Bitcoin Chills Before the Storm: Consolidation Sets Stage for $106K-$110K Breakout

After weeks of sideways action, Bitcoin’s price coils like a spring—traders brace for what analysts predict could be a 30% surge toward six figures. The ’digital gold’ narrative gets its polish back as institutional money lurks on the sidelines (probably waiting to overpay at the top, as usual).

Key levels to watch: A clean break above $72k resistance could trigger the rally, while $65k remains the line in the sand for bulls. Meme coins might be stealing headlines, but BTC’s slow-burn dominance play continues behind the scenes.

Funny how ’consolidation’ always sounds more respectable than ’whale accumulation phase’ when you’re pitching to mainstream media.

Bitcoin Price Consolidation Between Key Levels Building Momentum

Bitcoin’s rally from the $97,860 breakout zone to the $104,300 resistance area marked a clear distribution phase, and now the price is hovering between $104,300 and $102,300. It is easy to see that the price rally slowed down massively in the past 48 hours.

However, crypto analyst RLinda noted that this range-bound movement is a positive development, pointing to bullish continuation rather than weakness. A rebound from the lower end of this zone, particularly from $103,300, $102,300, or even as low as $101,700, could act as a springboard for a breakout attempt above $104,300.

Notably, the analyst highlighted that this third retest failed to push the price back up to resistance, leading to a local drop instead. However, the resulting breach of $103,336 shows that the underlying strength is still intact. Should Bitcoin retest $103,600 successfully and bounce off the liquidity zone between $102,700 and $102,300, the leading cryptocurrency could make another attempt at breaking through the $104,300 resistance.

If this plays out, the next leg could reach up to $106,000 or even $107,000, and from there, further momentum could drive the price above its current all-time high of $108,786 up until $110,000 before the end of May. Price targets beyond this level range from $120,000 to $180,000 before the end of the year.

Chart Image From TradingView: RLinda

On-Chain Signals Reinforce Bullish Outlook

This short-term consolidation is not occurring in isolation with selling pressure. Notably, on-chain data and market sentiment support Bitcoin’s upward path for the rest of the month.

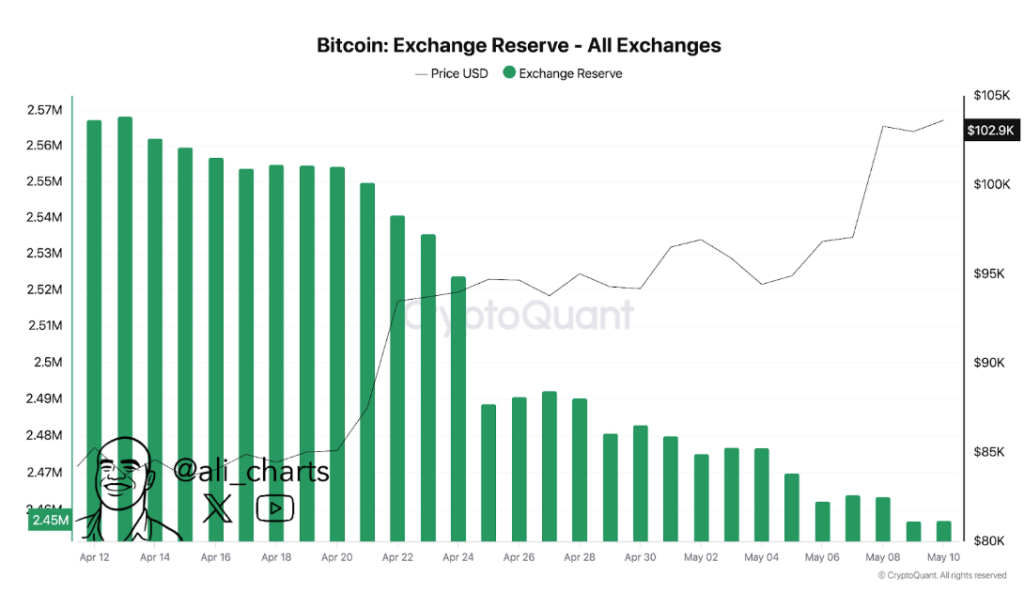

According to crypto analyst Ali Martinez, more than 110,000 BTC have been withdrawn from centralized exchanges over the past month. As illustrated in the CryptoQuant chart below, this has caused the total bitcoin reserve on crypto exchanges to drop from 2.57 million BTC to 2.45 million BTC.

This is a sign that investors are moving their holdings into cold storage or preparing for long-term hold, which reduces immediate selling pressure and supports upward price action.

Chart Image From X: @ali_charts

Right now, the most important support levels to watch are $103,300, $102,300, and $101,700, while the resistance levels to new all-time highs are $104,300 and $108,786.

At the time of writing, Bitcoin was trading at $103,670.

Featured image from Unsplash, chart from TradingView