Bitcoin Defies Gravity at $95K—Here’s Why the Blockchain’s ’Weak Activity’ Doesn’t Matter

Price pumps while chain activity flatlines? Welcome to crypto’s new normal.

The Paradox Explained

Analysts point to institutional accumulation—whales and ETFs are hoarding supply off-exchange, decoupling price from on-chain noise. Retail traders chasing the next meme coin haven’t noticed yet.

The Cynic’s Take

Wall Street’s latest ’digital gold’ narrative conveniently ignores that 90% of blockchain transactions are still speculative wash trades. But hey—when did fundamentals ever stop a bull market?

Why BTC Price Is Less Correlated To On-Chain Activity

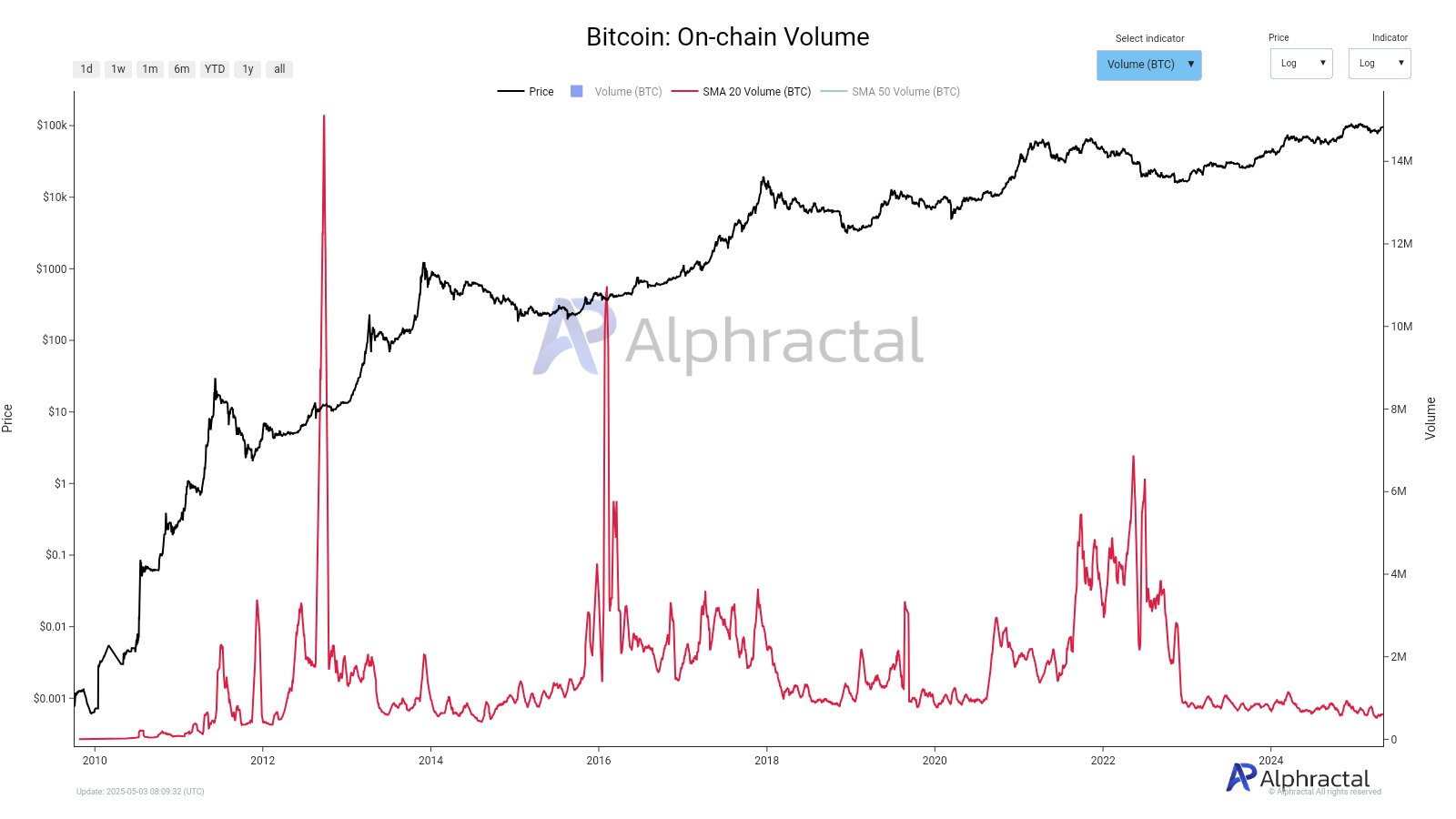

Crypto analytics platform Alphractal shared in a new post on X the major reasons why the Bitcoin price has managed to stay afloat despite transaction volume and active addresses being at low levels. According to the firm, BTC’s price rise doesn’t necessarily correlate to increased blockchain usage.

Firstly, Alphractal acknowledged that the Bitcoin market experienced a dynamic shift when the US spot exchange-traded funds (ETFs) were approved in January 2024. The value of BTC is now being driven by capital inflows through these financial products rather than blockchain activity.

The on-chain firm also mentioned that the historically low volatility in the market has had a major part to play in the low Bitcoin network activity. With relatively little price movement, traders are less incentivized to take new positions, leading to lower on-chain activity.

Additionally, Alphractal mentioned that the Bitcoin price has been kept afloat largely by the activities of speculative traders through derivatives and other financial instruments. As a result, there has been a reduced everyday adoption and limited practical demand for the Bitcoin network.

Alphractal also alluded to the macroeconomic uncertainty that has clouded the global financial markets in recent weeks. According to the on-chain analytics firm, this market condition, even though improving, has most investors waiting for clearer bullish signals before making any move.

Finally, Alphractal highlighted artificial exchange volumes amongst the main reasons for the Bitcoin price staying afloat. “Some exchange volume may be inflated, creating a misleading sense of activity while real network usage stays modest,” the on-chain platform added.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $96,150, reflecting an over 1% decline in the past 24 hours. Despite the choppy price action this weekend, the premier cryptocurrency is still up by nearly 2% on the weekly timeframe, according to data from CoinGecko.