Bitcoin’s Short-Term Wallets Are Loading Up—Dead Cat Bounce or the Start of a Mega Rally?

Bitcoin’s short-term holders just went on a buying spree—data shows balances surging at levels last seen before major price moves. Is this the calm before the storm, or just another ’buy the rumor, sell the news’ trap for retail traders?

Market veterans are split: some see a textbook relief rally after months of sideways action, while others point to whale accumulation patterns that preceded past bull runs. Meanwhile, Wall Street’s latest ’crypto expert’ is probably just now discovering what a UTXO is.

One thing’s clear: volatility is coming. Whether that means a breakout or another brutal shakeout depends on who you ask—and how much hopium they’re inhaling.

Bitcoin Shows Strength but Faces a Pivotal Moment

Bitcoin is now showing solid signs of strength after consolidating around key support levels. After a series of healthy retests at lower demand zones, BTC looks ready to continue its upward trajectory. However, global tensions remain a major threat, and fears of a possible recession could create a difficult environment for risk assets like Bitcoin in the months ahead.

Currently, Bitcoin is entering a critical phase where price action could determine the next few months of market behavior. Bulls are in short-term control after reclaiming important levels like $90K, but the risks of a sharp downturn remain high, as macroeconomic uncertainty continues to dominate sentiment.

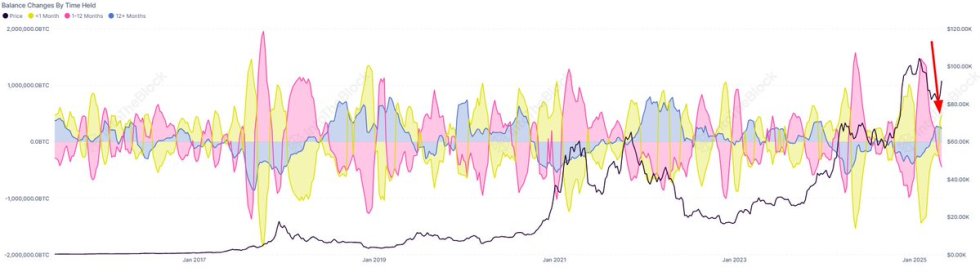

Adding to the bullish momentum, IntoTheBlock shared data revealing that Bitcoin saw a significant increase in short-term traders’ balances last week, pointing to renewed speculative demand. This trend is critical because it suggests fresh capital and new market participants are entering the space, fueling the current price action. If this influx persists, it would support the view that the current move is more than just a relief rally, potentially marking the opening leg of a broader, sustained uptrend for Bitcoin.

Nevertheless, caution remains necessary. Overextended leverage, rising volatility, and global economic fragility could quickly reverse sentiment. Bitcoin needs to hold above $90K and ultimately break above $100K to truly confirm the start of a new bullish phase. Until then, traders and investors must remain flexible and alert to both upside opportunities and downside risks.

Bitcoin Tests Resistance As Critical Week Approaches

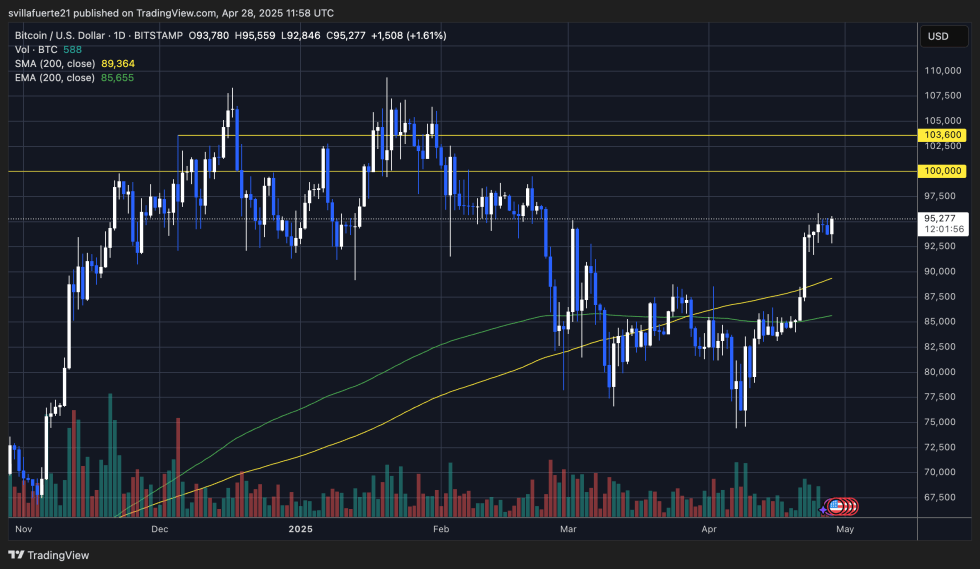

Bitcoin is trading at $95,200 after several attempts to push higher, testing resistance around the $95K–$96K zone. Bulls are trying to build enough momentum to set a fresh high above $96K, which would further strengthen the short-term bullish structure and open the door for a move toward the highly anticipated $100K level.

However, despite the strong recovery from April lows, a failed breakout at this critical resistance could quickly reverse sentiment. If Bitcoin fails to hold its ground and is rejected from current levels, the price could slip back below the $90K support zone — a level that bulls must defend to maintain control of the trend. A breakdown below $90K would likely signal an extended consolidation phase, or even a deeper retrace toward the 200-day moving average around $88K.

This week will be crucial in determining Bitcoin’s short-term direction. A confirmed breakout above $96K would set the stage for a major rally, while rejection could lead to a volatile retrace. Traders and investors are watching price action closely, as macroeconomic uncertainty and global tensions continue to influence market sentiment and risk appetite across all asset classes.

Featured image from Dall-E, chart from TradingView