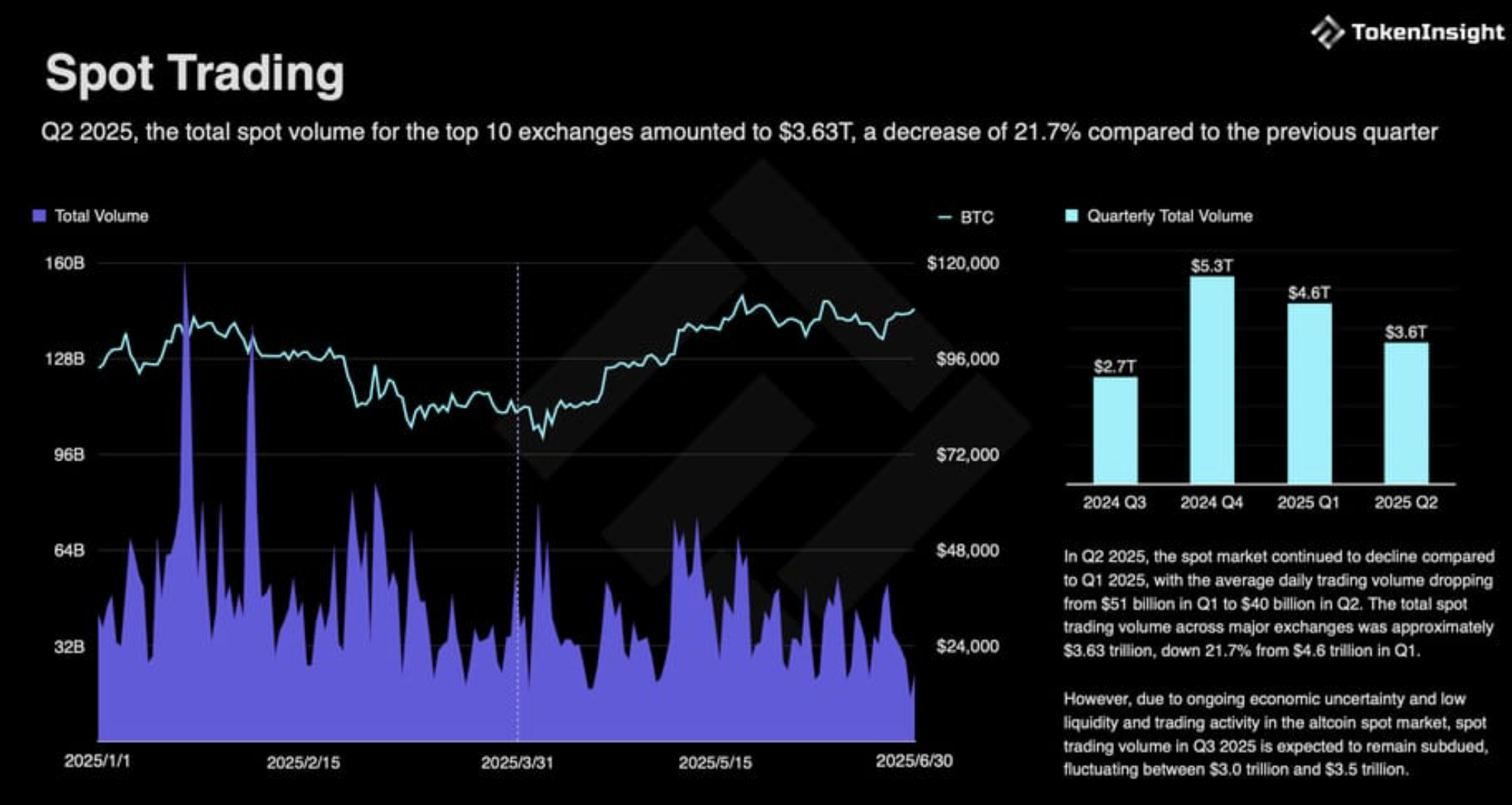

According to a report published today by TokenInsight, the crypto spot market trading volume experienced a decline in Q2 2025 compared to Q1 2025 – despite Bitcoin rising from a low of $83,000 to a high of $111,900, and closing the quarter near $106,000.

The report notes that average daily trading volume fell from $51 billion in Q1 2025 to around $40 billion in Q2 2025, representing a drop of approximately 10%. Meanwhile, total spot trading volume across all exchanges slumped from $4.6 trillion to $3.6 trillion over the same period.

Looking ahead, spot trading volume in Q3 2025 is expected to remain subdued, due to ongoing macroeconomic uncertainty, weak liquidity, and sluggish trading activity in the altcoin market. TokenInsight predicts total spot volume in Q3 to range between $3 trillion and $3.5 trillion.

Interestingly, the spot market’s share of total trading volume declined across most exchanges. Only MEXC and Bitget bucked the trend, increasing their spot trading shares by 2.70% and 0.66%, respectively.

As traders continue to hedge risks and capitalize on volatility, high-frequency derivatives trading remained the preferred strategy, consistent with Q1 2025 trends. The report noted:

This trend also underscored a sharper downturn in the spot market, as liquidity and trading activity in many altcoins dropped significantly, in contrast to the relative resilience of derivatives markets.

That said, derivatives volume also pulled back slightly, falling 3.6%, from $20.9 trillion in Q1 2025 to $20.2 trillion in Q2 2025. While the US Federal Reserve’s temporary rate pause lifted markets in April, rising geopolitical tensions dampened investor appetite for risk-on assets.

Binance Reigns Supreme Amid Tumultuous Quarter

In Q2 2025, Binance remained the dominant exchange, capturing 35.39% of total trading volume – the only platform to hold more than one-third of the market. However, this marked a slight drop from 36.57% in Q1 2025.

Meanwhile, five exchanges – OKX, Bitget, HTX, Gate, and KuCoin – saw gains in market share. Gate led the pack with a 2.55% increase, followed by OKX with a 1.08% rise.

Despite the muted Q2 trading volumes, liquidity is expected to continue flowing into the digital asset space, fueled by the ongoing rise in stablecoin market capitalization. At press time, bitcoin trades at $118,786, up 0.9% in the past 24 hours.