20,000 Bitcoin Awakens After 14 Years—Largest Dormant Stash in History Just Moved

A Bitcoin time capsule just cracked open. For the first time in 14 years, a whale stirred—moving 20,000 BTC ($1.2B at today's prices) that slept through three halvings, two crypto winters, and Elon Musk’s Dogecoin phase.

The Lazarus coins: These aren’t your average Satoshis. Mined in 2011 when pizza was still a viable BTC payment method, this haul predates Mt. Gox’s collapse—and possibly your crypto Twitter account.

Why now? Speculation’s running wild: OTC deal? Whale divorce? Or just some OG proving HODL beats Wall Street’s ‘smart money’—again.

One thing’s certain: when Bitcoin this old moves, the market holds its breath. Meanwhile, traditional finance bros still think ‘blockchain’ is a new Equinox class.

A Significant Amount Of Ancient Bitcoin Has Just Been Transferred

As explained by CryptoQuant community analyst Maartunn in a new post on X, there have been a couple of unprecedented transactions on the bitcoin blockchain.

The transfers in question involved the movement of 20,000 BTC in two batches (that is, 10,000 tokens in each move) sitting dormant since 14.3 years ago. “This is never before witnessed in Bitcoin’s entire history,” notes Maartunn.

When the tokens involved in these moves were last transacted in April 2011, they were worth a total of $15,586. Today, they are worth upwards of $2.1 billion.

This naturally suggests that with the move, the owner of the tokens has harvested an extraordinary amount of profit. More specifically, the MOVE has realized a gain of almost 13.8 million percent.

