Bitcoin’s Silent Majority: Long-Term Holders Gobble Up 339K BTC Since April Amid Market Turbulence

While Wall Street hedge funds flip-flop on crypto allocations, Bitcoin’s true believers keep stacking sats—noisy price swings be damned.

Key Trend: Steady Hands Win

Since April 4, long-term holders have quietly accumulated enough BTC to fill three MicroStrategy-sized vaults. This isn’t moonboy speculation—it’s cold, calculated conviction playing out on-chain.

Why It Matters

When the ’smart money’ panics over 10% corrections, these hodlers treat dips like a Black Friday sale. Their wallets don’t lie: 339,000 BTC doesn’t move without diamond-handed intent.

The Bottom Line

Traders scalp pennies while the patient eat steak. And if history repeats? This accumulation phase will look like a fire sale once the suits finally ’discover’ Bitcoin again—right after the next ATH.

Long-Term Holders Add Fuel To Bitcoin Bullish Outlook

Bitcoin is currently in a pivotal phase that could define the trajectory of the market for the coming months. After rallying over 40% from its April 9th low, BTC has spent the last few days consolidating below the $105K resistance. This consolidation has sparked a mix of expectations—some traders anticipate a breakout into a new all-time high, while others believe the market could be setting up for an extended range.

Despite short-term volatility, the broader trend remains clearly bullish. Bitcoin has maintained a steady uptrend for over five weeks, climbing through multiple resistance levels and attracting renewed investor attention.

One of the most significant signals of confidence comes from the behavior of long-term holders. According to data shared by top analyst Axel Adler, since April 4, long-term holders (LTH) have added a total of 339,000 BTC to their wallets. This brings the total LTH supply to 14,370,338 BTC—a record figure that underscores DEEP conviction in Bitcoin’s future value.

This wave of accumulation is a powerful bullish signal. Historically, periods of heavy LTH buying have preceded major rallies. If BTC can hold current demand zones and reclaim resistance, the market could enter a new phase of expansion. However, if resistance holds and momentum weakens, the market could remain trapped in a broader consolidation. For now, the pressure is on bulls to confirm strength, and LTH accumulation shows they’re not backing down.

BTC Holds Above Support, But Breakout Remains Elusive

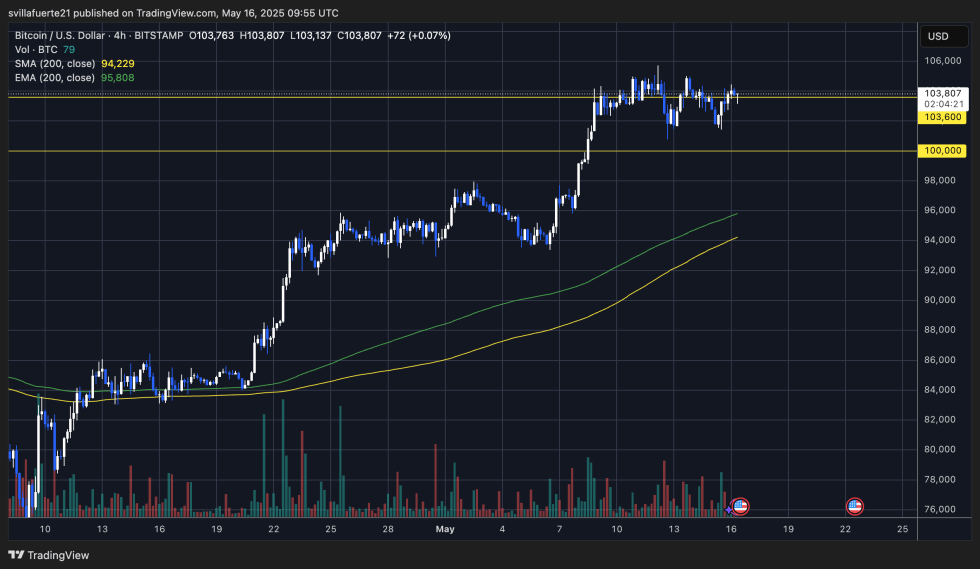

The 4-hour chart shows Bitcoin continuing to consolidate just above the $103,600 support level after failing to break cleanly above the $105,000 zone. Price action remains tightly ranged between $103,600 and $104,800, with multiple failed attempts at pushing higher, suggesting the presence of heavy sell-side liquidity in that region.

Despite this, Bitcoin’s structure remains bullish. The 200-period EMA and SMA on this timeframe are both trending upward and significantly below the current price, providing a strong foundation for continued support. Volume has slightly decreased during consolidation, which is typical in a pause phase before a potential breakout or breakdown.

If BTC holds above the $103,600 support, bulls may soon attempt another breakout, especially if volume picks up and macro conditions remain favorable. A confirmed move above $105,000 WOULD likely trigger a surge toward the next key psychological target near $110,000. On the downside, a loss of $103,600 opens the door for a deeper pullback toward $100,000—an area of strong psychological and structural demand.

Featured image from Dall-E, chart from TradingView