BitMine Doubles Down on Ethereum With $40M Accumulation - Betting Big on the Merge’s Legacy

BitMine just placed a $40 million vote of confidence in Ethereum's future. The institutional mining giant isn't just dipping a toe—it's diving headfirst into ETH accumulation, signaling a strategic pivot that's got the entire crypto-finance world watching.

The $40 Million Signal

Forget subtle positioning. This move screams conviction. Allocating capital on this scale isn't a hedge; it's a core portfolio thesis. It tells you BitMine's analysts see more than just speculative upside—they see fundamental infrastructure value, the kind that outlasts market cycles. They're buying the network, not just the token.

Beyond the Proof-of-Work Exodus

This isn't about mourning GPU rigs. The post-Merge landscape rewards a different kind of stakeholder: the strategic holder. BitMine's pivot reflects a cold, calculated read of crypto's evolution. The game changed from raw compute power to economic security and protocol influence. They're not abandoning mining; they're redefining what it means to 'mine' value in a proof-of-stake era.

What the Smart Money Sees

Look past the headline number. The real story is in the timing and the target. Accumulating Ethereum now isn't a passive index play—it's a bet on developer mindshare, on institutional adoption pipelines, and on a deflationary supply mechanic that would make a traditional central banker's head spin. It's a wager that the most-used blockchain will eventually command a valuation to match.

The move throws a stark light on the rest of finance, where allocating $40 million often means months of committee reviews and a prospectus thicker than your wrist—meanwhile, crypto's vanguard just rebalanced its future with a few wallet signatures. Sometimes, the most sophisticated play looks a lot like simply believing in the code.

Bitmine Expands Ethereum Exposure Amid Market Fear

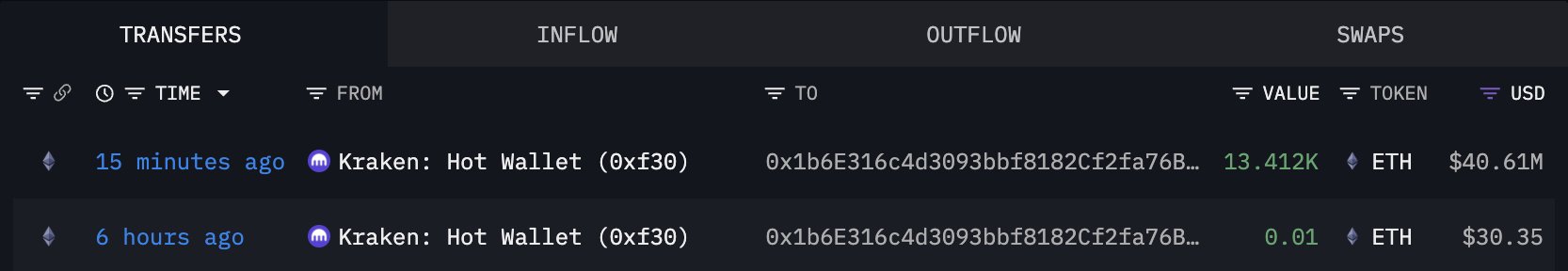

On-chain data from Arkham confirms that Bitmine has added another 13,412 ETH to its holdings, an acquisition valued at approximately $40.61 million at current market prices. The purchase comes at a time when ethereum sentiment remains deeply bearish, reinforcing the contrast between short-term market fear and long-term capital positioning.

Following this latest accumulation, Bitmine’s total Ethereum holdings now stand at roughly 3.769 million ETH, with an estimated market value of around $11.45 billion. This places Bitmine among the largest known Ethereum holders globally, highlighting the scale and conviction behind its strategy.

Such positioning is not consistent with short-term speculation. Instead, it reflects a deliberate approach centered on long-duration exposure to Ethereum’s network value and future role within the digital asset ecosystem.

Bitmine’s accumulation behavior suggests confidence in Ethereum’s long-term fundamentals despite near-term volatility and widespread pessimism. Historically, large-scale purchases during periods of extreme fear have often occurred when prices trade below perceived intrinsic value.

While this activity does not eliminate the risk of further downside in the coming months, it signals that structurally patient capital continues to deploy. The growing divergence between bearish sentiment and aggressive accumulation underscores a market environment where positioning, rather than headlines, may offer clearer insight into longer-term expectations.

Some investors are using current pessimism as an opportunity to build exposure, reinforcing the idea that fear-driven environments can also attract structurally patient buyers.

Ethereum Price Struggles to Rebuild Bullish Structure

Ethereum is currently trading just above the $3,000 level, attempting to stabilize after a prolonged corrective phase. The chart shows that ETH remains below its key medium-term moving averages, with the 50-day and 100-day MAs still acting as dynamic resistance overhead. Each recent attempt to push higher has been met with selling pressure, highlighting the market’s difficulty in reclaiming bullish momentum.

Structurally, the price action since the October peak reflects a clear sequence of lower highs and lower lows, confirming that ETH is still operating within a bearish trend on the daily timeframe. Although the recent bounce from the $2,800–$2,900 zone suggests the presence of demand, volume remains muted compared to earlier expansion phases, indicating a lack of conviction from buyers. This supports the view that the current MOVE is corrective rather than the start of a new impulsive rally.

From a support perspective, the $2,900 area is now critical. A sustained loss of this level WOULD expose ETH to a deeper retracement toward the $2,600–$2,700 region, where prior consolidation occurred. On the upside, bulls would need a decisive daily close above the descending moving averages near $3,300 to invalidate the bearish structure.

Overall, the chart points to consolidation under resistance rather than trend reversal. Until ETH reclaims key moving averages with expanding volume, price action suggests ongoing distribution and elevated risk of further downside.

Featured image from ChatGPT, chart from TradingView.com