Solana CME Futures Volume Smashes All-Time High—Are Institutions Finally Going All-In?

Solana’s CME futures just hit a record-breaking volume surge—Wall Street’s latest crypto crush or another fleeting fling?

Institutional FOMO or smart money stacking?

The numbers don’t lie: Solana’s derivatives market is heating up faster than a GPU running an unoptimized smart contract. But let’s be real—when have big players ever bet against themselves? One thing’s clear: the ‘regulated’ money is now chasing the same volatility they spent years warning retail investors about. How delightfully on-brand for finance.

Will SOL’s institutional embrace trigger the next leg up—or is this just another case of suits arriving late to the party? Place your bets.

Solana CME Futures Volume Just Set A New Record

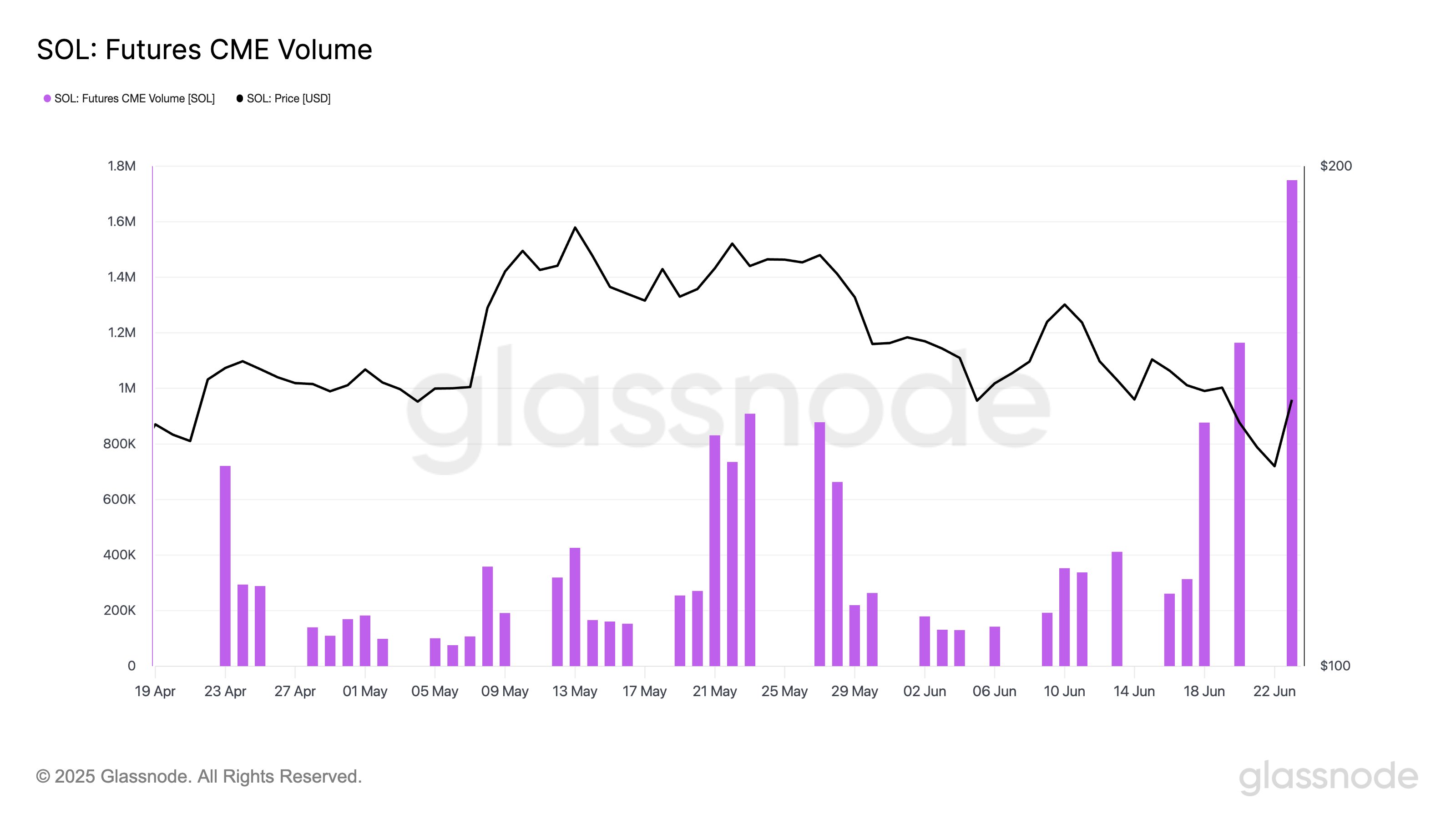

In a new post on X, the on-chain analytics firm Glassnode has talked about how the Futures Volume of Solana on the CME platform has recently looked. The Futures Volume here refers to an indicator that measures the total amount of SOL futures contracts trading that occurred during the past 24 hours.

Here is the chart shared by Glassnode that shows the trend in the metric for CME over the last couple of months:

As displayed in the above graph, the Solana Futures Volume on CME has just observed a huge spike of 1.75 million contracts. This is the highest that the metric has ever been.

As such, it WOULD appear that trading interest around SOL has shot up on the exchange. This could be particularly significant for the cryptocurrency, given that CME is a regulated platform that’s used by large entities like institutional traders.

“This surge suggests institutional investors are positioning aggressively as price rebounds to ~$145,” notes Glassnode. As for whether these positions correspond to bullish or bearish bets, volume data isn’t enough to say one way or another, just that there is significant activity occurring.

Considering that the spike in the CME Futures Volume has come as Solana has made some recovery, however, it’s possible that this could be investors trying to ride the bullish wave.

In some other news, the analytics firm Santiment has shared in an X post how the projects in the SOL ecosystem compare against each other on the basis of the Development Activity indicator.

The Development Activity tells us, as its name already suggests, the amount of work that a cryptocurrency project’s developers are putting in on its public GitHub repositories.

The indicator gauges the work in terms of ‘events,’ where each event corresponds to some action taken by the developer on the repository, like pushing a commit, creating a pull request, or making a fork.

From the table, it’s apparent that Solana itself has topped the list, with its Development Activity standing at 100.93 over the past 30 days. Wormhole (W) and Pyth Network (PYTH) round the top three with metric values of 37.77 and 30.67, respectively.

SOL Price

Solana fell to a low of $126 on Sunday, but it seems the coin has made some notable recovery since then as its price is now back at $144.