Bitcoin Mining Difficulty Skyrockets 8%—Here’s Why It Matters in 2025

Bitcoin’s mining difficulty just blasted through another ceiling—jumping 8% in its latest adjustment. Here’s what’s fueling the surge.

More Miners, Bigger Problems

The network’s self-correcting mechanism is working overtime as hash rate climbs. Translation? The gold rush is back on—with rigs fighting harder than Wall Street traders for the last slice of liquidity.

Profit or Pain?

Higher difficulty means slimmer margins for small players. Survival now demands industrial-scale ops or dirt-cheap energy—good luck finding either without VC backing or a shady power deal.

The Bullish Silver Lining

Every upward adjustment screams one thing: institutional confidence. Miners don’t deploy capital unless they’re betting on higher prices ahead. Meanwhile, your bank’s savings account still yields less than a hardware wallet full of memecoins.

Bottom line: The network’s growing pains are your gain—if you’ve got the stomach for volatility. Just don’t expect central bankers to understand.

Bitcoin Difficulty Has Seen An 8% Jump In Latest Adjustment

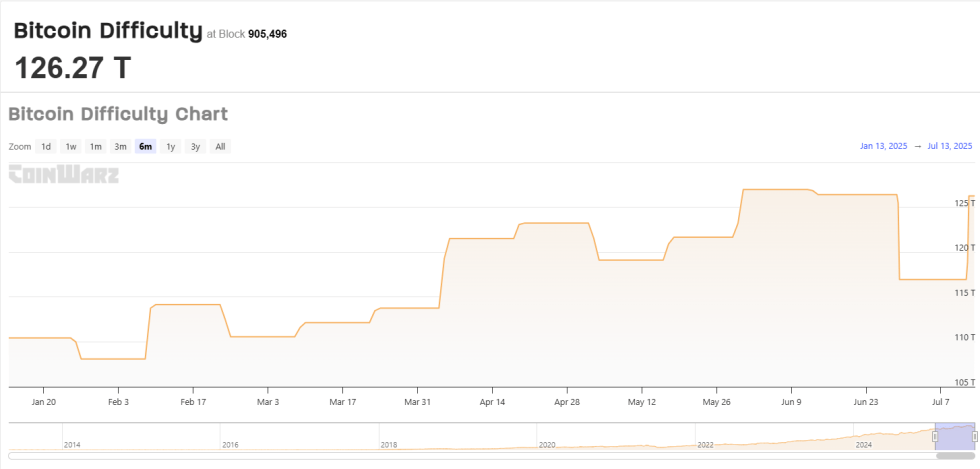

According to data from CoinWarz, the most recent BTC Difficulty adjustment made things harder for the miners. The “Difficulty” here refers to a feature built into the bitcoin blockchain that controls how hard the validators would find it to mine blocks on the network right now.

The metric is controlled entirely by the code that Satoshi wrote in and automatically changes its value about every two weeks, according to network conditions at the time.

The pseudonymous creator of the cryptocurrency had one goal in mind when creating the Difficulty: the network must not deviate from a standard block time of 10 minutes per block.

Whenever the miners are faster than this rate (that is, they mine a block in fewer than 10 minutes on average), the network reacts by raising the metric, in order to slow the validators back down to the intended speed. Similarly, the blockchain reduces the Difficulty if miners are unable to hit the target time.

The latest network adjustment occurred this past weekend. Here’s a chart that shows how the Difficulty changed during it:

Prior to the adjustment, the Bitcoin Difficulty stood at 116.9 terahashes, but now, it has jumped to 126.2 terahashes. This reflects a very notable rise of almost 8%.

