CryptoQuant Sounds Alarm: Bitcoin Demand Boom Fading, Bear Market Looms

Is the party over for Bitcoin? A key on-chain analytics firm just threw cold water on the rally, pointing to fading demand as the potential start of a new crypto winter.

The Demand Engine Sputters

CryptoQuant's latest data suggests the explosive institutional and retail appetite that propelled Bitcoin to recent highs is cooling off. The metrics they track—the ones that don't lie—show capital inflows slowing to a trickle. It's the kind of shift that historically precedes significant price corrections, not just a temporary dip.

Reading the On-Chain Tea Leaves

Forget the hype on social media. The real story gets written on the blockchain. Analysts are watching exchange reserves, whale wallet movements, and network activity like hawks. When those signals turn from green to amber, it's time to pay attention. The data implies new buyers aren't rushing in at the same pace, leaving the market vulnerable.

What Comes After the Boom?

If this is the start of a bear phase, it reshapes the game entirely. Strategies built on perpetual growth—from leveraged trading to yield farming—get stress-tested. Projects without real utility or robust treasuries could get exposed. It's the part of the cycle where 'number go up' meets financial reality, separating the resilient from the reckless. After all, on Wall Street, they call a 'correction' what crypto Twitter calls a 'bloodbath'.

The big question now: is this a healthy cooldown or the first domino to fall? One firm's warning shot just made the entire market hold its breath.

Bitcoin Cyclical Behavior Depends On Demand Cycles: CryptoQuant

In its latest market report, blockchain analytics firm CryptoQuant has associated the steady decline in bitcoin price with the fading demand boom. According to data on the on-chain platform, the BTC demand growth has slowed down in the course of 2025, signaling the start of a bear market.

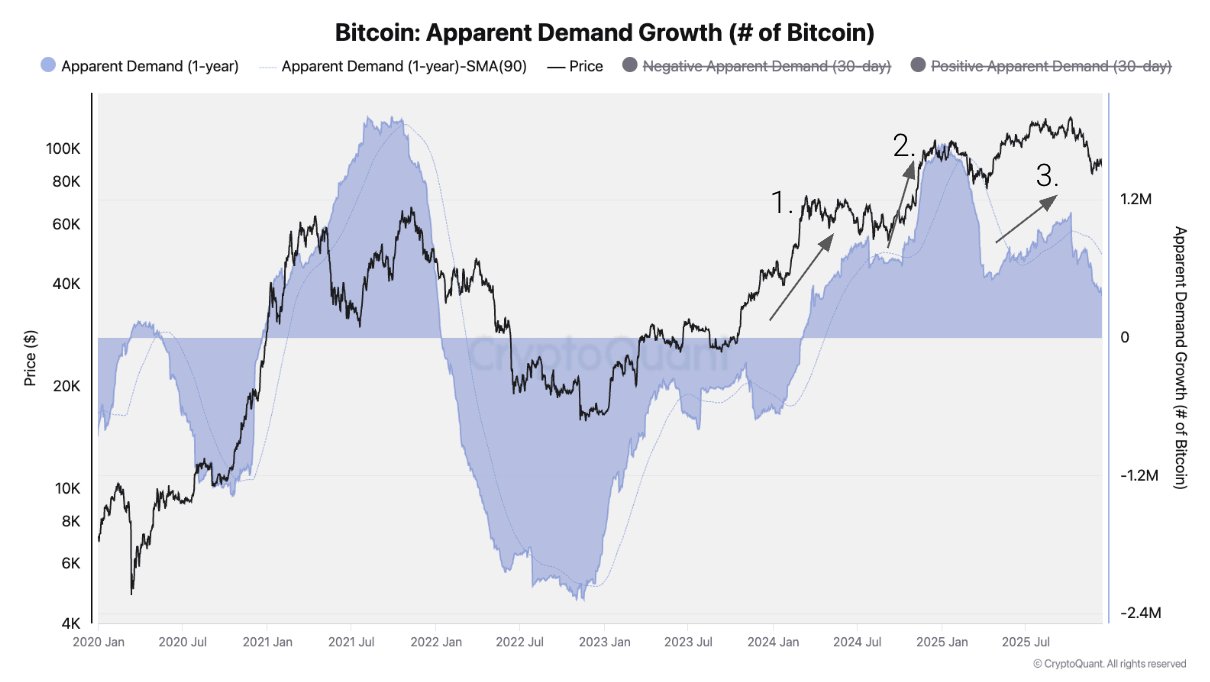

CryptoQuant highlighted that Bitcoin has witnessed three major spot demand waves—triggered by the US spot ETF launch, the US presidential election outcome, and the Bitcoin Treasury Companies bubble—since the bull cycle started in 2023. However, the demand growth has slowed down since early October 2025.

Unsurprisingly, this trend reversal for the demand growth coincides with the October 10 market bloodbath, one of the largest liquidation events in crypto history. The bitcoin price has since struggled to mount any convincing recovery, falling to as low as $82,000 in late November.

CryptoQuant went on to hypothesize that a key pillar of price support has been removed as most of this cycle’s incremental demand has already been realized. For instance, demand from institutional and large investors is in a downturn, with US-based Bitcoin exchange-traded funds (ETFs) turning into net sellers in 2025’s fourth quarter.

According to CryptoQuant’s data, the US spot ETF holdings have declined by 24,000 BTC in Q4 2025, which is a far cry from the steady accumulation seen in Q4 2024. “Similarly, addresses holding 100–1K BTC—representing ETFs and treasury companies—are growing below trend, echoing the demand deterioration seen at the end of 2021 ahead of the 2022 bear market,” the blockchain firm added.

Besides the weakening spot demand, the Bitcoin derivatives market has also seen reduced activity and decreased risk appetite. CryptoQuant revealed that BTC’s funding rates have fallen to their lowest level since December 2023, an on-chain signal that suggests the reduced willingness of traders to maintain long exposure; this trend is often associated with bear markets.

Ultimately, the blockchain firm concluded that the Bitcoin four-year cycle hinges more on demand phases—expansions and contractions in demand growth— rather than on the halving event. In essence, a bear market tends to come after the BTC demand growth peaks and topples over.

What Next For BTC Price?

In its report, CryptoQuant revealed that the Bitcoin price structure has worsened in line with the demand weakness. The flagship cryptocurrency is currently trading below its 365-day moving average, a key long-term support level that has historically separated bull and bear phases.

According to CryptoQuant, the downside reference points suggest that the Bitcoin bear market might not be as DEEP as feared. As in previous bear seasons, the realized price—currently around $56,000—has been identified as the potential bottom.

This implies a possible 55% correction from the latest all-time high, Bitcoin’s smallest drawdown on record (during a bear market). Meanwhile, the market leader has its intermediate support level around $70,000.

As of this writing, the price of BTC stands at around $88,170, reflecting a 3% jump in the past 24 hours.