BitMine’s $140M Ethereum Shopping Spree: Smart Move or Desperate Gamble as Prices Dip?

While retail investors panic-sell, a crypto whale just made a nine-figure bet on Ethereum's future.

On-chain data reveals a single entity—identified as mining giant BitMine—scooping up a staggering $140 million worth of ETH during the recent market dip. The move wasn't a slow accumulation; it was a concentrated buy order that rippled through the order books.

The Buy Signal That Roared

This isn't pocket change. A $140 million purchase in a single tranche acts as a massive vote of confidence, suggesting institutional players see the current price weakness as a prime buying opportunity, not a reason to flee. It's the ultimate 'buy when there's blood in the streets' play, executed with cold, algorithmic precision.

Decoding the Miner's Motive

Why would a mining operation deploy capital this way? It's a strategic hedge. By converting fiat reserves into a core ecosystem asset like Ethereum, BitMine isn't just betting on price appreciation—it's aligning its treasury with the very network its operations may depend on. It's vertical integration, blockchain-style.

The trade also highlights a cynical truth of modern finance: for entities with deep pockets, market downturns aren't crises—they're fire sales. Retail gets liquidated; institutions get shopping lists.

The Ripple Effect

Moves of this magnitude don't happen in a vacuum. They provide tangible on-chain support, can signal a local bottom, and often precede renewed bullish momentum. Other large holders are watching. Will this trigger a wave of copycat accumulation, or stand as an isolated act of defiance against bearish sentiment?

One thing's clear: while headlines scream about price drops, the smart money is quietly loading up. The real narrative isn't on the charts—it's in the ledger.

BitMine Has Received 48,049 Ethereum From FalconX

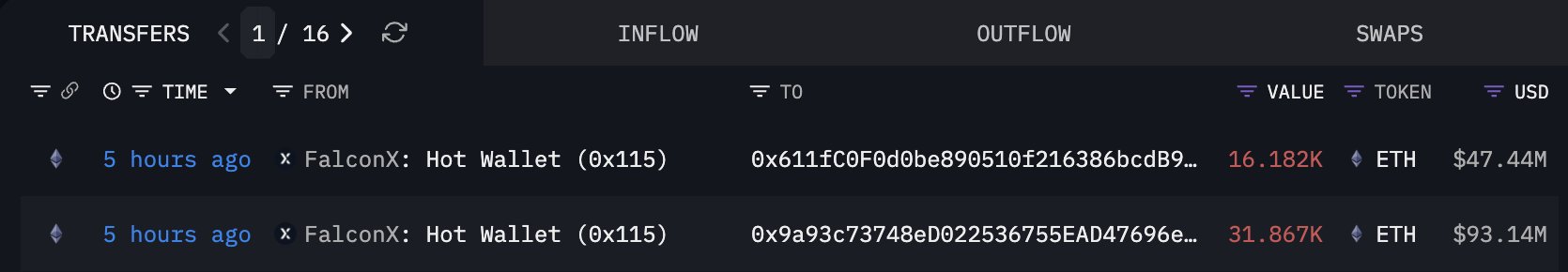

In a new post on X, on-chain sleuth Lookonchain has pointed out how BitMine appears to have acquired 48,049 ETH from a hot wallet connected to FalconX, an institutional digital asset trading platform.

The coins transferred through two transactions to two different wallets. The larger transfer involved 31,867 ETH, while the smaller one 16,182 ETH. In total, the tokens were worth about $140.58 million at the time that they were transacted.

The moves have come as Ethereum has plunged alongside the wider cryptocurrency sector, with its price dropping below the $3,000 level. Thus, it would appear possible that they are a sign of BitMine buying the dip.

Originally a Bitcoin mining-focused company, BitMine transitioned to being an Ethereum treasury vehicle under the leadership of chairman Tom Lee in June of this year. Since then, the firm has rapidly accumulated the cryptocurrency and has established itself as the “Strategy” of ETH.

On Monday, BitMine published a press release announcing that its holdings reached 3,967,210 ETH. So far, the company hasn’t made any official announcement of the latest buy, but if confirmed, it WOULD take the total reserve past the 4 million ETH milestone.

The firm has set a target of 5% of the total circulating Ethereum supply. At present, the company still has some ways to go before this goal is hit, but at about 3.3% of the supply now sitting in its wallets, it has certainly made significant progress.

With holdings valued at more than $11 billion, BitMine is the second-largest cryptocurrency corporate holder in the world, only behind Strategy. Unlike Michael Saylor’s firm, however, the Ethereum hoarder has its treasury sitting in the red right now. Nonetheless, if the two blockchain transactions correspond to purchases, then it’s a sign that BitMine is still committed to accumulating more.

CryptoQuant community analyst Maartunn has talked in an X post about how the ethereum price has changed since BitMine started its accumulation spree. It’s visible in the chart that during the initial buying period, ETH witnessed some rapid growth.

Clearly, however, despite continued buying from the treasury company, the asset’s price first flatlined and then declined. “Big buys ≠ sustained momentum,” noted the analyst.

ETH Price

Ethereum managed to make a recovery to $3,400 last week, but the coin has once again gone through bearish momentum since then, as its price has returned to the $2,930 level.