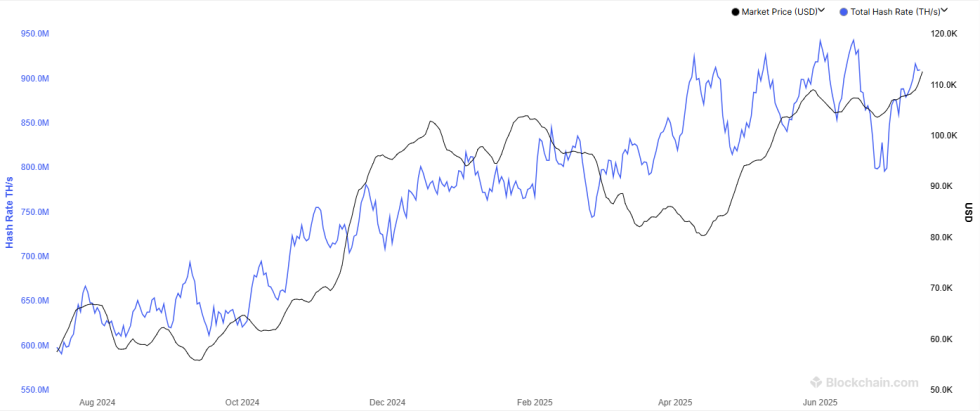

Considering the increase, it WOULD appear that the miners were significantly faster at their task during the last couple of weeks compared to the norm. Miners speed up whenever they add more computing power to their facilities. And indeed, the trend in the Hashrate, a metric keeping track of the miners’ total computing power, confirms that the validators have aggressively been expandingrecently.

As the above chart from Blockchain.com shows, the 7-day average Bitcoin Hashrate had plummeted earlier, which had caused a steep drop in the Difficulty. But since the low, miners have expanded back up and while the metric isn’t back at the all-time high (ATH) yet, it has come close.

Now that things are difficult for the miners again, though, it remains to be seen how long these upgrades would stick around. Miners that are just breaking-even can get pushed underwater by spikes in Difficulty and they usually respond by disconnecting their machines, causing a drop in the Hashrate.

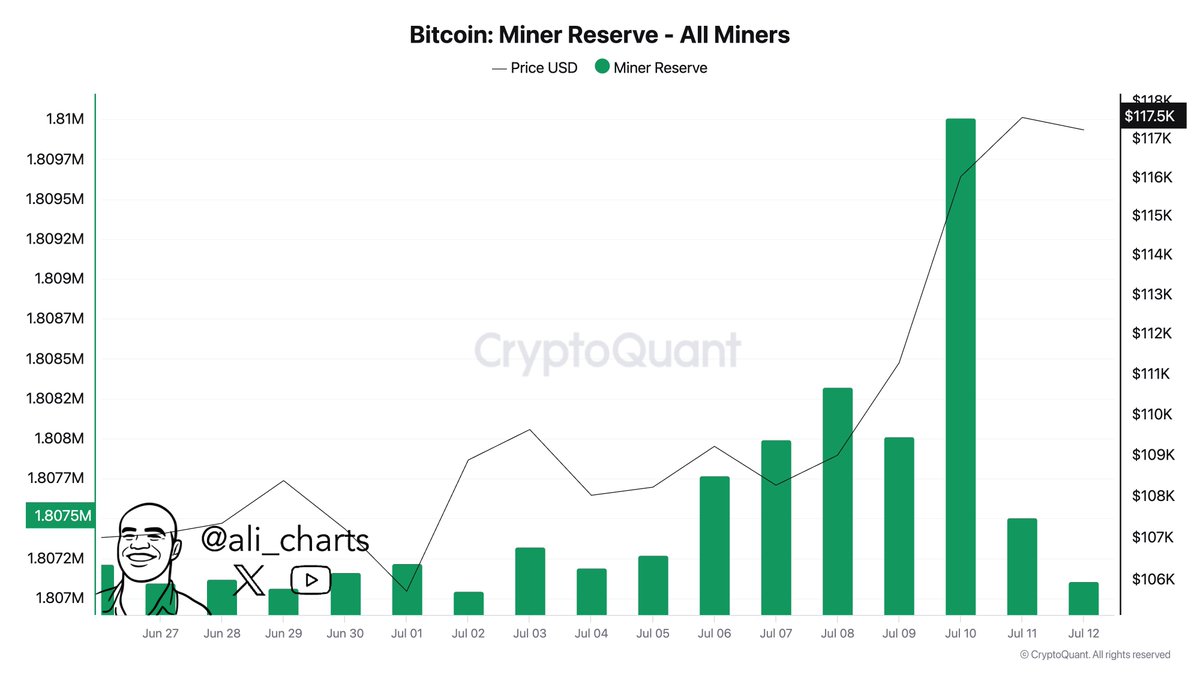

In related news, the Bitcoin miners have been taking advantage of the breakout to the new price ATH, as analyst Ali Martinez has explained in an X post.

As is visible in the graph, the Bitcoin miner-associated wallets have offloaded around 70,000 BTC (worth almost $8.4 billion) since Thursday.

BTC Price

At the time of writing, Bitcoin is floating around $119,800, up nearly 11% in the last seven days.