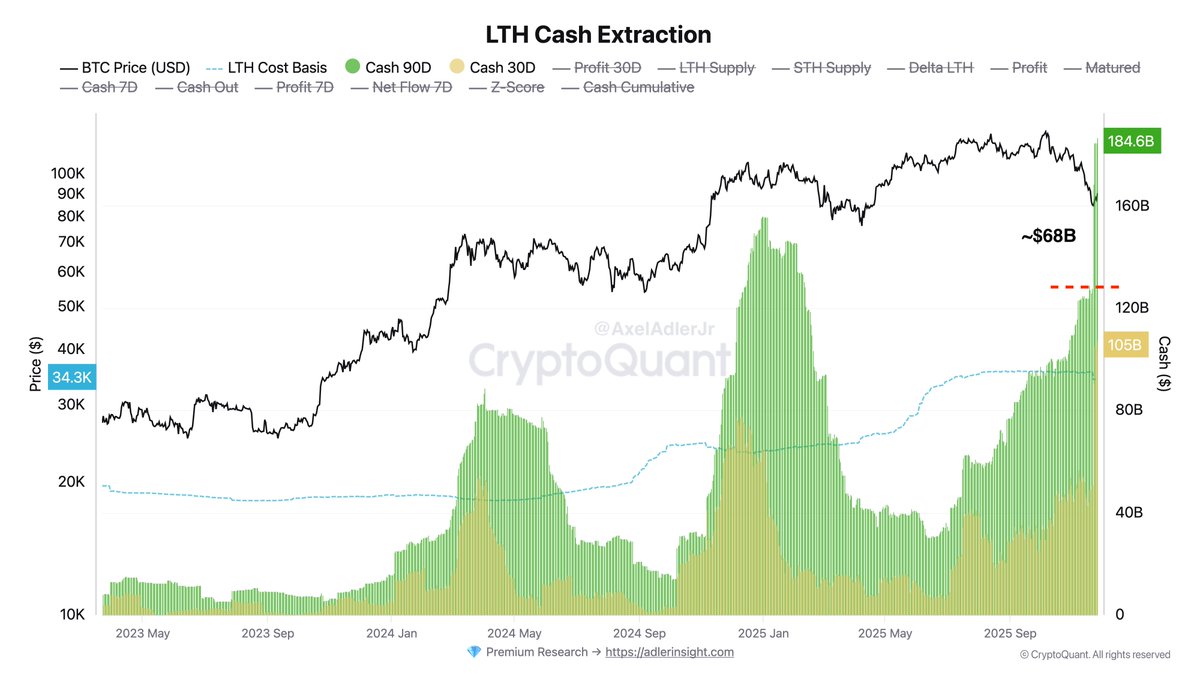

Coinbase Wallet Rebalancing Sparks $68B False Alarm in LTH Distribution - Market Reality Check

When $68 billion in Bitcoin movements flashed across screens, panic nearly set in—until the truth emerged.

The Great Wallet Illusion

Coinbase's internal rebalancing operations created what appeared to be massive long-term holder distribution, triggering algorithmic trading systems and sending shockwaves through derivative markets. The $68 billion signal turned out to be nothing more than institutional housekeeping—another reminder that in crypto, sometimes the scariest monsters are just shadows on the wall.

Market Mechanics Exposed

Professional traders watched as the false signal rippled through order books, creating temporary arbitrage opportunities while retail investors scrambled for explanations. The incident reveals how sensitive crypto markets remain to large wallet movements—and how quickly narratives can spiral when billions appear to be on the move.

Another day, another reason for traditional finance to clutch its pearls while secretly taking notes.

Coinbase Internal Transfers Distorted Key On-Chain Metrics

According to detailed analysis by Axel Adler, Coinbase’s internal migration of approximately 800,000 BTC created one of the largest distortions in on-chain data ever recorded — without a single coin being sold.

The exchange executed 286 transactions totaling 798,636 BTC, moving funds from legacy P2PKH (Pay-to-Public-Key-Hash) addresses to modern P2WPKH (SegWit) addresses. This technical reorganization produced an artificial $68 billion “realized profit” spike, misleading many market observers into interpreting it as massive long-term holder distribution.

This large UTXO migration disrupted several major on-chain indicators. LTH and STH Supply metrics were temporarily skewed, showing a sharp drop in Long-Term Holder supply and a rise in Short-Term Holder supply — a pattern typically associated with heavy “smart money” selling. In reality, no distribution occurred; Coinbase simply restructured its internal wallets.

The distortion also affected LTH Realized Profit/Loss models, which reflected tens of billions in phantom gains, and HODL Waves, where UTXO ages were “reset,” suggesting long-term holders had suddenly spent old coins. Even Coin Days Destroyed (CDD) showed a significant spike, mimicking an “old coin awakening,” though the activity was entirely internal.

These disruptions highlight how exchange operations can temporarily break the reliability of on-chain metrics, requiring careful interpretation from analysts and investors.

Total Market Rebounds but Remains Under Critical Pressure

The Total crypto Market Cap chart shows a sharp rebound after tagging the $2.88T zone, a level that aligns closely with the 100-week moving average (green), acting as a key structural support in previous cycles. This bounce has pushed total valuation back above the $3T mark, but the broader trend remains fragile after weeks of heavy selling across majors like BTC and ETH.

Price structure highlights a clear breakdown from the $3.6T–$3.8T consolidation zone, followed by a fast, impulsive decline—mirroring the speed of corrections seen during 2021 and mid-2022. Despite the latest recovery candle, the market remains below the 50-week moving average (blue), signaling that buyers must regain momentum quickly to avoid deeper downside toward the 200-week moving average NEAR $2T.

Volume has surged on recent sell-offs, showing widespread forced selling and capitulation behavior—a pattern consistent with cycle mid-reset phases. The rebound, however, shows reduced sell volume, suggesting exhaustion from bearish participants. To confirm strength, total market cap must reclaim the $3.25T–$3.3T area, which currently acts as the first major resistance.

Failure to break above this zone risks further consolidation or a retest of the $2.8T support. For now, the market shows early signs of stabilization, but broader recovery depends on Bitcoin’s ability to sustain its own rebound and restore confidence across altcoins.

Featured image from ChatGPT, chart from TradingView.com