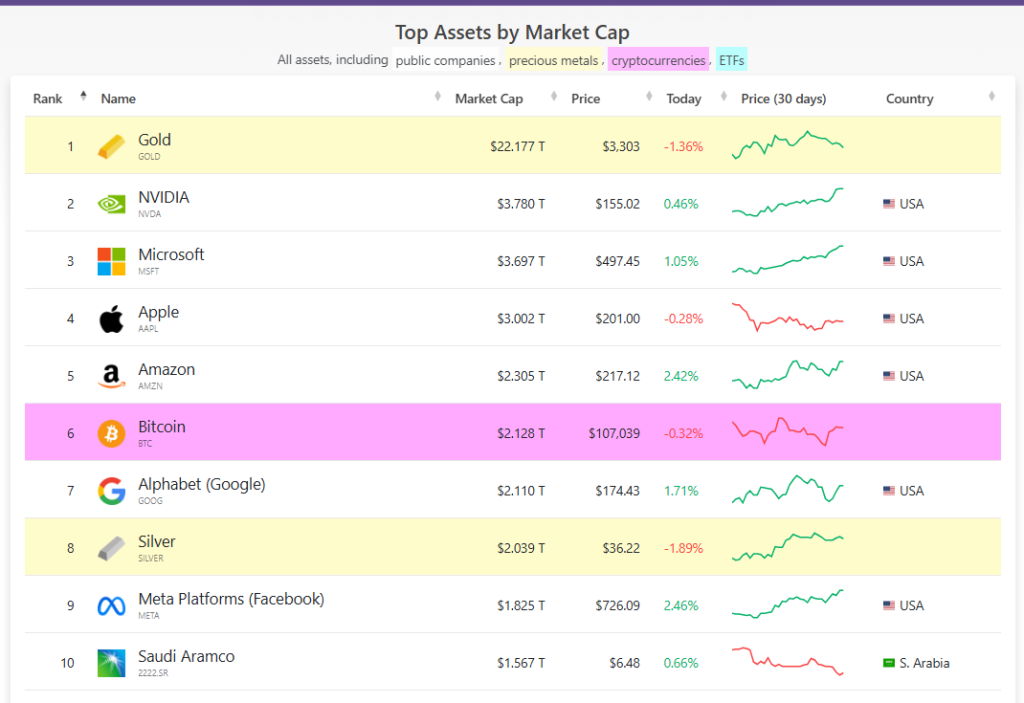

Bitcoin Smashes Records: Now a Top 6 Global Asset—Leaving Google in the Dust

Move over, legacy giants—Bitcoin just bulldozed its way into the elite club of the world’s top 6 assets. No permission needed.

The Unstoppable Ascent

Forget 'too volatile' or 'just a bubble.' Bitcoin’s market cap now dwarfs corporate titans and commodities alike, rewriting the rules of wealth storage. Gold’s looking over its shoulder.

Wall Street’s Awkward Pivot

Fund managers who mocked crypto now scramble to explain why their clients demand exposure. (Hint: 10,000% returns tend to focus minds.) Meanwhile, central banks keep printing—some things never change.

The New World Order

Decentralization isn’t coming—it’s here. And it’s wearing a Bitcoin nametag. Whether you’re HODLing or still 'waiting for the dip,' the financial landscape just got a seismic upgrade.

*‘But the fundamentals!’—last words of every finance bro who bet against it.*

Bitcoin Surges Past Google

Based on the latest data, Bitcoin’s climb above Google reflects more than a price bump. It shows how a token born in 2009 can measure up to a tech giant that started in a Silicon Valley garage.

Google remains a force in search, ads and AI, but Bitcoin’s network value now ranks just below gold, Nvidia, Microsoft, Apple and Amazon.

The comparison isn’t perfect—one measures coins in circulation, the other shares outstanding—but the headline is hard to ignore.

ETF Flows Drive Growth

According to figures from June 9, BlackRock’s iShares bitcoin Trust has attracted over $70 billion in assets, making it the largest spot ETF for Bitcoin. Fidelity’s FBTC follows with $20 billion and Grayscale’s GBTC holds just under $20 billion.

Those numbers climbed fast after the US Securities and Exchange Commission approved spot ETFs. Big investors have piled in, nudging Bitcoin’s price upward while ETF balances reflected the gains almost in real time.

Based on campaign statements and subsequent executive actions, US President Donald Trump has signaled support for Bitcoin. He floated the idea of a Bitcoin reserve during his run for office and later signed an executive order aimed at creating a digital-asset stockpile.

Critics point out that setting up a government wallet is far more complex than signing a memo. Still, the president’s backing has fueled Optimism among traders and some policy experts.

Analysts Eye Sky-High TargetsZach Shapiro of the Bitcoin Policy Institute said a US government purchase of 1 million coins WOULD trigger a “global seismic shock” in price. He predicted such a move could lift Bitcoin to around $1 million per token.

Fellow BPI director Matthew Hines added that other countries are watching the US playbook before shaping their own crypto rules.

Meanwhile, some analysts believe Bitcoin could top $150,000, or even $250,000, in the next few years if current trends continue.

Regulators Put Google Under The MicroscopeBased on filings from the UK’s Competition and Markets Authority, Alphabet faces an antitrust probe into its search and ad businesses under the Digital Markets, Competition and Consumers Act 2024.

The CMA is weighing rules on choice screens, ranking fairness and data portability. In the EU, regulators are scrutinizing AI-generated overviews that may cut into publisher revenue, with one study linking such summaries to a drop in organic views.

Featured image from Fingerlakes1, chart from TradingView