Crypto Watchlist: Key Events To Watch In The Week Ahead

Markets brace for a volatile week as regulatory deadlines, network upgrades, and macroeconomic data converge.

Regulatory Spotlight Shifts

Watch for final comments on the SEC's proposed custody rules—a decision that could either legitimize institutional crypto holdings or send compliance costs soaring. Meanwhile, the UK's FSA begins its crypto promotion regime enforcement. Expect some awkward silence from previously loud marketing campaigns.

Network Upgrades Go Live

Two major Layer-1 protocols execute scheduled hard forks. Ethereum's latest testnet shadow fork aims to refine post-merge client performance, while a competing chain launches its promised scalability upgrade. Success means faster, cheaper transactions; failure means a long week for their developer relations teams.

Economic Data Incoming

Wednesday's CPI print remains the week's main event for risk assets. A hot number could hammer sentiment, while a cool read might ignite the 'digital gold' narrative—traders will pivot on a dime either way. Remember, in crypto, the narrative often moves faster than the blockchain itself.

Token Unlocks & Treasury Movements

Over $200 million in previously vested tokens hit circulating supply from several major projects. History suggests sell pressure, but some teams have signaled coordinated buyback plans. It's the financial equivalent of watching someone promise to refill the punch bowl after taking a gallon home.

The bottom line? This week separates proactive projects from reactive ones. Keep one eye on the charts and the other on the calendar—volatility isn't just a market feature; it's the schedule.

#1 Crypto On Alert: Fed’s Dec. 10 Rate Decision

The US Federal Reserve’s FOMC interest rate decision on Dec. 10 looms as a key macro catalyst for crypto. Markets overwhelmingly expect a 25 bps rate cut – about an 87% probability according to Fed funds futures– which WOULD lower the target rate to ~3.5–3.75%. Such a move would be the third cut in as many meetings, signaling a pivot to easing as the Fed prioritizes a faltering job market over inflation.

Bitcoin (BTC) has historically reacted sharply to Fed surprises: BTC often faces downward pressure into FOMC announcements, then significant volatility as markets parse the Fed’s language. Indeed, ahead of this meeting, BTC dipped below $88,000 over the weekend on “FOMC nerves” but quickly jumped back above $91,000.

If the Fed delivers the expected 0.25% cut, it could bolster crypto by improving liquidity conditions and risk appetite. Easing financial conditions have been core to the recent crypto rebound. Any dovish signals may prompt a relief rally in BTC and the broader crypto market.

However, a hawkish surprise – if the Fed were to hold rates steady or sound cautious – risks upsetting this fragile optimism. As reported on NewsBTC, a special focus will be on whether the Fed announces a new program for Treasury bill purchases.

#2 Solana’s Breakpoint (Dec. 11–13)

Solana’s Breakpoint conference kicks off Dec. 11 in Abu Dhabi, and traders are eyeing SOL’s price action around this flagship event. Breakpoint has a track record of stirring excitement – and volatility – in SOL. At the 2023 conference in Amsterdam, for example, SOL surged over 20% to a 14-month high (~$45) as a “flurry of announcements” (like Jump Crypto’s Firedancer client and Google Cloud integrations) dropped during the event.

This year, investors are anticipating major updates once again. The full launch of Firedancer (a high-performance solana validator) and new ecosystem partnerships are rumored, and Breakpoint acts on investors like a magnet, usually triggering strong FOMO ahead of anticipated news.

If Solana’s team delivers headline-worthy developments, SOL could rally, as happened last year when announcements at Breakpoint corresponded with a price spike. Conversely, if the conference HYPE fades without new catalysts, short-term traders might take profit. Still, sentiment is clearly bullish going in.

#3 Do Kwon Sentencing (Dec. 11)The long-awaited sentencing of Terraform Labs co-founder Do Kwon on Dec. 11 could mark a climactic chapter in the Terra/Luna saga. Kwon’s legal fate is largely sealed after he pleaded guilty to fraud in August, but the severity of punishment matters for the market psyche.

US prosecutors have asked for the maximum 12-year prison term for Kwon’s role in the $40 billion Terra meltdown. Paradoxically, traders have taken this bad news as bullish fuel: when the DOJ’s 12-year recommendation hit headlines, LUNC spiked 130% in a day, suggesting speculators see a tough sentence as a FORM of closure.

