US Institutional Demand Fuels Bitcoin’s Unstoppable Rally – Coinbase Premium Stays Green for 15 Straight Months

Wall Street's crypto thirst won't quit—Bitcoin's institutional backbone just flexed harder than a VC's pitch deck.

The Coinbase Premium Effect

That persistent green on Coinbase's institutional flows? It's not just bullish—it's a full-blown endorsement from the suits who once mocked crypto. Turns out nothing converts skeptics like double-digit returns.

When Main Street Meets Blockchain

Retail FOMO may drive volatility, but these sustained institutional inflows reveal the dirty secret: crypto's gone corporate. The same banks that warned about 'speculative bubbles' now quietly accumulate BTC between martini lunches.

Funny how a 15-month buying spree coincides with Bitcoin eating gold's lunch—but sure, keep calling it a 'fad.'

Bitcoin Faces Defining Week As Price Tests Resistance

This week could prove pivotal for Bitcoin as it continues to trade just below its $112,000 all-time high. After weeks of grinding higher, bulls are attempting to break through this key resistance level. However, the market remains on edge, as no clear direction has been established. Volatility continues to shake short-term sentiment, and the possibility of a retracement back toward the $100,000 level—or even below—remains on the table if bulls fail to deliver a breakout.

Adding a LAYER of optimism, the US stock market recently reached a new all-time high, reinforcing risk-on sentiment across financial markets. Many analysts believe Bitcoin and altcoins could be next to follow, especially as liquidity conditions improve and investor appetite for high-beta asset returns.

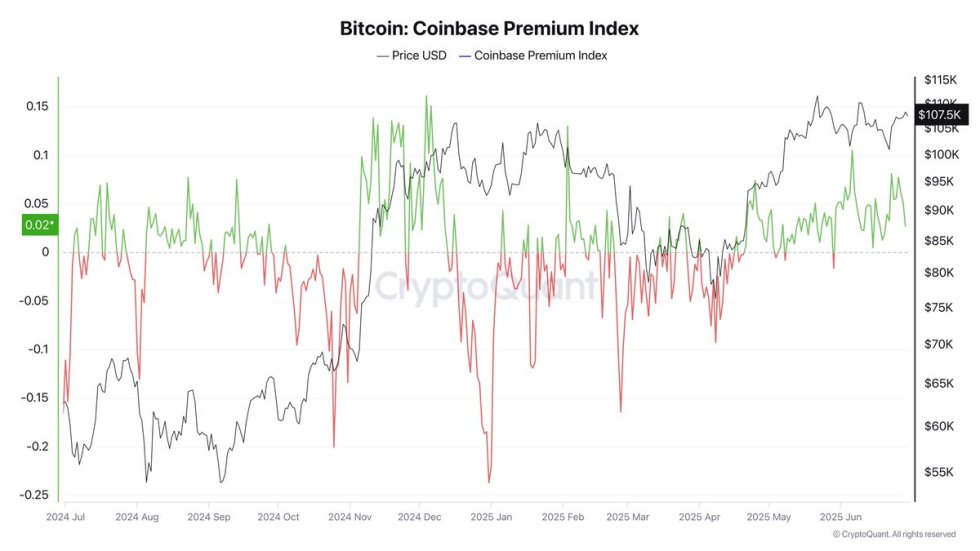

A key driver supporting BTC’s strength is the Coinbase Premium Index, which has remained in a consistent positive trend since the end of April, according to insights from Darkfost. This indicator measures the price difference between Coinbase and other exchanges, and is widely viewed as a proxy for US institutional and whale demand. Historically, a sustained positive premium has coincided with bullish price trends.

The continued strength in this metric—alongside steady ETF inflows—suggests that US buyers are playing a major role in keeping Bitcoin above the six-figure mark. Some attribute this renewed institutional interest to US President Donald Trump’s pro-crypto positioning, as he pushes to establish the US as the global leader in digital assets, particularly Bitcoin.

As the week unfolds, all eyes remain on the $112K level. A confirmed breakout could trigger the next leg of the bull cycle, while failure to hold may lead to a broader retracement and renewed caution in the market.

BTC Holds Range Between $103.6K and $109.3K

The 3-day chart shows Bitcoin trading at $107,714, consolidating in a tight range between key support at $103,600 and major resistance at $109,300. This range has defined price action for several weeks, with bulls maintaining control above support but struggling to push decisively into new all-time highs. The pattern reflects growing tension in the market, as prices coil in anticipation of a breakout.

BTC remains firmly above all major moving averages: the 50 SMA ($95,164), 100 SMA ($89,475), and 200 SMA ($73,090). This alignment confirms a strong, long-term bullish structure, with each dip being met by strong demand. Volume, however, has started to flatten, suggesting indecision among traders and the need for a strong catalyst to trigger the next move.

A daily or 3-day candle close above $109,300 WOULD likely ignite a breakout into price discovery territory. On the other hand, a breakdown below $103,600 could lead to a deeper correction toward the $95K level, where the 50 SMA may act as dynamic support.

Featured image from Dall-E, chart from TradingView