BlackRock CIO Drops the Mic: Bitcoin Crushes Ethereum in Brutal Takedown

Wall Street’s biggest whale just settled the crypto civil war. BlackRock’s chief investment officer shredded the ’flippening’ narrative with cold, institutional logic—while traders scrambled to reposition portfolios.

Ethereum’s ’ultrasound money’ thesis? Pivoting to proof-of-stake slashed its inflation rate, but Bitcoin’s fixed supply and regulatory clarity keep winning the institutional game. The CIO’s verdict: ’Digital gold beats programmable money when trillion-dollar balance sheets enter the chat.’

Bonus burn: ’Some chains still think 10% yields are sustainable. Tell me you’ve never seen a Fed cycle without telling me.’

Bitcoin Vs. Ethereum

This stands in sharp contrast to Ethereum, where Cohen’s tone was notably more cautious. While BlackRock has also launched Ethereum-based ETPs, demand has been far less robust. “Ethereum is still a distant second,” she said when discussing institutional investor interest. Unlike Bitcoin, which is increasingly viewed as a potential store of value and a diversifying asset class, Ethereum’s investment thesis has yet to solidify at the institutional level.

Cohen elaborated on the complexity institutions face when evaluating Ethereum. “You might be really bullish on the utility of the public Ethereum blockchain but not know how that translates into value accrual to the native token,” she said. This uncertainty complicates the case for broad-based adoption. While Bitcoin’s narrative as a “borderless store of value” is relatively straightforward, Ethereum’s positioning remains more opaque, intertwining technological utility with questions about token economics, competition, and long-term market dynamics.

Beyond the narrative gap, Cohen identified a more structural obstacle: crypto’s general lack of standardized data and metrics. “Crypto does broadly have a data and standards problem,” she stated. Drawing comparisons to traditional markets, Cohen emphasized that metrics like cash flow, governance, and team transparency — critical components for equity investing — are largely absent or inconsistent across most crypto assets. “If I think about indexing fundamentally as an organizing technology for a market, how do you perform that task in crypto right now?” she asked rhetorically, highlighting how foundational standards remain missing even in leading crypto ecosystems.

Bitcoin’s adoption, by contrast, is supported by clearer metrics around its scarcity, issuance schedule, and market infrastructure maturity, making it easier to fit into traditional portfolio models. Cohen confirmed that BlackRock recommends a 1–2% Bitcoin allocation for investors seeking exposure, rooted in detailed analysis of risk contribution to portfolios. “If you go beyond 2%, the incremental contribution to overall portfolio volatility gets exponentially higher,” she warned.

While Ethereum continues to make technological strides — particularly in decentralized finance and onchain applications — BlackRock’s view, at least for now, reflects the reality that institutions require clarity, standardization, and well-defined valuation models before committing meaningful capital. As Cohen summarized, “Understanding how to create a valuation framework for Ethereum or any other token gets more complicated.”

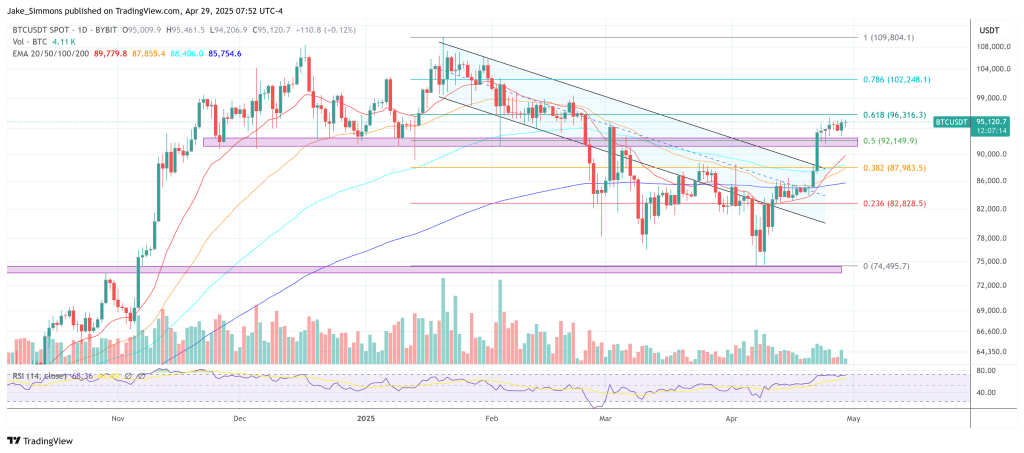

At press time, BTC traded at $95,120.