Crypto Funds Bleed $1.7 Billion in Record Exodus — What’s Next?

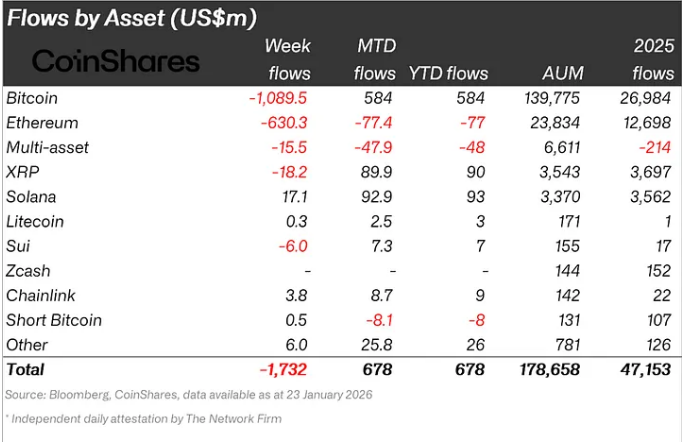

Digital asset funds just witnessed their largest capital flight on record. A staggering $1.7 billion walked out the door last week, marking a historic shift in institutional sentiment.

The Great Unwind

This isn't your typical weekly volatility. The scale of the outflow suggests a coordinated move—a strategic retreat by major players rather than retail panic. It's the kind of number that makes portfolio managers reach for the antacid.

Following the Money Trail

Where did it all go? While the headline figure is stark, the devil's in the details. The exodus was heavily concentrated in broad-market Bitcoin and Ethereum products. Meanwhile, a handful of altcoin-focused funds actually saw minor inflows, hinting at a sector rotation rather than a full-scale abandonment.

The Contrarian Signal?

In crypto, extreme fear often precedes opportunity. Veteran traders are watching these flows like hawks, knowing that capitulation from one cohort can signal a bottom forming. It’s the old market adage: when the last weak hand folds, the stage is set for the next move.

A Reality Check for Finance Bros

Let's be real—this kind of movement separates the long-term builders from the fair-weather financiers chasing the last cycle's gains. It's a brutal reminder that this asset class doesn't care about your Lamborghini dreams or your favorite influencer's price prediction.

The $1.7 billion question now is whether this is a cleansing flush or the start of a deeper winter. One thing's certain: the easy money era is over, and the market is demanding conviction.

Flows Reverse Sharply

Big names felt the hit. BlackRock’s iShares led issuers with roughly $950 million leaving its coffers. Fidelity lost close to $470 million, and Grayscale saw withdrawals NEAR $270 million.

In the regional front, the US accounted for the bulk of the movement, with nearly $2 billion exiting from that market alone.

Some managers did attract fresh capital — groups focused on volatility or niche strategies posted modest gains — showing that investors are shifting tactics rather than abandoning the sector entirely.

Who Pulled Money Out

Bitcoin and Ether were the largest contributors to the outflows. Combined, they comprise most of the $1.73 billion. Based on reports, Ether funds lost roughly $1.10 billion while Bitcoin-focused products shed about $630 million.

That split shows a renewed skepticism about large-cap tokens even as traders weigh macro signals. Smaller tokens told a mixed story: solana drew about $17 million in inflows, while XRP and SUI saw withdrawals of a little over $18 million and $6 million, respectively.

Bitcoin Price ActionMeanwhile, price moves matched the money flow. bitcoin traded in a choppy range and slipped below $90,000 at one point as risk appetite evaporated. But it did not cave in.

Periodic buying returned, and shorts were put under stress when prices bounced back. Traders are watching macro cues; weakness in sentiment has been paired with bouts of institutional interest, creating a seesaw battle that keeps volatility up.

What This Means For TradersMarket behavior suggests that confidence is unsettled, not totally evaporated. Reports note that investors are recalibrating timeframes and tools. Some are rotating into altcoins that look cheap to them, while others beef up hedges or step back from Leveraged positions.

Featured image from Unsplash, chart from TradingView