Bitcoin Long-Term Holder Selling Pressure Reaches Annual Minimum — Is the Bull Market Poised for Liftoff?

As of April 2025, Bitcoin’s long-term holders (LTHs) have demonstrated significantly reduced selling activity, marking the lowest pressure point this year. This trend often signals strong conviction in future price appreciation, potentially setting the stage for the next bullish phase. Market analysts are closely monitoring on-chain metrics, including LTH spending behavior and exchange inflows, to gauge whether this reduction in sell-side pressure could catalyze a sustained upward trajectory. The current macroeconomic landscape, combined with Bitcoin’s fixed supply dynamics, further reinforces the possibility of an impending breakout. Institutional accumulation patterns and derivatives market positioning also suggest growing confidence among sophisticated investors.

Bitcoin Long-Term Holders Looking To Halt Selling Pressure

In a recent post on X, Adler Jr. shared an important update in Bitcoin long-term holders (LTH) activity, which could prove significantly positive for the broader BTC market.

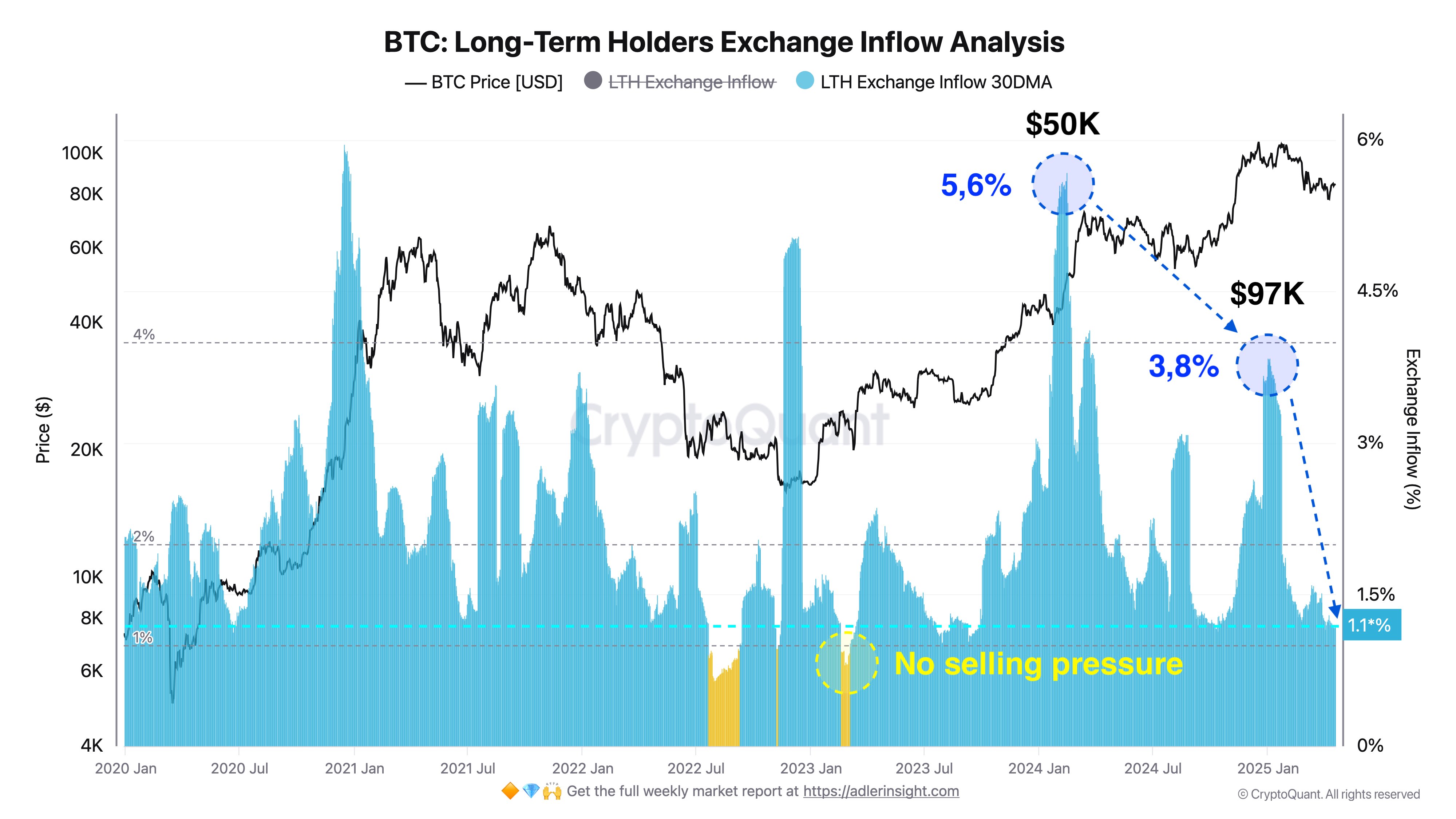

Using on-chain data from CryptoQuant, the renowned analyst reports that selling pressure by long-term holders, i.e. amount of LTH holdings on exchanges, has now hit its lowest point at 1.1% over the past year. This development indicates that Bitcoin LTH are now opting to hold on to their assets rather than take profits.

Adler explains that a further decline in these LTH exchange holdings to 1.0% would signal the total absence of selling pressure. Notably, this development could encourage new market entry and sustained accumulation, creating a strong bullish momentum in the BTC market. Importantly, Alder highlights that the majority of the Bitcoin LTH entered the market at an average price of $25,000, Since then, CryptoQuant has recorded the highest LTH selling pressure of 5.6% at $50,000 in early 2024 and 3.8% at $97,000 in early 2025.

According to Adler, these two instances likely represent the primary profit-taking phases for long-term holders who intended to exit the market. Therefore, a resurgence in selling pressure from this cohort of BTC investors is unlikely in the short-term, which supports a building bullish case as long-term holders currently control 77.5% of Bitcoin in circulation.

BTC Price Overview

At the time of writing, Bitcoin was trading at $85,226 following a 0.36% gain in the past day and a 0.02% loss in the past week. Both metrics only reflect the ongoing market consolidation as BTC continues to struggle to achieve a convincing price breakout beyond $86,000. Meanwhile, the asset’s performance on the monthly chat now reflects a 1.97% gain, indicating a potential trend reversal as the market correction ceases. Nevertheless, BTC remains in need of a strong market catalyst to ignite any sustainable price rally. With a market cap of $1.67 trillion, Bitcoin is ranked as the largest digital asset, controlling 62.9% of the crypto market.