Bitcoin’s Capital Rotation Hits Overdrive – Bullish Inflows Cement Market Foundation

Money’s sloshing into BTC like Wall Street discovered a new fee structure—except this time, it’s actually building something.

The big move: On-chain data shows sustained capital rotation into Bitcoin, with long-term holders refusing to budge even as prices flirt with all-time highs. This isn’t 2021’s leverage-fueled madness—it’s institutional FOMO meeting diamond hands.

Why it matters: The market’s forming its healthiest structure since the last cycle, with spot buying absorbing every sell order. Even the usual ’sell the news’ crowd got burned after the halving failed to trigger the expected dump.

The kicker: Watch the $65K level. If that holds as support, we’re looking at a launchpad—not a ceiling. Just don’t tell the guys still waiting for $20K to ’get in cheap.’

Bitcoin Confirms Recovery Rally As Market Enters Bullish Phase

Bitcoin has officially confirmed a recovery rally after reclaiming the $100,000 level—a major psychological and technical milestone. The move signals a powerful shift in momentum, with BTC pushing above resistance levels that had capped its price for months. The rally, which saw Bitcoin reach as high as $104,300, comes amid broader strength across the crypto market, with ethereum breaking out above $2,400 and pulling altcoins higher in tandem.

This synchronized breakout has reignited bullish sentiment, marking the beginning of what many analysts believe is a new bullish phase. Top market analyst Axel Adler shared insights that support this narrative, pointing to key on-chain metrics that show the rally is not based on short-term HYPE but on growing conviction.

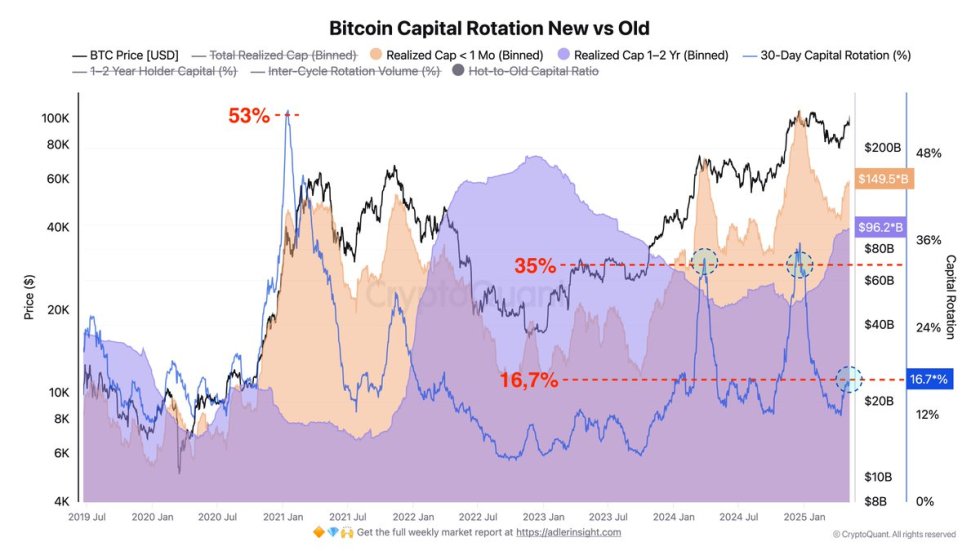

According to Adler, the 30-Day Capital Rotation (%)—a metric that tracks the share of realized capital coming from “new” coins (held for less than one month) relative to all realized capital over the past 30 days—offers a valuable perspective. Historically, peaks NEAR 35% have aligned with euphoric, speculative rallies. However, the current level stands at 16.7%, indicating a steady, controlled inflow of fresh capital without signs of excess or overheated sentiment.

This suggests that new buyers are entering the market, but not in a frenzy—more in confidence. It reflects a healthy accumulation environment where both long-term and short-term holders are aligning toward growth. With key levels reclaimed and on-chain data confirming sustainability, Bitcoin appears to be building a strong foundation for continuation. If this trend persists, the $100K breakout may not be the top—but just the beginning of a much larger rally that could shape the next phase of this cycle.

BTC Price Analysis: Momentum Favors Bulls

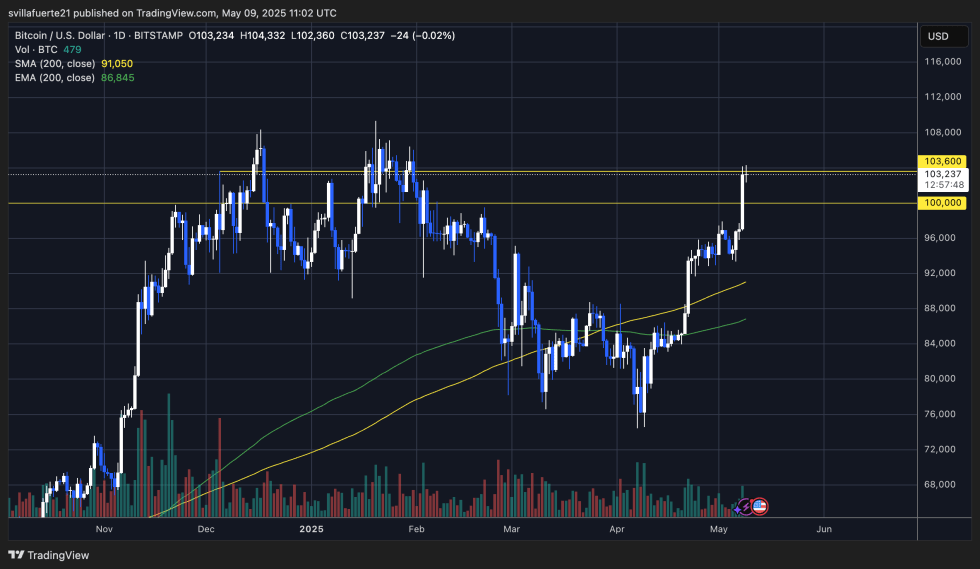

Bitcoin is trading at $103,237 after a powerful breakout above the long-standing $100,000 psychological resistance. The daily chart shows BTC pushing through key levels with strong bullish momentum, peaking at $104,332 earlier today. This marks the first clean MOVE above $100K since February, and the highest daily close in months.

The price action confirms a major bullish shift. After consolidating above the 200-day EMA ($86,845) and 200-day SMA ($91,050), bitcoin accelerated higher, breaking through resistance zones with rising volume. The breakout above $100K has now turned this level into immediate support, while the next significant resistance stands at $103,600—a level BTC is now testing.

If BTC can close above $103,600, it would mark the highest daily close in this cycle and potentially set the stage for price discovery. Failure to hold above $100K could result in a short-term pullback, but current momentum favors the bulls. Volume has increased significantly, validating the breakout, and broader market conditions are improving, with Ethereum and altcoins following BTC’s lead.

Overall, the chart reflects strength, conviction, and room for continuation. Holding $100K as support will be critical in confirming this move as the beginning of a new leg higher in the ongoing bull cycle.