Bitcoin Retail Demand Craters to 6-Month Lows — But Wall Street’s Institutional Frenzy Just Won’t Quit

Retail investors are fleeing Bitcoin like a sinking ship—but the suits and algorithms are diving in headfirst.

Main Street taps out while Wall Street loads up

Coinbase outflows and dormant wallets tell the story: small-time holders are capitulating after months of sideways action. Meanwhile, the CME's Bitcoin futures open interest just hit another record. Guess who's buying the dip? The same hedge funds that called it a 'fraud' at $3,000.

Institutional FOMO reaches comical levels

BlackRock's ETF now holds more BTC than MicroStrategy. Pension funds are allocating despite 90% volatility swings. Even sovereign wealth funds are quietly accumulating—because nothing says 'stable reserve asset' like a commodity that routinely drops 20% before lunch.

The great crypto divide widens

While retail gets shaken out by every tweet and CPI print, institutions deploy dollar-cost averaging strategies worth billions. The irony? This exact dynamic—weak hands selling to strong hands—is what fuels every historic bull run. Cue the 'smart money' victory laps in 3...2...1.

BTC Retail Demand Falls By 10% In June: Analyst

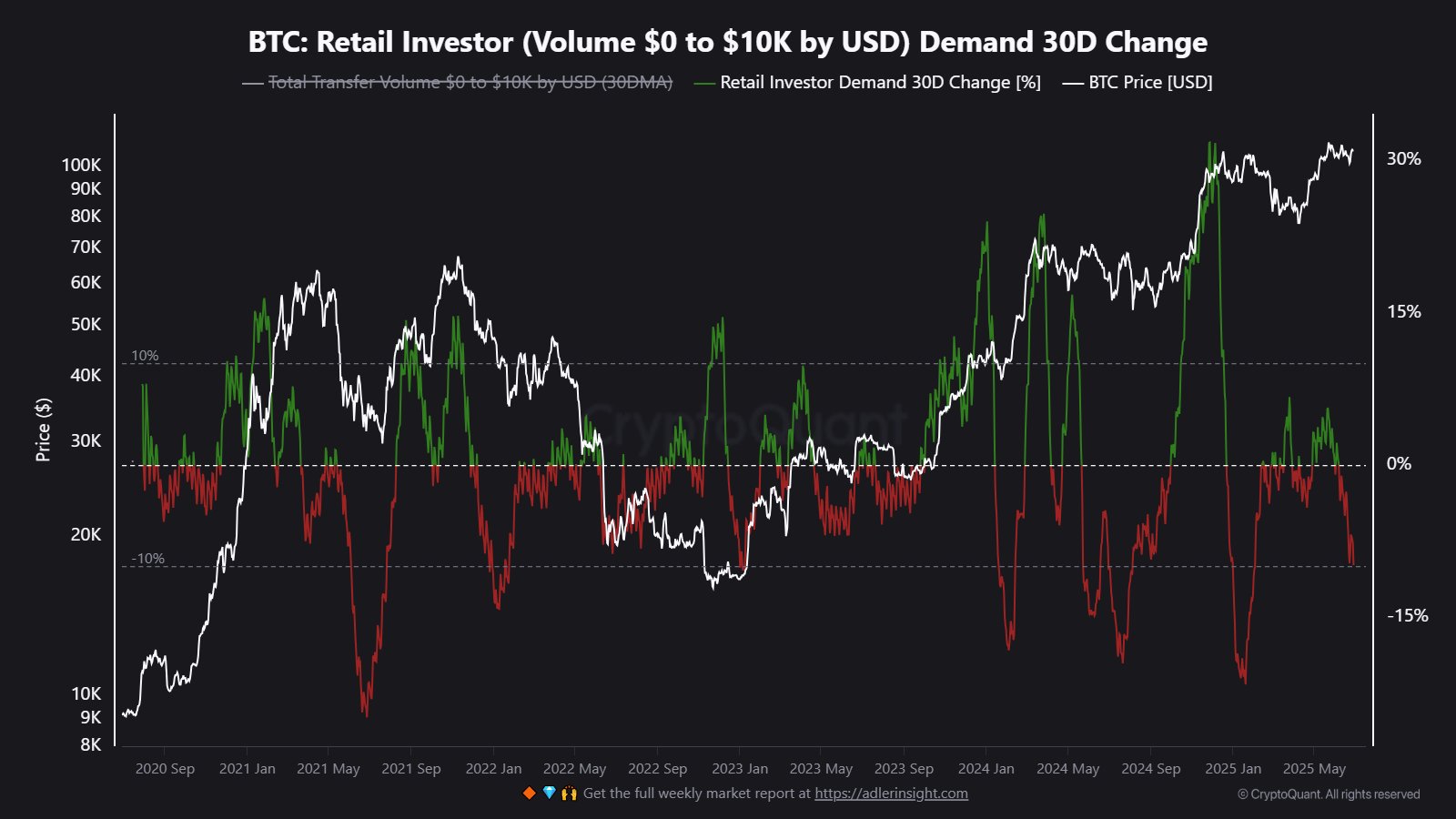

In a June 28 post on social media platform Z, on-chain analyst Maartunn revealed that a cohort of market participants known as retail investors has been relatively inactive over the past few months. This on-chain revelation is based on the Retail Investor Demand metric, which estimates the demand for BTC amongst small-scale investors.

In essence, this on-chain metric tracks the activity of small wallets typically involved in transfers of small sizes. Specifically, this Retail Investor Demand indicator measures the percentage change in the cumulative volume of small transactions (worth $10,000 or less) over a 30-day period.

In the chart highlighted by Maartunn, the 30-day change in the Bitcoin Retail Investor Demand plunged into the negative territory and has remained in the red since early June. More recently, the metric fell to the 10% level, which represents the lowest level in more than six months.

Considering that the Bitcoin price action has been fairly steady in this period, it is quite surprising that small-scale investors have refrained from entering the market. The market seems to be rather dominated by institutional investors — primarily through the spot Bitcoin exchange-traded funds.

Institutional And Bitcoin ETF Investors Take Charge

This trend of falling retail demand was also spotlighted by on-chain analyst Burak Kesmeci on the X platform, saying that institutional investors and spot ETF investors seem to currently have a strong appetite for accumulating Bitcoin. In the past week, the US-based BTC exchange-traded funds posted a significant weekly total net inflow of $2.2 billion.

Furthermore, Kesmeci mentioned that if the decline in retail demand continues, it could mean that the bitcoin price is nearing a bottom. Hence, the flagship cryptocurrency could enjoy some bullish momentum and upward price movement over the coming weeks.

As of this writing, the price of BTC stands at around $107,244, reflecting a mere 0.1% increase in the past 24 hours. According to data from CoinGecko, the market leader is up by more than 4% on the weekly timeframe.