Bitcoin Options Market Hits Summer Slump – Here’s Why Traders Should Care

The Bitcoin options market just caught a case of the summer doldrums – and seasoned crypto traders know this script all too well.

Volatility takes a vacation

Open interest and trading volumes are pulling back harder than a beachgoer avoiding jellyfish. The derivatives market's cooling off mirrors patterns we've seen every July since 2020, when institutional players first dove into crypto waters.

Smart money plays the long game

While retail traders panic about the slowdown, whales are using the lull to accumulate positions. 'This is when the real money makes its moves,' says a Goldman Sachs alum turned crypto OTC desk operator. 'The summer slowdown is basically Wall Street's happy hour.'

What the charts won't tell you

The options market's summer siesta hides a brutal truth: most traders lose money chasing fireworks when they should be studying the quiet periods. But hey, someone's got to fund those Hamptons beach houses for the prop trading firms.

Don't mistake calm for capitulation. When the September surge comes – and it always does – the players who used this slowdown wisely will cash in while everyone else plays catch-up.

Summer Slowdown Hits Bitcoin Options

Since recovery from its pullback, Bitcoin has remained in an upward trajectory and appears to have found stability above the $108,000 level. Despite this notable upside performance of the flagship asset, a worrying trend has been observed in BTC’s on-chain and market dynamics.

Popular on-chain data and financial platform, Glassnode, has reported a negative development in the bitcoin options market. Presently, the BTC options market is starting to exhibit clear signs of slowing down despite the recent upward price action.

While the market is cooling down, the development is echoing familiar trends observed during previous periods of less desire for speculation. Recent on-chain data shows that both implied volatility and trading volumes have significantly decreased lately, which may indicate that traders are reducing their exposure as sentiment is hindered by seasonal or unclear causes.

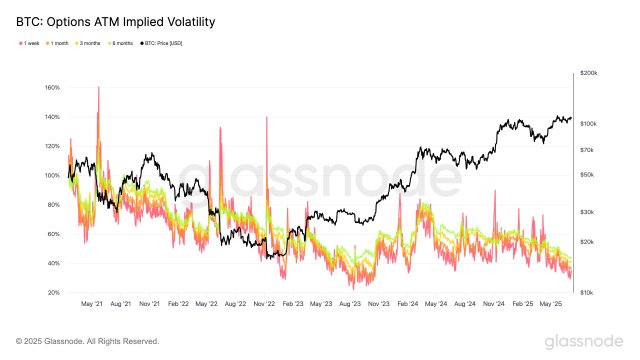

Glassnode, after analyzing the Bitcoin Options ATM Implied Volatility metric, has revealed that the options market is echoing the summer slowdown. According to the on-chain platform, the implied volatility across all expiries, especially the 1-week and 1-month holders, is approaching all-time lows.

Such a development signals a cautious pause from BTC investors, suggesting that the market may be building momentum or just taking a collective breather before making its next big move. The on-chain platform further highlighted that the options market is currently pricing some of the lowest volatility levels since the middle of 2023. This trend has continued despite BTC’s price hovering NEAR all-time highs.

Glassnode has also drawn attention to trading volume, which seems to have dived down sharply. According to Glassnode, the summer lull is here, and BTC’s volumes are drying up in spite of the flagship asset’s ongoing run toward the $110,000 price mark.

Data shows that the spot volume has fallen to $5.01 billion, whereas the futures volume has fallen to approximately $31.2 billion. The platform noted that volumes in these two areas are currently at their lowest in over a year and are still trending downward.

BTC Makes Key Breakouts

Despite the summer lull, Bitcoin’s price continues to display strength. Melijn The Trader, a crypto analyst, has predicted a major rally as the asset breaks out of both a falling wedge pattern and a bull flag pattern.

According to the analyst, this structure reflects momentum and not noise, classifying the development as a breakout phase. Considering the breakout, Melijn is confident that BTC could surge to a new all-time high of $140,000.

At the time of writing, BTC’s price was valued at $108,271, demonstrating a nearly 1% decline in the last 24 hours. While prices may be down, trading volume is gradually picking up pace, as indicated by a more than 15% increase in the past day.