BlackRock’s Bitcoin ETF Climbs to 6th in 2025 Global ETF Flows — A Wall Street Stampede

The old guard of finance just can't stop buying the dip—on digital gold, that is.

BlackRock's spot Bitcoin ETF, the IBIT, isn't just participating in the market; it's leading a charge. Fresh data for 2025 shows the fund has muscled its way into the global top ten for ETF inflows, securing the number six spot worldwide. That's not a niche play; that's mainstream capital voting with its wallet.

From Skepticism to Sixth Place

Forget the cautious toe-dipping of years past. This ranking signals a phase shift. Institutional and retail investors are funneling billions into the vehicle, treating it not as a speculative punt but as a core strategic holding. The flow is relentless, outpacing thousands of established equity, bond, and commodity funds.

The Liquidity Engine Revs Up

What does sixth place actually mean? It translates to unprecedented daily liquidity and a deepening of the market's foundations. Every billion that flows in tightens spreads, improves price discovery, and makes the asset class harder for even the most cynical portfolio manager to ignore. It's building a runway for the next cycle.

Sure, some traditional finance veterans might grumble about 'digital tulips' between sips of their overpriced coffee—but their firms' order books tell a very different, and far more profitable, story. The train has left the station, and BlackRock just secured a first-class car.

BlackRock’s IBIT Records $25 Billion Net Inflow In 2025

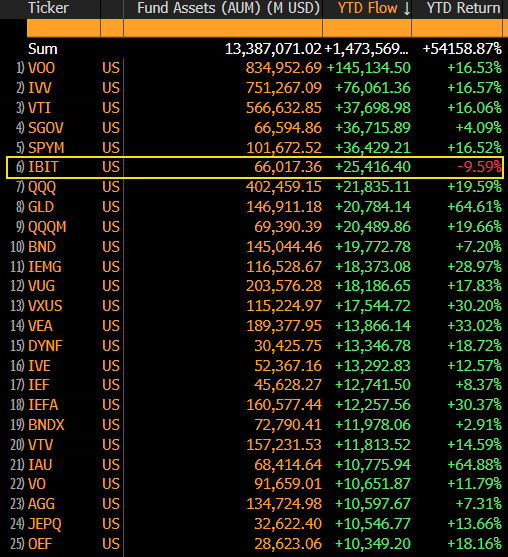

In a recent post on the social media platform X, senior Bloomberg analyst Eric Balchunas revealed that BlackRock’s bitcoin ETF has ranked sixth in net capital inflows in the past year. This feat comes despite the BTC exchange-traded fund posting a negative return in the same period.

According to data shared by Balchunas, BlackRock’s IBIT registered a net inflow of approximately $25 billion so far this past year. What’s interesting is that the Bitcoin ETF pulled in this significant capital despite being the only fund with negative performance among the traditional equity and bond ETFs, as observed in the chart below.

Interestingly, SPDR’s GLD ETF, the world’s largest physically backed Gold exchange-traded product, lags behind BlackRock’s IBIT in terms of capital inflows despite its 64% return in the year. Notably, Vanguard’s S&P 500 ETF (VOO) led the cohort with a year-to-date capital inflow of over $145 billion.

Furthermore, Balchunas highlighted that while the crypto community would naturally complain about the Bitcoin ETF’s yield, it is also important to recognize the significant feat of attracting the sixth-largest capital in spite of this negative return. According to the ETF expert, this yearly performance is a good sign in the long term.

Balchunas wrote:

If you can do $25b in a bad year, imagine the FLOW potential in a good year.

The Bloomberg analyst did credit the older, long-term investors (the boomers) in what he called a “HODL clinic” for the positive net inflows seen by BlackRock’s Bitcoin ETF.

Bitcoin ETFs Record $497 Million Weekly Outflow

According to SoSoValue data, the US-based Bitcoin ETFs closed the week with a total net outflow of $158 million on Friday, December 19. This brought the ETFs’ record to about $497.05 million in outflows over the past week.

The dismal run of performances in the Bitcoin ETF market can be seen in the price action of the premier cryptocurrency in recent weeks. The Bitcoin price is down by exactly 30% from its all-time high of $126,080.

As of this writing, the price of BTC stands at around $88,293, reflecting a 2% decline in the past seven days.