Bitcoin Derivatives Bloodbath Continues: $450M More Liquidated From Crypto Bulls

Crypto markets just witnessed another brutal derivatives squeeze—and the bulls are taking the hit.

The $450 Million Wipeout

Liquidations ripped through leveraged long positions as Bitcoin failed to hold key support levels. Another half-billion dollars evaporated from trader accounts in what's becoming a painful pattern for overconfident bulls.

When Greed Meets Reality

Traders stacking long positions got caught when volatility spiked against them. The derivatives market continues showing zero mercy to those betting with borrowed money—proving once again that in crypto, your leverage can become someone else's profit in seconds.

Meanwhile, traditional finance types are probably sipping champagne and muttering 'told you so'—because nothing makes Wall Street happier than watching crypto traders learn the same expensive lessons they did decades ago.

Crypto Sector Has Just Seen $700 Million In Liquidations

On Friday, bitcoin and other digital assets were shook by a sharp crash, resulting in a record amount of liquidations in the futures market. A “liquidation” occurs when an open contract amasses losses of a certain degree and gets forcibly shutdown by its platform.

Last week’s market downturn was violent, so naturally a massive amount of positions were caught off guard. Bitcoin alone saw liquidations of over $11 billion during this volatility, as data from Glassnode shows.

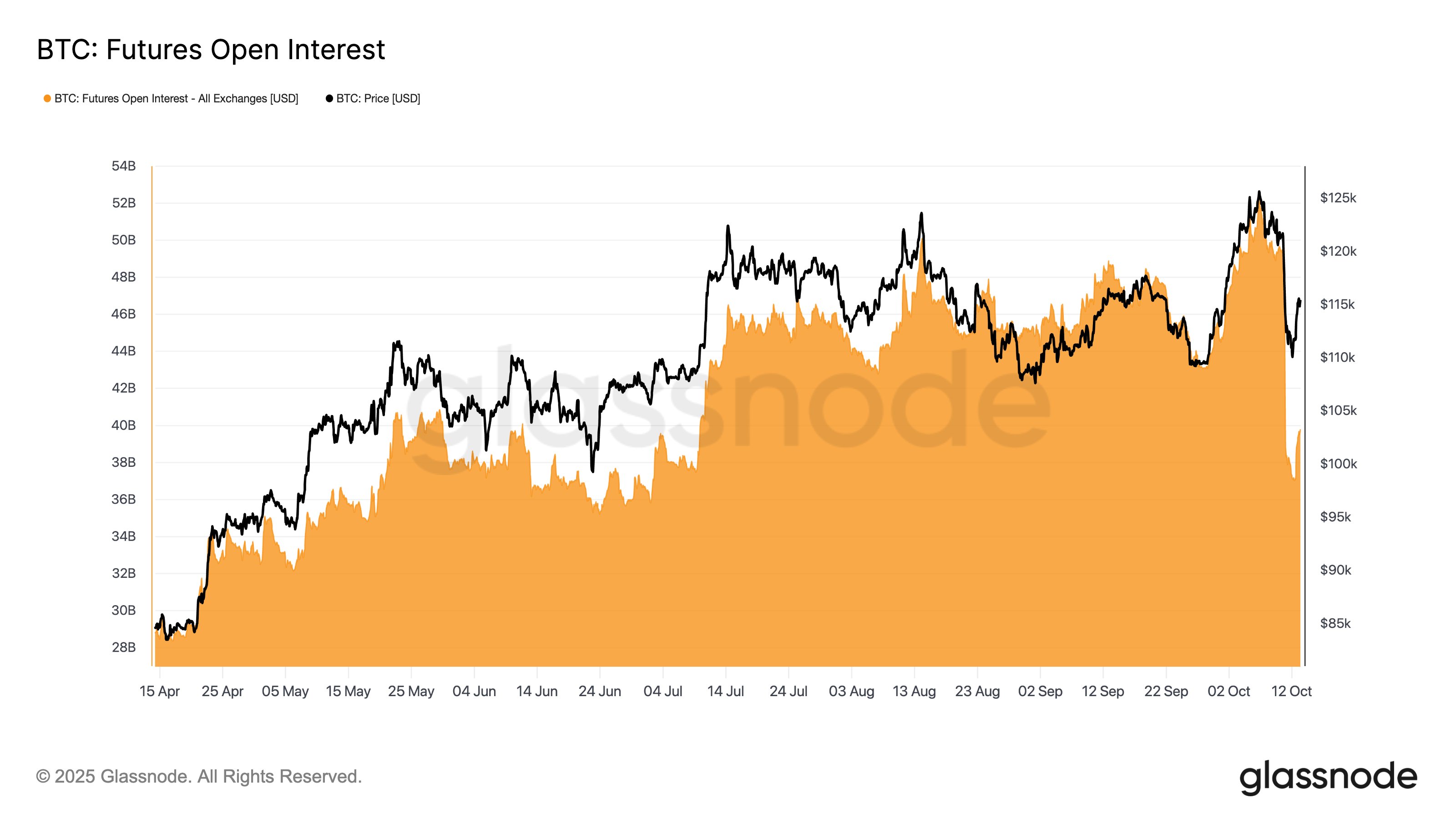

This plunge in the Bitcoin futures Open Interest was the largest in the cryptocurrency’s history and caused a reset in speculative excess across the derivatives market. The Open Interest here is naturally a USD measure of the total amount of positions related to BTC that are currently on all centralized exchanges.

