Bitcoin Smashes Cycle Theory—Analyst Drops Truth Bomb

Bitcoin’s price action is flipping the script—again. Just when Wall Street thought they’d mapped its cycles, BTC laughs in the face of patterns. One chart-wielding analyst just torched conventional wisdom with a single tweetstorm.

Key takeaways:

- Halving math? Maybe. Greed-flation? Definitely.

- Retail FOMO meets institutional chess moves—checkmate or bluff?

- ’Store of value’ narrative now competing with ’volatility casino’ reality (thanks for that, Jamie Dimon).

As traders scramble to adjust their models, one thing’s clear: predicting Bitcoin is like herding crypto cats—lucrative when you’re right, humiliating when you’re wrong. Place your bets, folks—the house always wins... until it doesn’t.

Investors Could See The First Unique Cycle In Bitcoin’s History

Pseudonymous on-chain analyst Darkfost took to X to share their perspective on the current cycle and Bitcoin price potentially breaking the fractal cycle dynamics. According to the online pundit, the current market cycle could be different from the typical cycles seen in the past, but perhaps not as much as investors think.

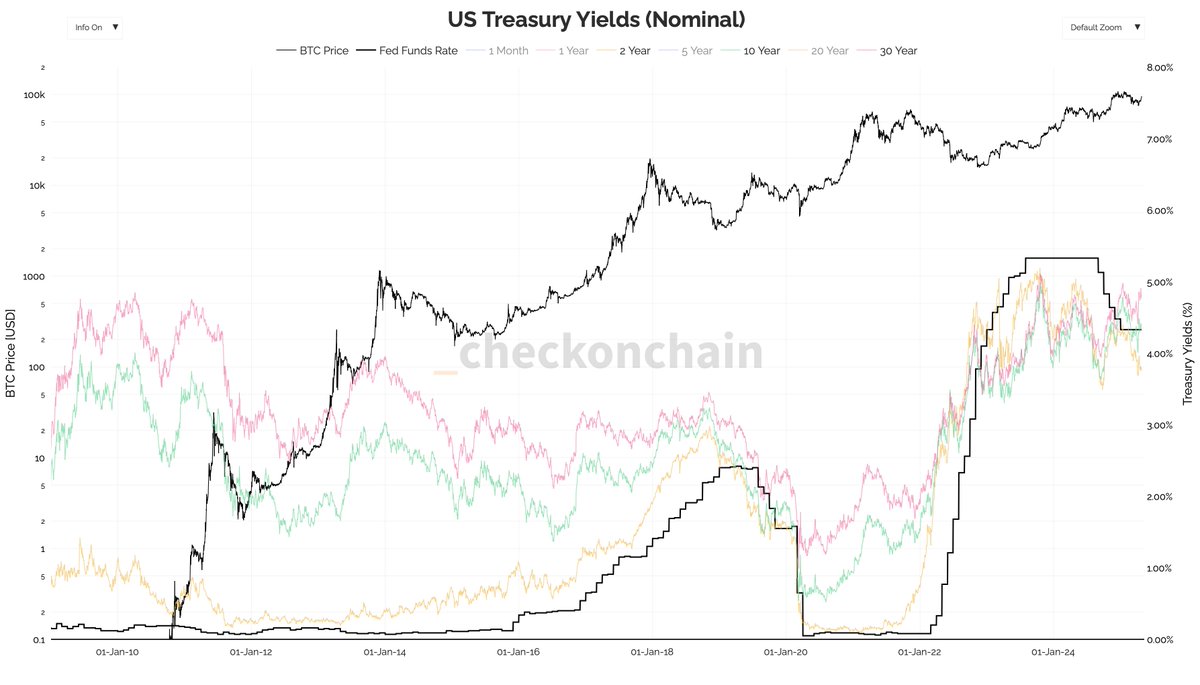

Darkfost based their analysis on the highlighted chart, which brings together key macroeconomic data and compares it to Bitcoin’s price movements. Firstly, the on-chain analyst believes that the flagship cryptocurrency has never had to evolve under market conditions this hostile for risk assets.

Darkfost alluded to the high interest rates by the US Federal Reserve, saying the potential juicy returns on safer investment instruments have not stopped the Bitcoin price from reaching two new all-time highs in the current cycle. Specifically, the crypto analyst pointed to the situation with Treasury yields. Darkfost said:

Why would big money, especially institutions, be willing to take risks when they could earn a SAFE 5% yield without any real risk? What’s even more striking is that the US2Y has been higher than long-term yields, an unusual and historically significant setup.

Darkfost went further to say that the current cycle might indeed be different, as liquidity has not been completely directed towards risk assets. However, this has not stopped the premier cryptocurrency from performing impressively in the past year.

In the end, Darkfost mentioned that the reelection of United States President Donald Trump brings some level of uncertainty to the market. The on-chain analyst concluded that while Bitcoin remains in a typical cycle for now, investors could see the first truly unique cycle if macro conditions improve this year and last till 2026.

BTC Price At A Glance

As of this writing, Bitcoin is valued at around $94,752, reflecting a roughly 0.5% price decline in the past 24 hours.