Ethereum Whale Redistribution Continues: 5,000 ETH Move Sparks Rally as Price Reclaims $3K

Whales are shifting the tectonic plates beneath Ethereum's market again.

While retail investors debate minor price swings, the real action unfolds in the shadows of blockchain ledgers. A single transaction moving 5,000 ETH—worth over $15 million at current prices—signals a deeper narrative. This isn't just a trade; it's a strategic repositioning by entities who measure their influence in network percentages, not dollar gains.

The Mechanics of a Mega-Move

Forget the simple 'buy low, sell high' mantra. Whale movements often precede or confirm major technical levels. The reclaiming of the $3,000 price point isn't a coincidence following this redistribution. It acts as a massive vote of confidence, a liquidity event that often absorbs sell-side pressure and paves the way for the next leg up. These moves create a gravitational pull, dragging the broader market sentiment along with them.

Beyond the Price Tag

The focus on the $3K level misses the forest for the trees. The true significance lies in the continued redistribution itself. It suggests accumulation, consolidation, or preparation for a larger market play. Are whales positioning for an upcoming protocol upgrade? Anticipating a surge in institutional demand? Or simply executing a sophisticated profit-cycling strategy that would give a traditional fund manager an aneurysm? This activity underscores Ethereum's maturation from speculative asset to a cornerstone of digital finance, where major players actively manage their holdings like a strategic reserve.

So, the next time you see a green candle, remember: it might just be the wake from a whale diving deeper. Meanwhile, your stock broker is still trying to explain what a wallet is.

Ethereum Whale Distribution Highlights Market Caution

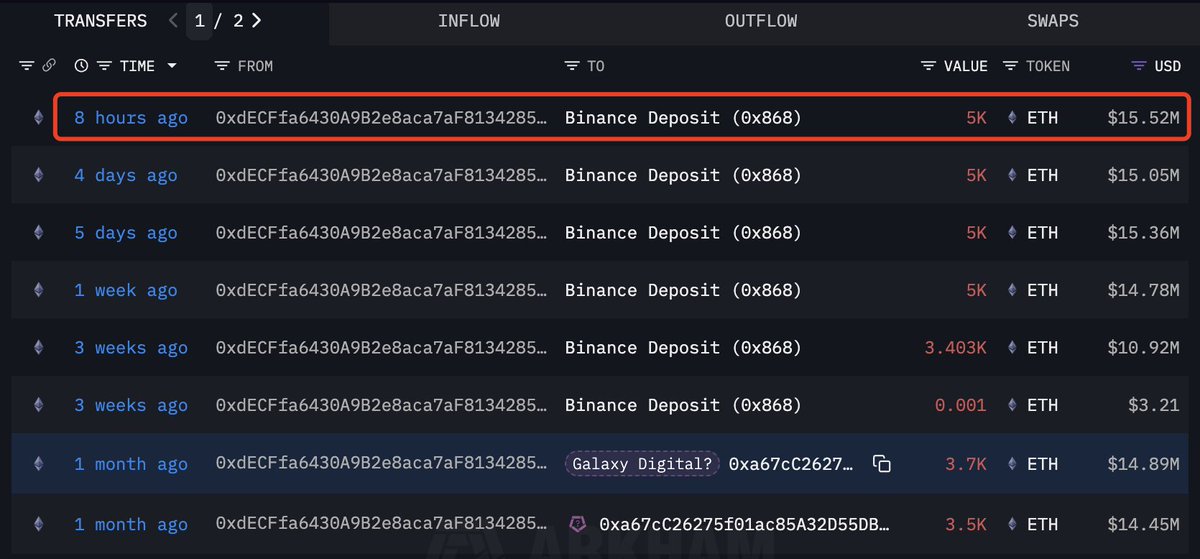

According to Lookonchain, whale 0xdECF has sold 25,603 ETH—valued at approximately $85.44 million—across Binance and Galaxy Digital since October 28. Despite this substantial distribution, the wallet still holds 5,000 ETH (around $15.52 million), suggesting that the whale has not fully exited its position but has significantly reduced exposure during the recent market decline.

This pattern of behavior provides important insight into sentiment among large holders: while they are not abandoning Ethereum entirely, they are actively managing risk and responding to volatility more aggressively than usual.

Such persistent selling pressure from a large wallet often acts as a drag on price during periods of weakness, especially when market liquidity is thin. However, the fact that the whale continues to retain a meaningful position indicates an expectation of potential recovery—or at least a desire to remain strategically exposed to future upside.

Ethereum now finds itself in a critical phase. The asset has reclaimed key levels, but its mid-term structure remains highly sensitive to macro conditions and whale behavior. If selling from major holders slows and accumulation begins to outpace distribution, the recent rebound could solidify into a sustained trend. Otherwise, renewed sell flows could place Ethereum at risk of revisiting lower support zones.

ETH Reclaims Short-Term Momentum but Faces Heavy Resistance

Ethereum’s daily chart shows a clear improvement in momentum after reclaiming the $3,150–$3,200 region, but the broader structure remains fragile. The bounce from the $2,750–$2,850 support zone marked a decisive shift in buyer behavior, with strong lower wicks indicating aggressive demand. This rebound has pushed ETH back above key short-term levels, yet the asset still faces a challenging path forward.

Price is now approaching the 50-day SMA, currently sloping downward just above $3,250, which now acts as immediate resistance. This moving average has capped every rally since late October and remains the first major barrier for bulls to reclaim. Beyond it, the 100-day SMA around $3,450 and the 200-day SMA NEAR $3,600 form a tight cluster of overhead resistance that defines the medium-term downtrend.

Volume on the recent bounce is stronger than previous attempts, signaling that buyers are showing more conviction compared to the mid-November attempts to recover. However, the overall trend still leans bearish until ETH can break above the 50-day SMA and begin closing daily candles over $3,300.

Ethereum sits in a critical inflection zone: holding above $3,100 strengthens the case for continued recovery, while rejection from the $3,250–$3,300 band could trigger another retest of the $2,800 region. The next few sessions will determine whether this rebound evolves into a deeper trend reversal.

Featured image from ChatGPT, chart from TradingView.com