XRP Daily Fees Plunge 89% Since February: Is the Network Losing Steam?

XRP's transaction fee revenue has taken a nosedive—down a staggering 89% since its February peak. The numbers don't lie, and they're painting a stark picture of dwindling on-chain economic activity.

The Fee Fade: What's Behind the Drop?

Network fees act as the heartbeat of any blockchain, a real-time pulse check of demand and utility. When that pulse weakens by nearly 90%, it forces a hard look at the underlying health. Are developers building elsewhere? Are users simply holding, not transacting? The data suggests a network in a lull, waiting for the next catalyst to spark its engine back to life.

Beyond the Surface Metrics

A sharp fee decline often signals more than just quiet days—it can hint at shifting developer focus, competitive pressures, or a market waiting for a regulatory green light that's stuck on amber. In crypto, stagnation is rarely neutral; it's typically a prelude to a pivot or a problem. It's the financial equivalent of watching a once-bustling mall slowly become a ghost town, one shuttered storefront at a time.

The Verdict: Pause or Decline?

One quarter's data point isn't a death sentence—it's a diagnosis. For XRP, this 89% fee collapse is a glaring symptom. The network now faces its ultimate test: proving this is a temporary cooldown, not the start of a long, slow fade into irrelevance. The market is watching, and its patience, like those fees, isn't what it used to be.

XRP Transaction Fee Has Dropped To 650 Tokens Per Day

In a new post on X, on-chain analytics firm Glassnode has discussed the latest trend in the Total Transaction Fees indicator for XRP. This metric measures, as its name suggests, the amount of fees that senders on the XRP network attach to their transactions every day.

On blockchains like Bitcoin and Ethereum, the transaction fee goes to the network validator who added the associated move to the next block. In the case of BTC, the network runs on a consensus mechanism called the proof-of-work (PoW), with validators called miners competing against each other using computational resources to get the chance to add the next block to the chain.

While for ETH, validators known as stakers handle consensus by locking in an ETH amount known as the “stake.” This mechanism is known as the proof-of-stake (PoS).

XRP takes an approach that differs from both digital asset giants. In the XRP Ledger Consensus Protocol, network validators maintain a list of other validators that they trust. Validators propose and vote on transactions, with consensus being reached when more than 80% of trusted nodes agree on the validity of the transactions.

The key difference is that in this system, there are no block/staking rewards, and validators aren’t compensated with transaction fees, either. Instead, the fee that users pay is destroyed. This means that every time a transaction occurs, a tiny part of the asset’s supply exits from circulation.

While the destination of the transaction fees is different for XRP when compared to bitcoin and Ethereum, the network dynamics can still be similar. In other words, high traffic can push the Total Transaction Fees metric up, while low activity periods can lead to a drop in it.

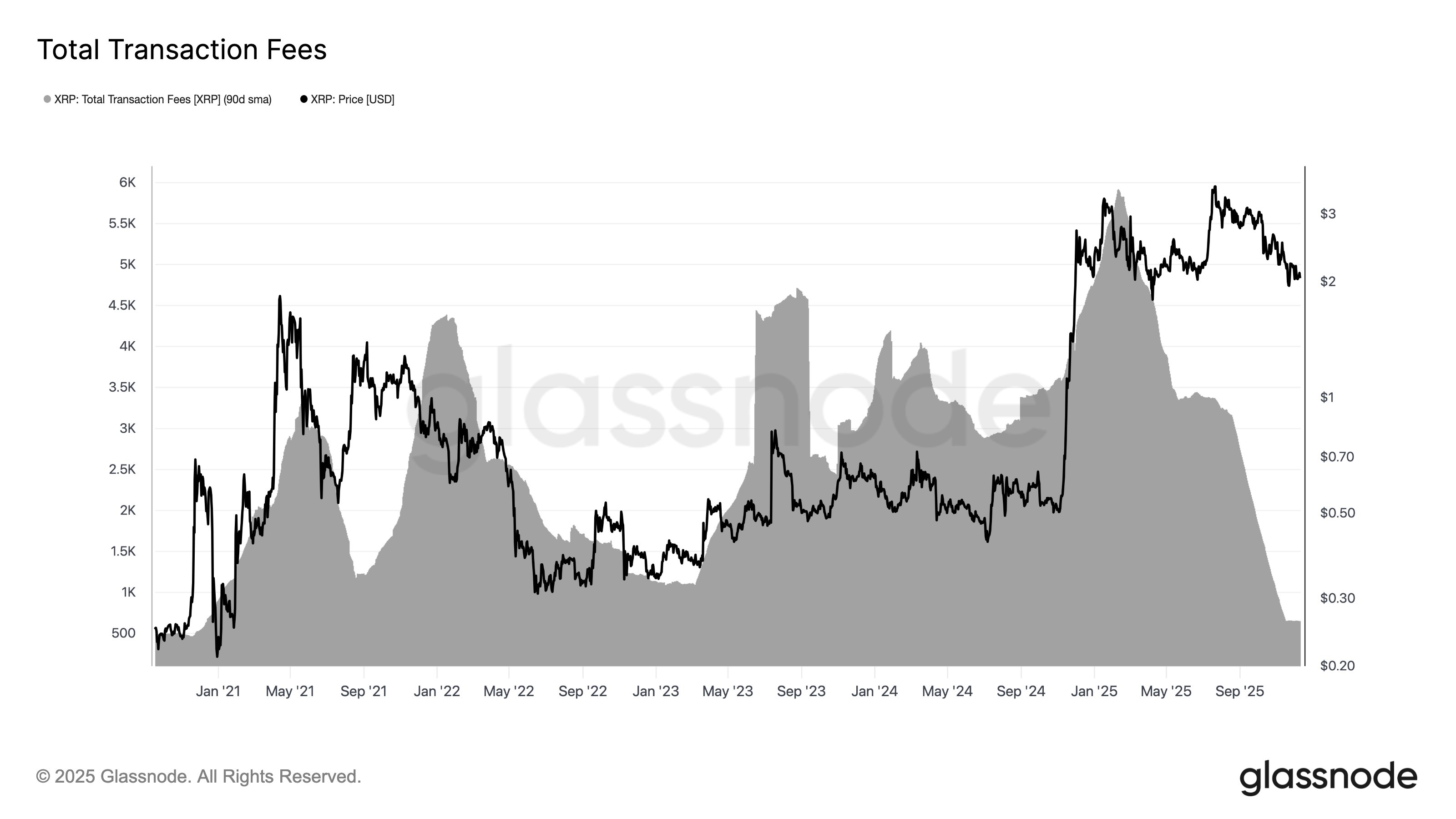

Now, here is the chart shared by Glassnode that shows the trend in the 90-day simple moving average (SMA) of the XRP Total Transaction Fees over the last few years:

As displayed in the above graph, the XRP Total Transaction Fees witnessed a surge to an extreme level in early 2025. Users were paying 5,900 tokens per day as transfer fees at the peak of this explosion in February.

Since then, however, the blockchain has witnessed a rapid decline in the indicator. Today, the network is witnessing just 650 tokens per day in fees, reflecting a decrease of about 89% from the February high. The 90-day SMA Total Transaction Fees haven’t been this low for the asset since December 2020.

XRP Price

XRP has gone downhill during the last couple of days as its price has returned to the $2.00 level.