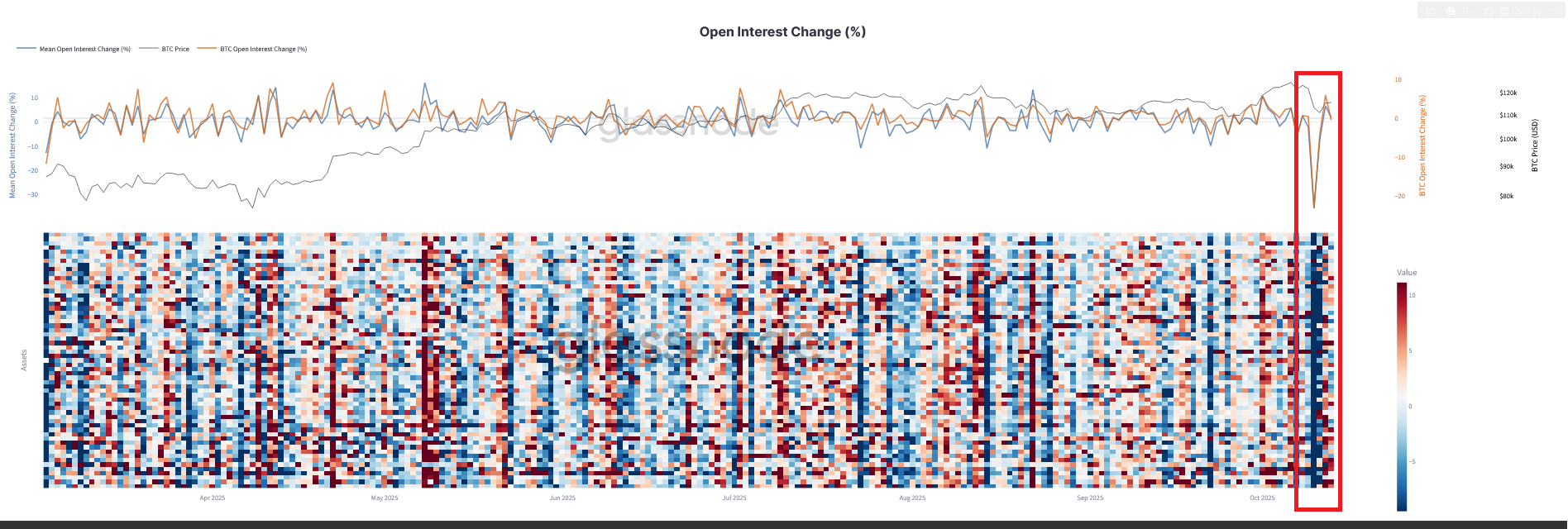

The analytics firm has also shared a heatmap that puts into perspective just how intense the swing in the Open Interest was across the top 100 coins by market cap.

Despite this recent squeeze, however, traders have once again been caught out by market volatility in the past day as liquidations have piled up on the various platforms.

As data from CoinGlass displays, the crypto sector has witnessed almost $708 million in liquidations on the derivatives exchanges over the last 24 hours.

Around $457 million of these liquidations, equivalent to 64% of the total, involved long positions. The derivatives flush has mostly been triggered by a decline in Bitcoin and company, so it makes sense that bullish bets have taken the brunt of the squeeze.

Overall, this mass liquidation event is significantly smaller than the one from last week, but that’s because excess leverage already saw a degree of reset then and the latest volatility hasn’t been quite as sharp.

In terms of the individual symbols, ethereum was the coin that contributed the most toward the liquidations with more than $234 million in contracts involved. Bitcoin was second with liquidations of $168 million and Solana third with $42 million.

A mass liquidation event like today’s isn’t an uncommon sight in the crypto market, due to the fact that coins can be volatile and extreme amounts of leverage can easily be accessible. Even so, the recent liquidations have been extraordinary.

BTC Price

At the time of writing, Bitcoin is floating around $113,300, down about 6.5% in the last seven days.