Bitcoin’s Next Rally: Bitfinex Longs Could Signal the Comeback

Is Bitcoin gearing up for another bull run? The answer might lie in Bitfinex’s long positions—where traders are betting big on a rebound.

Forget the Wall Street analysts with their crystal balls—crypto moves on its own chaotic rhythm. This time, the smart money’s watching leveraged longs like hawks.

One thing’s certain: when Bitcoin starts climbing, even the skeptics suddenly remember their ’long-term belief in blockchain.’ Funny how that works.

‘Decreased Bitfinex Longs May Be Good For BTC’s Momentum’ — Alphractal

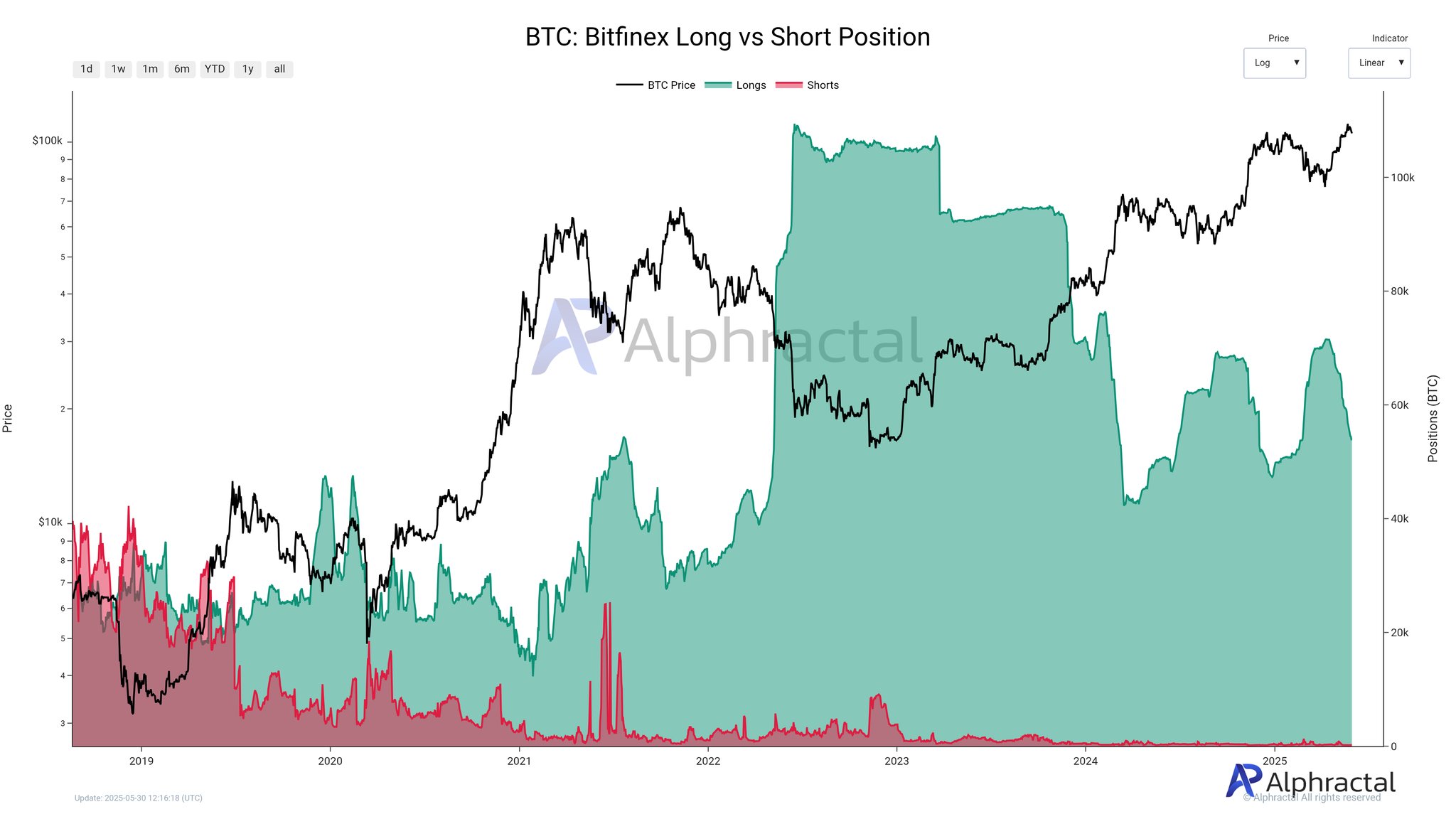

In a May 30 post on social media platform X, crypto analytics firm Alphractal delved into the relationship between leveraged long positions on crypto exchange Bitfinex and the Bitcoin price direction. This analysis is based on the Bitfinex Long Vs. Short Position metric, which estimates the ratio of buys against the sells of a cryptocurrency (BTC, in this case).

According to Alphractal, the relationship between BTC’s price trajectory and the Leveraged long positions on Bitfinex is inversely proportional. This means that if there are more long positions on the crypto trading platform, the likelihood of a price drop increases. Meanwhile, a decrease in long positions on the exchange could be bullish for the Bitcoin price.

The analytics firm attributed this pattern to the propensity of traders to be wrong about the market’s actual trajectory. According to Alpractal, these wrong price predictions eventually lead to liquidations and forced position closures, which drive the BTC’s price in the opposite direction.

In the recent post on X, Alphractal pointed out that the Bitfinex Long Position is declining, and if this trend is sustained, the premier cryptocurrency could resume its upward run. On the flip side, if the metric were to ascend above its current level, the Bitcoin price could be preparing for a severe pullback.

Bitcoin Price At A Glance

As of press time, bitcoin trades just above $104,100, reflecting a more than 2% decline in the past 24 hours. The flagship cryptocurrency’s performance is even more disappointing on the weekly timeframe, having lost over 4% of its value in the past seven days.