Bitcoin or Ethereum to $62,000? Fundstrat’s 2026 Predictions Spark Debate

Which crypto giant hits $62,000 first? A major research firm just dropped two wildly different roadmaps for 2026.

The $62,000 Question

Forget modest gains. The new price target from Fundstrat Global Advisors throws a $62,000 figure into the ring, setting the stage for a heavyweight bout between Bitcoin and Ethereum. It's not a unified forecast—it's a split decision that forces the market to pick a side.

Diverging Paths to the Peak

The analysis doesn't hand out participation trophies. One asset gets crowned, the other gets a reality check. The $62,000 target acts as a litmus test for each network's fundamental thesis, from store-of-value dominance to decentralized computer utility.

What the Split Really Means

This isn't just number-crunching. Contrasting predictions expose the core battle in crypto: digital gold versus the world's programmable financial layer. The winner in 2026 won't be decided by hype, but by which narrative actually delivers real-world adoption and investor conviction.

One thing's clear—someone's prediction is going to look very smart, and someone else's is going to require a creative earnings call explanation. Welcome to finance.

$60,000 Is The Target, But Not For Ethereum

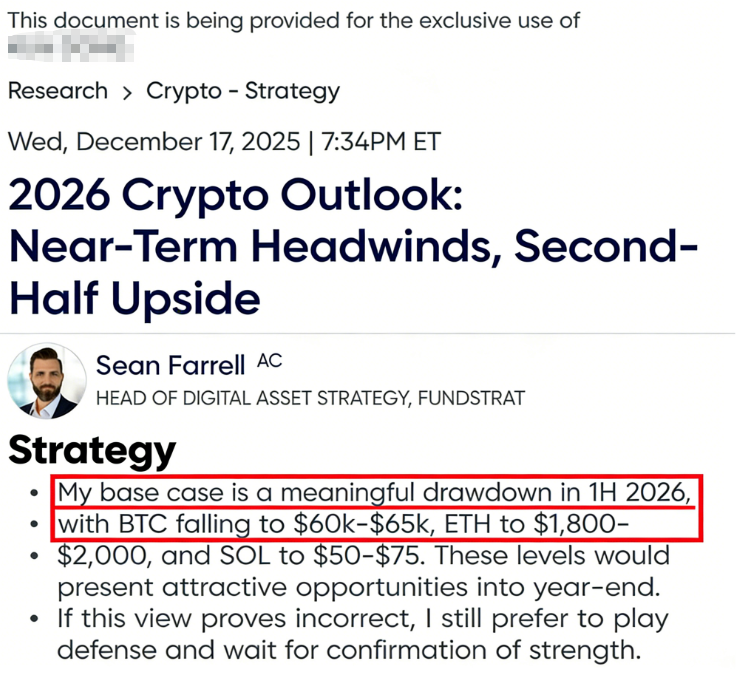

According to screenshots posted on social media platform X, Fundstrat released a 2026 crypto strategy report, warning internal clients of potential market headwinds in early 2026. The report’s title, however, also suggested that Bitcoin, Ethereum, and solana could enjoy significant growth in the second half of next year.

Sean Farrell, Fundstrat’s head of digital asset strategy, projected significant drawdowns for the crypto market in the first half of 2026. The research set the target for the Bitcoin price between $60,000 to $65,000, the ethereum price within $1,800 – $2,000, and the Solana price around $50 – $75.

Farrell wrote in the report:

These levels WOULD present attractive opportunities into year-end. If this view proves incorrect, I still prefer to play defense and wait for confirmation of strength.

This circulating report stands in contrast to the predictions of Tom Lee, who is the chief investment officer (CIO) at Fundstrat. Speaking to attendees at the Binance Blockchain Week earlier this month, Lee stated that the price could run up to as much as $62,000 as ethereum becomes the core infrastructure for tokenized finance.

In September, at the Korea Blockchain Week, Lee said that the price of Bitcoin could reach as high as $250,000 by year-end, while Ethereum’s value could climb toward $12,000. The rationale for this projection revolved around macro tailwinds and growing institutional interest in crypto assets.

Now, while the Fundstrat internal document has yet to be authenticated by Bitcoinist as of press time, Colin Wu-led outlet Wu Blockchain verified that this document was indeed distributed to internal clients.

Bitcoin And Ethereum Price At A Glance

As of this writing, Bitcoin, the world’s largest cryptocurrency by market cap, is valued at around $88,180, reflecting no significant movement in the past 24 hours. Meanwhile, the price of ETH stands at around $2,980.