The actual sentencing on Dec. 11 could thus be a “sell the news” moment if those gains are purely hype-driven. Any outcome within expectations may prompt profit-taking after the event.

#4 Bittensor’s First TAO Halving (Dec. 12)Bittensor (TAO), an AI-focused blockchain network, will undergo its inaugural token halving around Dec. 12–14, a pivotal event that echoes Bitcoin’s quadrennial cycle. After this “maturation milestone”, TAO’s issuance rate will be cut from 7,200 tokens per day to 3,600.

The halving cements Bittensor’s hard cap of 21 million TAO (just like BTC’s 21M) and is seen as a key milestone in the network’s maturation”. In the community, bulls have been hyping the “halving = scarcity” narrative for months – daily supply dropping 50% overnight is expected to “fuel scarcity narratives” and amplify TAO’s appeal as the base asset of a decentralized AI economy.

#5 Avalanche Spot ETF DecisionAvalanche (AVAX) could make history this week, as the US SEC faces a Dec. 12 deadline to approve or reject VanEck’s spot Avalanche ETF. This is the final decision date after multiple delays. Approval would mark one of the first mainstream investment vehicles for a “Ethereum-killer” layer-1 token, potentially unlocking new capital for AVAX.

Regulatory watchers are optimistic – Bloomberg ETF analysts Eric Balchunas and James Seyffart put the odds around 90% for approval. They argue that a spot AVAX fund would likely follow the path of recent Bitcoin and Ether ETFs.

#6 Aster’s S4 Buyback Program (Dec. 10)Aster (ASTER), a DeFi protocol on BNB Chain, is commencing its Season 4 (S4) token buyback program on Dec. 10. Under this program, Aster will allocate 60–90% of all fees collected in Season 4 to buying back ASTER tokens from the open market.

This aggressive buyback scheme is designed to reduce supply and support the token’s price. In fact, the team announced it is accelerating the Phase 4 buybacks, with execution ramped up to roughly $4 million worth of ASTER purchases per day as of Dec. 8. Aster’s developers stated that this acceleration allows them to quickly deploy the fees accumulated since Nov. 10 onto the blockchain to prop up the market “during periods of volatility.”

By their estimates, it will take 8–10 days of these heightened buybacks to catch up, after which daily buybacks will continue at a steady 60–90% of the prior day’s fee revenue for the remainder of Season 4. A dedicated on-chain wallet for the buybacks is to be made public, ensuring transparency as the protocol executes what is essentially a large-scale, programmatic share (token) repurchase.

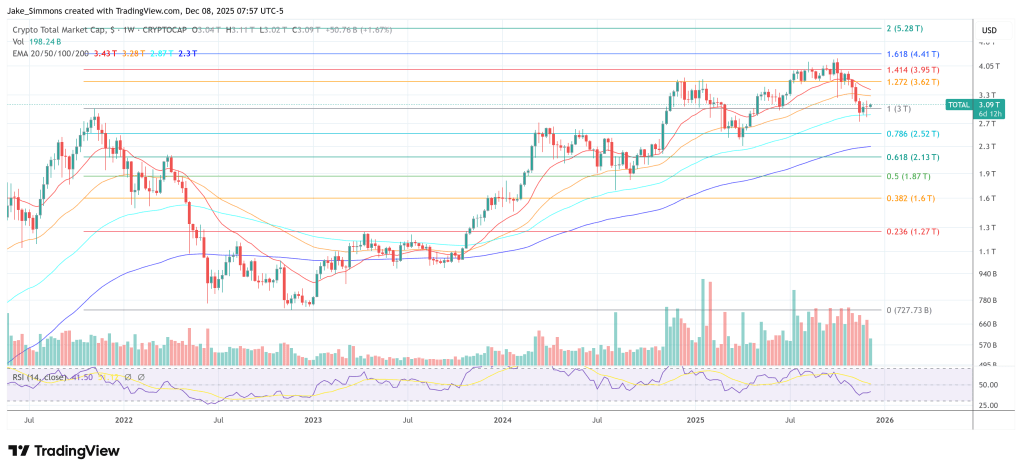

At press time, the total crypto market cap stood at $3.09 trillion.