From Top To Bottom: Bitcoin’s Largest & Smallest Hands Both Now Accumulating – A Rare Unanimous Bet

Forget the noise. The smart money—and the small money—are speaking with one voice: buy Bitcoin.

The Whales Are Back

After months of sideways churn, on-chain data reveals a clear trend. The largest Bitcoin wallets, the so-called 'whales,' are gobbling up supply. This isn't a tentative dip-buying exercise; it's a strategic accumulation phase. These entities, often institutional funds or long-term holders with deep pockets, aren't known for emotional trades. Their moves signal a fundamental conviction in the asset's long-term trajectory, a quiet bet that drowns out the daily price chatter.

The Retail Rush Resumes

Meanwhile, at the other end of the spectrum, the smallest wallet cohorts are also expanding their holdings. This retail accumulation, often measured in fractions of a Bitcoin, tells a different but equally important story. It reflects renewed grassroots confidence, a belief that filters down from crypto-native communities to first-time buyers. When both the boardroom and the kitchen table agree on an asset, it's worth paying attention—even if the traditional finance crowd is still busy arguing about 'intrinsic value.'

A Rare Alignment of Interests

This top-to-bottom accumulation is a powerful, albeit rare, market signal. It suggests a convergence of timelines. The whales are positioning for a macro move, while retail is betting on the next cycle's momentum. It creates a foundational support layer of buying pressure that can absorb volatility and set the stage for the next leg up. It's the market equivalent of both the generals and the infantry advancing on the same objective.

The last time this pattern emerged with such clarity, it preceded a significant revaluation of the network. While past performance is the favorite disclaimer of every cynical fund manager (right before they quietly copy the trade), the current on-chain narrative is unmistakable: accumulation is underway, from the largest hands to the smallest.

Bitcoin Accumulation Trend Score Shows Shift Toward Buying

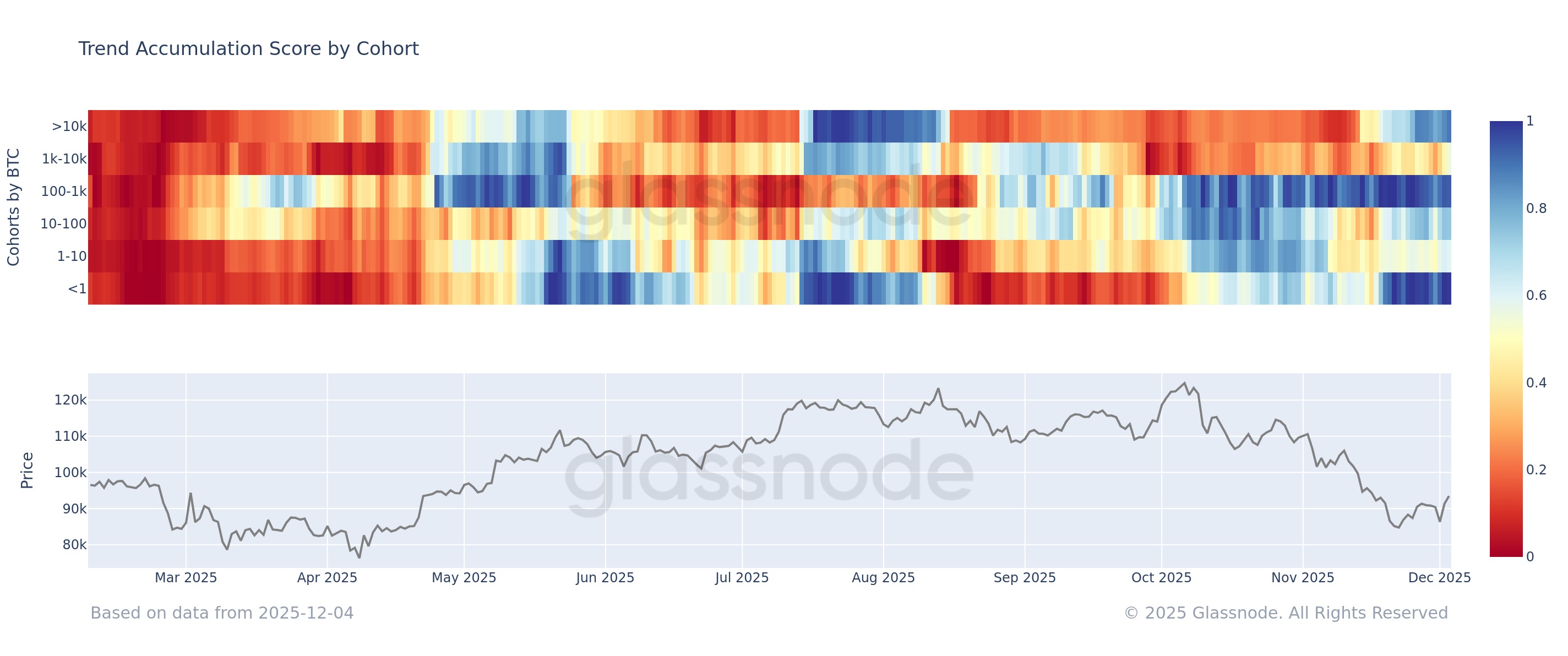

As explained by Glassnode analyst Chris Beamish in an X post, bitcoin investors have been showing a lot less distribution at the recent price levels. The on-chain indicator of relevance here is the “Accumulation Trend Score,” which tells us about whether BTC holders are buying or selling.

The metric tracks investor behavior using not just the changes happening in their wallet balance, but also accounting for the size of their wallets. This means that larger entities have a higher influence on the score.

When the value of the Accumulation Trend Score is greater than 0.5, it means the investors are displaying a net trend of accumulation. On the other hand, it being under the threshold suggests the dominance of distribution.

Now, here is the chart shared by Beamish that shows how the Accumulation Trend Score has changed for the different Bitcoin investor segments over the last few years:

As displayed in the above graph, the Bitcoin Accumulation Trend Score has reflected a varied behavior for the different investor segments during the last couple of months, but very recently, a uniform picture has started to develop.

The smallest of investors in the market, those holding less than 1 BTC, started participating in aggressive accumulation around the time of BTC’s low in November and have since maintained the indicator nearly at a perfect value of 1. This suggests that retail investors have been buying the dip.

Meanwhile, the 100 to 1,000 BTC traders, popularly called the sharks, have been accumulating throughout the drawdown that has followed since the early October peak, indicating that these investors haven’t lost conviction despite the DEEP decline.

The story is a bit different for the whale cohorts, however. The 10,000+ BTC holders, corresponding to the largest of hands on the network, were in a phase of distribution between August and November, but they have finally started accumulating since the price low, although the Accumulation Trend Score isn’t as high as the retail investors in their case.

The 1,000 to 10,000 BTC whale group didn’t stop distributing even after the bottom, but very recently, their score has just breached the 0.5 mark. With this, a uniform behavior has begun to appear on the Bitcoin blockchain, with investors as a whole opting to expand their wallet balance.

It now remains to be seen how long this trend of accumulation will continue.

BTC Price

Bitcoin has faced a drop of more than 3% over the last 24 hours that has taken its price to $89,300.