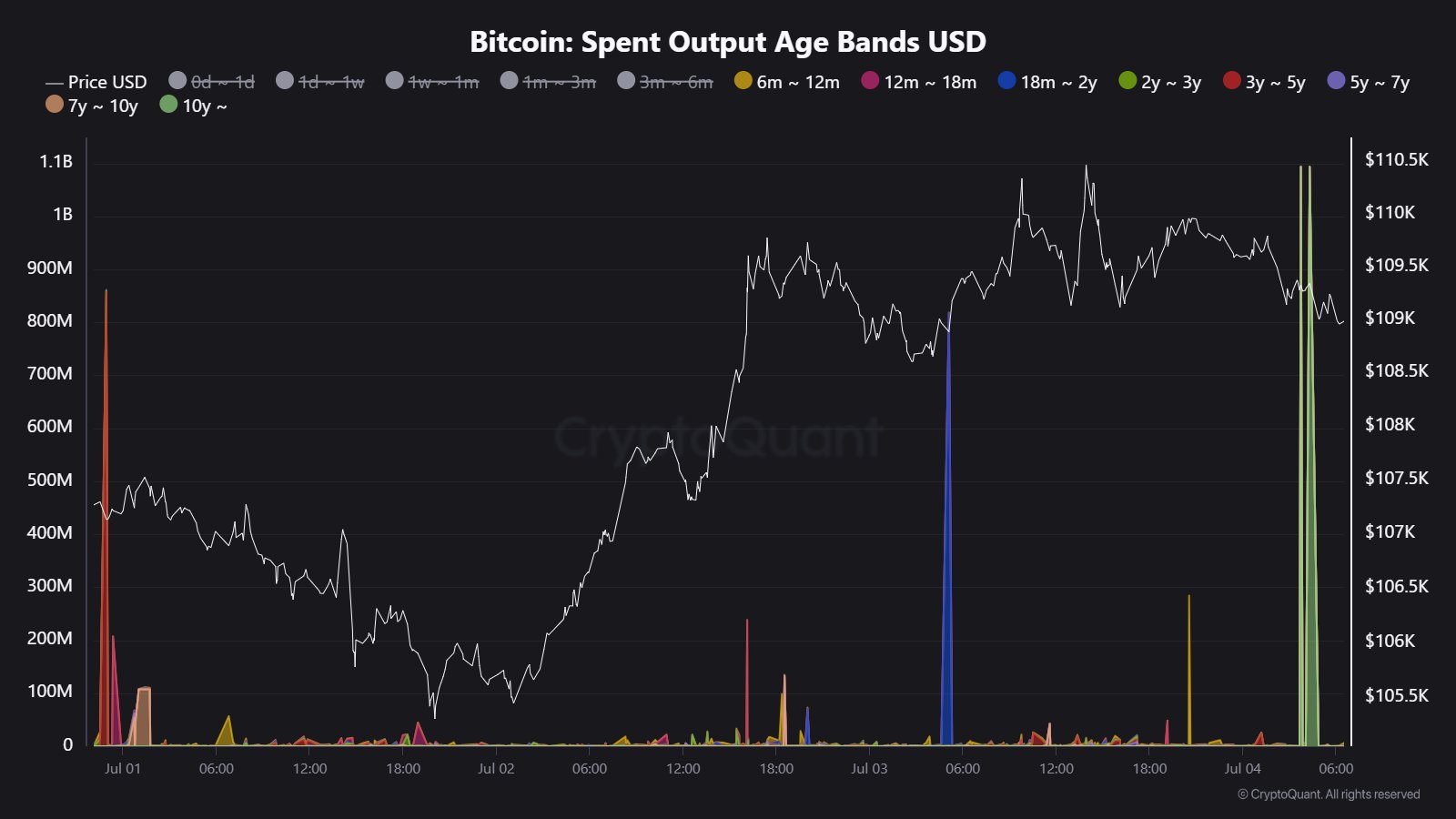

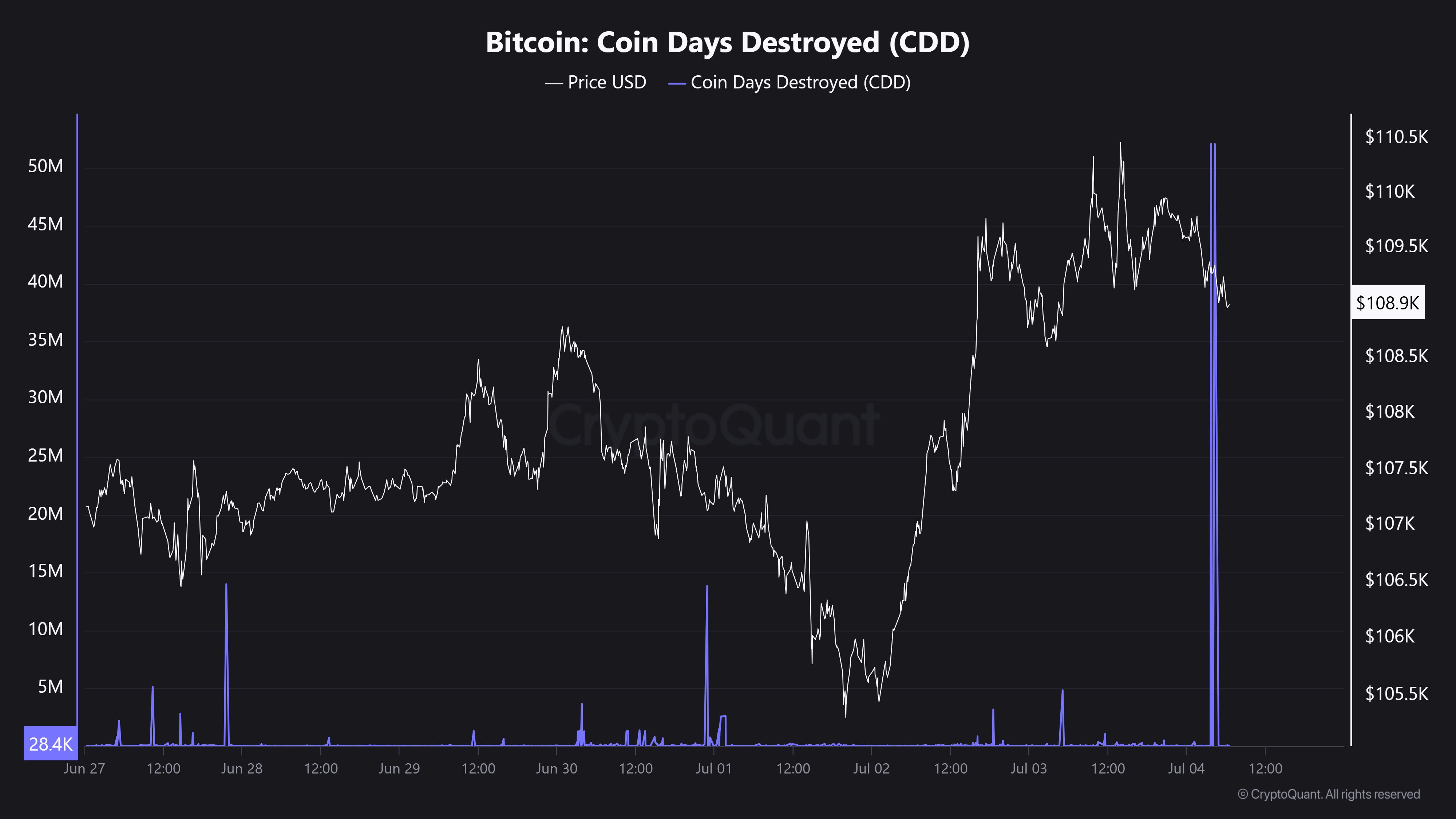

An indicator that has registered a notable spike because of the dormancy-breaking transactions is the Bitcoin Coin Days Destroyed (CDD). A ‘coin day’ is a quantity that one token of the asset accumulates after being still on the blockchain for one day.

When a coin that has been dormant for some number of days is moved, its coin days counter resets back to zero and the coin days that it had been carrying are said to be ‘destroyed.’ The CDD measures the total number of coin days being reset in this manner across the network.

Naturally, the CDD is particularly sensitive to moves from the diamond hands of the Bitcoin market, as their tokens tend to carry a large number of coin days. The 20,000 BTC transactions from today are quite ancient, so it’s to be expected that they WOULD register on the indicator.

And indeed, as the chart for the metric displays, each of the two 10,000 BTC transfers involved the destruction of more than 52 million coin days. Thus, collectively, the moves have caused the CDD to reach over 104 million coin days.

Now, what could these moves mean for the Bitcoin market? Generally, when such ancient coins move, the motive is likely to be selling. In this particular case, however, the investor involved may not be a high-conviction holder. This is because coins that reach such an old age usually get there by becoming lost, either due to their existence being forgotten or having their keys misplaced.

As such, it’s probable that the tokens have only recently been rediscovered. Selling from holders carrying coins from a few years ago can be a sign of conviction breaking in the sector, but this particular move may not be it.

BTC Price

Bitcoin has retraced some of its latest recovery as its price has pulled back down to $107,900.