Bitcoin Miners Defy Low Profits – Hoarding Coins Signals Bullish Conviction

Bitcoin miners are playing the long game—clinging to their stash even as profit margins get squeezed. Here's why their diamond hands could shake up the market.

The HODL Mentality Goes Professional

Miners aren’t folding. Despite razor-thin margins, they’re accumulating BTC like digital Scrooges—betting big on a future price surge. No panic sells, no fire sales. Just cold, calculated conviction.

Market Mechanics at Work

When miners hold supply off exchanges, it tightens liquidity. Fewer coins up for grabs means one thing: upward pressure on prices. Classic supply shock in the making.

Wall Street’s Watching (And Probably Overcomplicating It)

Meanwhile, institutional analysts are spinning this into 50-page reports—because nothing says 'blockchain' like unnecessary intermediation. Miners? They’re too busy printing money the old-fashioned way: by not selling at the bottom.

BTC Transaction Fees At Lowest Level Since 2012

In a new post on X, blockchain analytics firm Alphractal revealed that bitcoin miners are still holding on to their reserves despite the decline in revenue. The on-chain data platform discussed the reasons behind this trend and its potential implications on the BTC mining industry.

Firstly, Alphractal highlighted low on-chain activity in this cycle as one of the reasons behind the significant decline in miner revenues. As a result of the reduced activity, the total transaction fees paid on the Bitcoin network have dropped to their lowest levels since 2012.

The market intelligence platform also mentioned that the mining difficulty has remained high even though the hash rate recently witnessed a drop. Typically, there is a direct relationship or positive correlation between the hashrate and mining difficulty. However, according to Alphractal, this recent lag or dissociation further strains miner profitability and delays network equilibrium.

Furthermore, Alphractal revealed on X that the Bitcoin hash rate volatility has reached new all-time highs. This basically implies that the network is witnessing the highest hash rate fluctuations or changes in its history.

The blockchain analytics firm added:

This is likely caused by large mining operations shutting down ASIC machines, possibly due to falling revenues and low network demand.

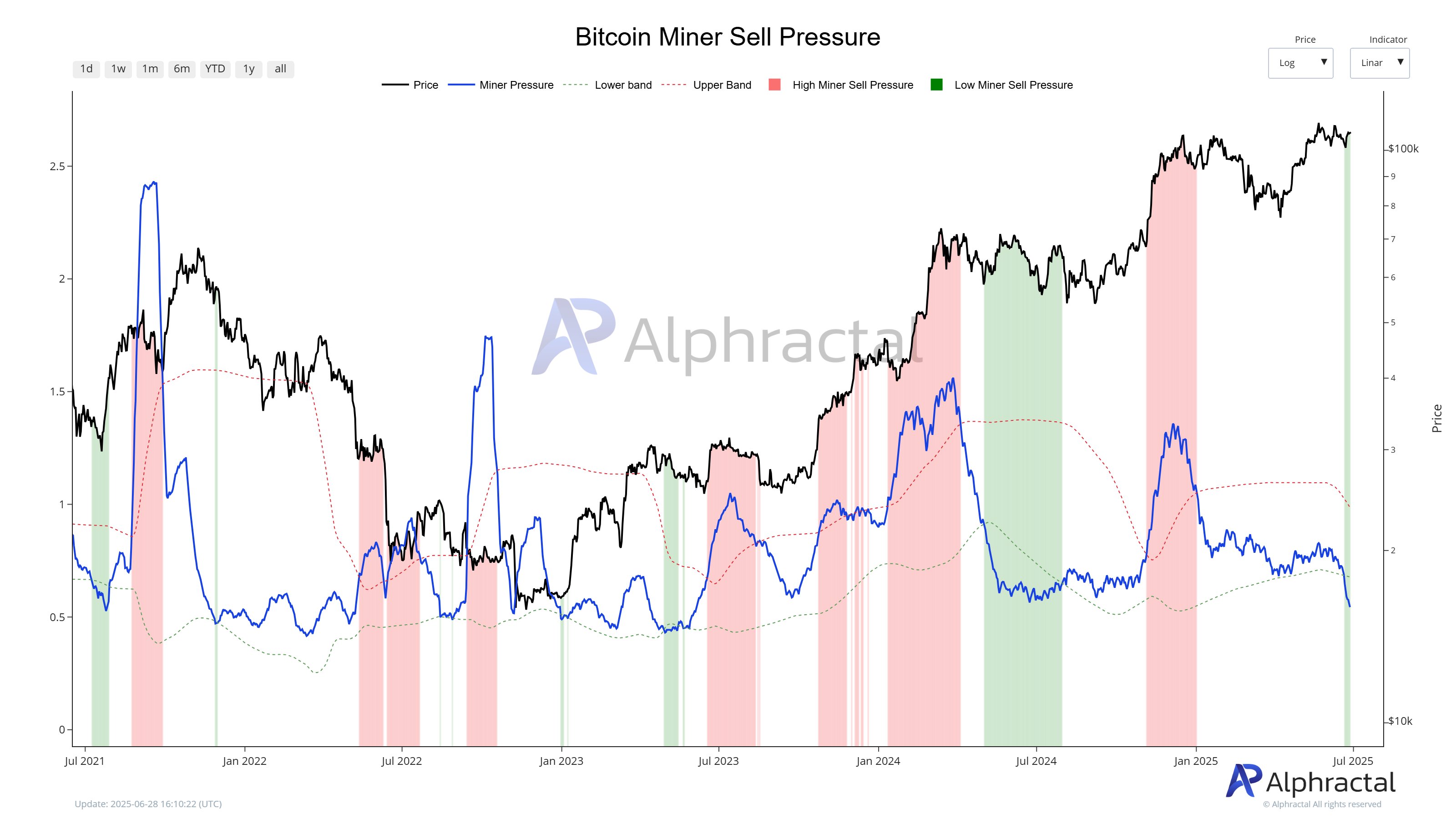

Despite the network revenues and the high mining difficulty, selling pressure from miners has remained at low levels. As exhibited by the low Miner Sell Pressure metric, this indicates that miners are not aggressively offloading their holdings for profit.

Alphractal admitted that the low selling pressure from miners is a positive sign, especially for the price of Bitcoin. The blockchain firm noted the possibility of some mining pools scaling down their operations in response to the decreased activity on the Bitcoin network. “As BTC trades above $107K, we may simply be witnessing miners reallocating their hash power to adapt to the current demand,” Alphractal added.

Typically, BTC miners tend to sell their coins for profit during periods of rapid price increases and high blockchain activity. However, Alphractal believes the current absence of both suggests a period of adjustment rather than capitulation amongst the miners.

Bitcoin Price At A Glance

As of this writing, BTC is valued at around $107,375, continuing its sideways movement with a mere 0.3% increase in the past 24 hours.