Bitcoin Miners Rake in $50M Daily—How Does This Stack Up Against Past Booms?

Bitcoin miners are hauling in a staggering $50 million per day—numbers that would make even Wall Street’s most cynical quant raise an eyebrow. But is this a historic peak, or just another Tuesday in crypto?

Let’s break it down.

The Gold Rush 2.0

Miners are the backbone of Bitcoin’s decentralized network, and right now, they’re feasting. At $50 million daily, the rewards are flirting with all-time highs—though anyone who’s been in crypto longer than a bull market knows these numbers can evaporate faster than a meme coin’s liquidity.

Historical Context: Feast or Famine?

Compare this to past cycles: during the 2021 mania, daily miner revenues briefly touched $60 million before crashing harder than a leveraged trader’s portfolio. Back in 2017? A mere $20 million peak—chump change by today’s standards.

The Bottom Line

While $50 million sounds like monopoly money to traditional finance (and let’s be honest, to them it might as well be), it’s a razor-sharp indicator of Bitcoin’s network health. Just don’t expect the suits to admit it—they’re still too busy shorting the top.

Bitcoin Miner Revenue Has Seen A Surge Recently

In a new post on X, CryptoQuant author Axel Adler Jr has talked about the latest trend in the revenue of the bitcoin miners. Miners on the BTC network earn their income through two means: block subsidy and transaction fees.

The first of these, the block subsidy, refers to the reward that these chain validators receive as compensation for adding a block to the chain. This reward is given out as a fixed BTC amount and the rate at which the miners are able to receive it is also more or less fixed. As such, the only variable related to it is the asset’s price itself.

The other component of the miner revenue, the transaction fees, is the payment that miners receive from each individual sender on the network. Users attach this amount when they are sending out a transaction on the blockchain. The total transaction fees that miners receive on any given day vary according to the amount of activity present on the chain.

When the mempool is congested, users who want their transfers to go through as soon as possible have no choice but to pay an above-average fee to provide an incentive for the validators to prioritize them. As many senders compete against each other in this manner, the transaction fees can witness a spike.

Most of the time, transfer activity doesn’t get too high on the Bitcoin network, so the miners end up relying on the block subsidy to make the majority of their revenue.

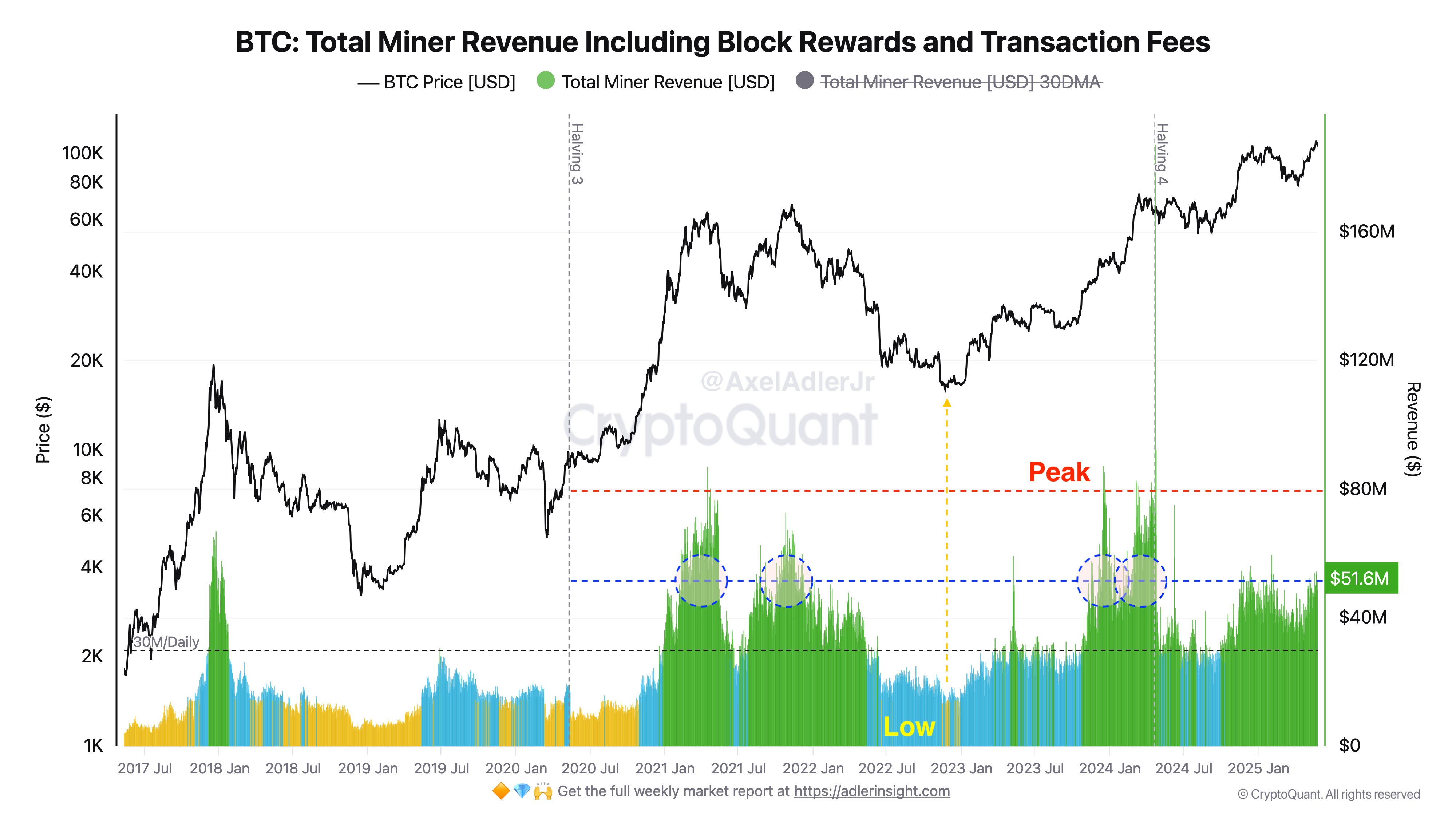

Now, here is the chart shared by the analyst that shows the trend in the combined revenue of the BTC miners over the last few years:

As displayed in the above graph, the Bitcoin miner revenue saw a decline earlier in the year, a consequence of the downturn in the asset’s price that reduced the USD value of the block subsidy. Investors tend to lose interest in periods of decline, so a drop in transfer fees could have also contributed to this revenue loss.

Recently, as the cryptocurrency has seen a reignition of bullish momentum, miner revenue has also naturally bounced back. These chain validators are now earning around $51.6 million per day.

While this income level is certainly not low, it’s still far off from the peaks above $80 million witnessed last year and in the 2021 bull run. “This indicates a high but not yet peak level of network activity: miners are already generating significant income, yet there’s still room to climb back to those previous highs,” notes Adler Jr.

BTC Price

Bitcoin is currently once more sitting on the doorstep of a new all-time high as its price is floating around $110,000.