Hedge Funds Go Crypto: 55% Now Hold Digital Assets in Bold Portfolio Shift

Wall Street's old guard finally caves—digital assets storm mainstream portfolios.

Hedge funds aren't just dipping toes anymore. Over half have plunged into crypto, scrambling for alpha in a zero-yield world. The 55% adoption mark isn't just a statistic—it's a surrender to inevitability.

No more 'experimental allocation' whispers. Bitcoin and Ethereum now sit alongside Treasuries and blue chips in quarterly reports. Even the most cynical fund managers can't ignore the institutional-grade custody solutions and regulated futures markets that emerged this cycle.

Of course, some still hedge their bets—allocating just enough to avoid FOMO while sneering at 'degenerate' retail traders. But when pensions and endowments start demanding exposure, even the suits have to adapt. The irony? Many funds now chasing the very volatility they once claimed made crypto 'uninvestable.'

One thing's clear: the smart money's playing catch-up. Again.

Crypto: Broad Adoption, Small Stakes

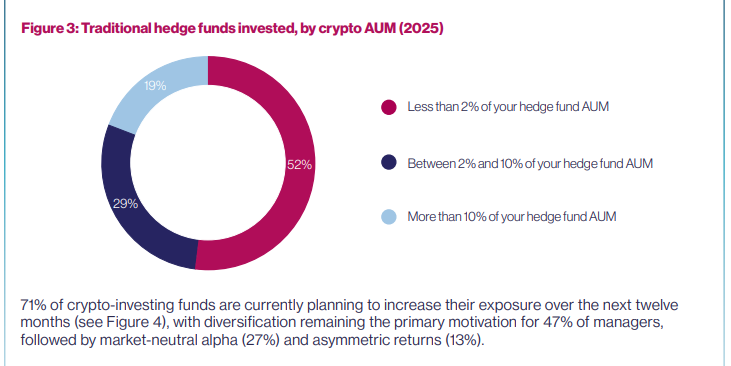

Most managers are being careful, for now. Many funds keep their digital currency positions tiny. Over half of those with exposure hold less than 2% of their portfolios in crypto.

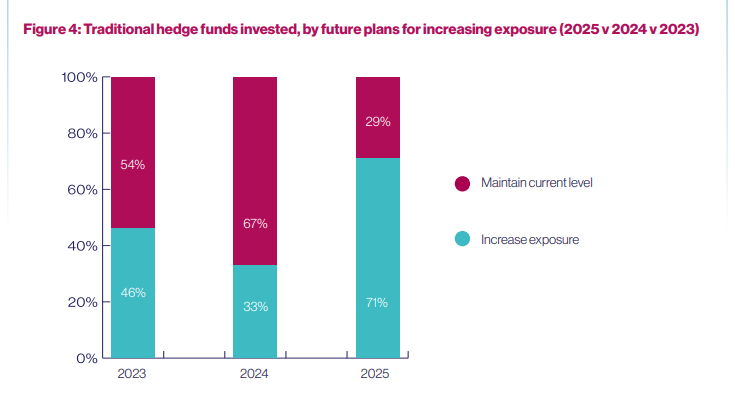

On average, funds put about 7% into crypto-related investments. Yet plans point upward: 71% of holding funds say they will raise their positions over the next 12 months.

Risk is on their minds. Reasons given include portfolio diversification (47%), market-neutral alpha opportunities (27%), and asymmetric return potential (13%).

The survey’s scale gives weight to the trend. The report asked 122 hedge fund managers controlling over $980 billion in assets. That sample shows a 17% year-over-year increase in the share of funds holding crypto.

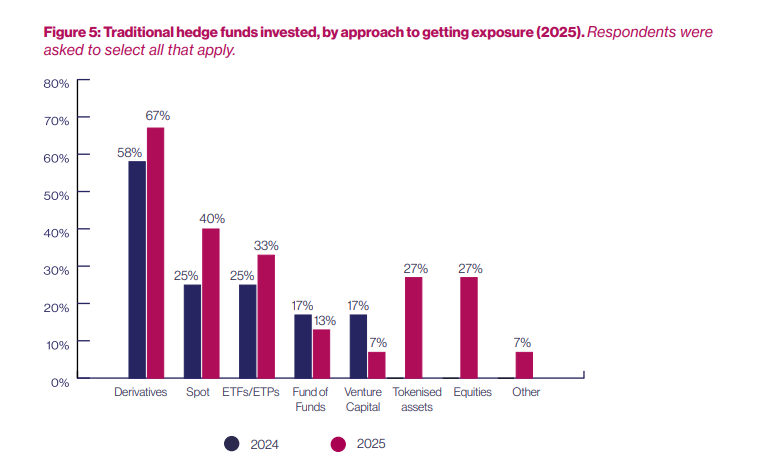

Many managers prefer indirect exposure. According to the findings, 67% use digital currency derivatives — up from 58% in 2024 — which lets them take positions without holding coins directly.

That approach can be safer on paper. But it also carries risks. The October 2025 flash crash caused close to $20 billion in liquidations, a stark reminder of what can happen when markets MOVE quickly.

How Funds Gain Market Exposure

Spot trading is growing while derivatives remain popular. Spot trading grew from 25% to 40% as a method of access. Exchange-traded products account for 33%.

Tokenized assets and related equities each sit at 27%. The numbers show funds want choice. Derivatives offer flexibility; spot gives direct ownership. Both have places in portfolios, depending on rules and risk limits.

Crypto-native funds are getting bigger. Pure crypto managers report larger pools of capital. Average assets under management reached more than $130 million in 2025, compared with $79 million in 2024 and over $40 million in 2023.

The coins held most often are Bitcoin (86%), ethereum (80%), Solana (73%), and XRP (37%). Solana’s adoption jumped from 45% last year. Yield strategies are widespread too — custodial staking is used by 39% of crypto funds and liquid staking by 35%.

Institutional interest is rising, but barriers remain. Fund-of-funds participation ROSE to almost 40% in 2025 from 21% in 2024. Institutional allocations from pension funds, foundations, and sovereign wealth funds climbed to 20% from 11%.

Two-thirds of institutional investors surveyed now allocate to digital assets. Yet half of traditional hedge funds without crypto say they will not invest in the next three years.

Featured image from Unsplash, chart from TradingView