Bitcoin Long-Term Holders Hit the Brakes on Selling—Here’s Why It Matters

Bitcoin's most committed investors are suddenly holding tight—and the market's taking notice.

The Great Hold-Off

Long-term Bitcoin holders have dramatically slowed their selling activity, creating what analysts call a 'supply shock' in the making. These diamond-handed investors, who've weathered multiple market cycles, appear to be betting big on what's coming next.

Market Mechanics Shift

With fewer coins hitting exchanges and institutional demand quietly building, the stage sets for potential price discovery that could make traditional finance folks clutch their pearls. The same Wall Street analysts who dismissed Bitcoin as a 'pet rock' now scramble to understand why holders won't sell at these levels.

The Quiet Accumulation

While retail investors watch price charts, smart money accumulates in the shadows. The hodl mentality isn't just memes—it's becoming a sophisticated investment strategy that's leaving traditional portfolio managers in the dust. After all, nothing terrifies a banker more than an asset class that doesn't need their permission to exist.

This isn't just a pause—it's a positioning. And the market's about to find out what happens when conviction meets scarcity.

LTHs’ Selling Pace On The Decline

In a recent post on social media platform X, Alphractal revealed what may be good news for Bitcoin’s bullish onlookers. According to the on-chain analytics firm, there seems to be a shift in the behavior of the premier cryptocurrency’s long-term holders (LTH).

This on-chain revelation is based on the Coin Days Destroyed (CDD) Multiple Metric, which measures the intensity of coin spending in relation to historical averages.

As explained by the firm, the metric calculates how many “coin days” are destroyed when old coins are moved. In other words, it looks at when long-term holders decide to spend their coins, thereby tracking a shift in the Bitcoin LTH activity.

As pointed out by Alphractal, members of this investor class have continued to move their old coins, but the pace of their sales has dropped significantly. Compared to 2024, the movement of bitcoin long-term holders in the market has been slow over the past few months. Ultimately, this dip in CDD Multiple also signals reduced selling pressure from Bitcoin’s seasoned investors.

What This Means For Price

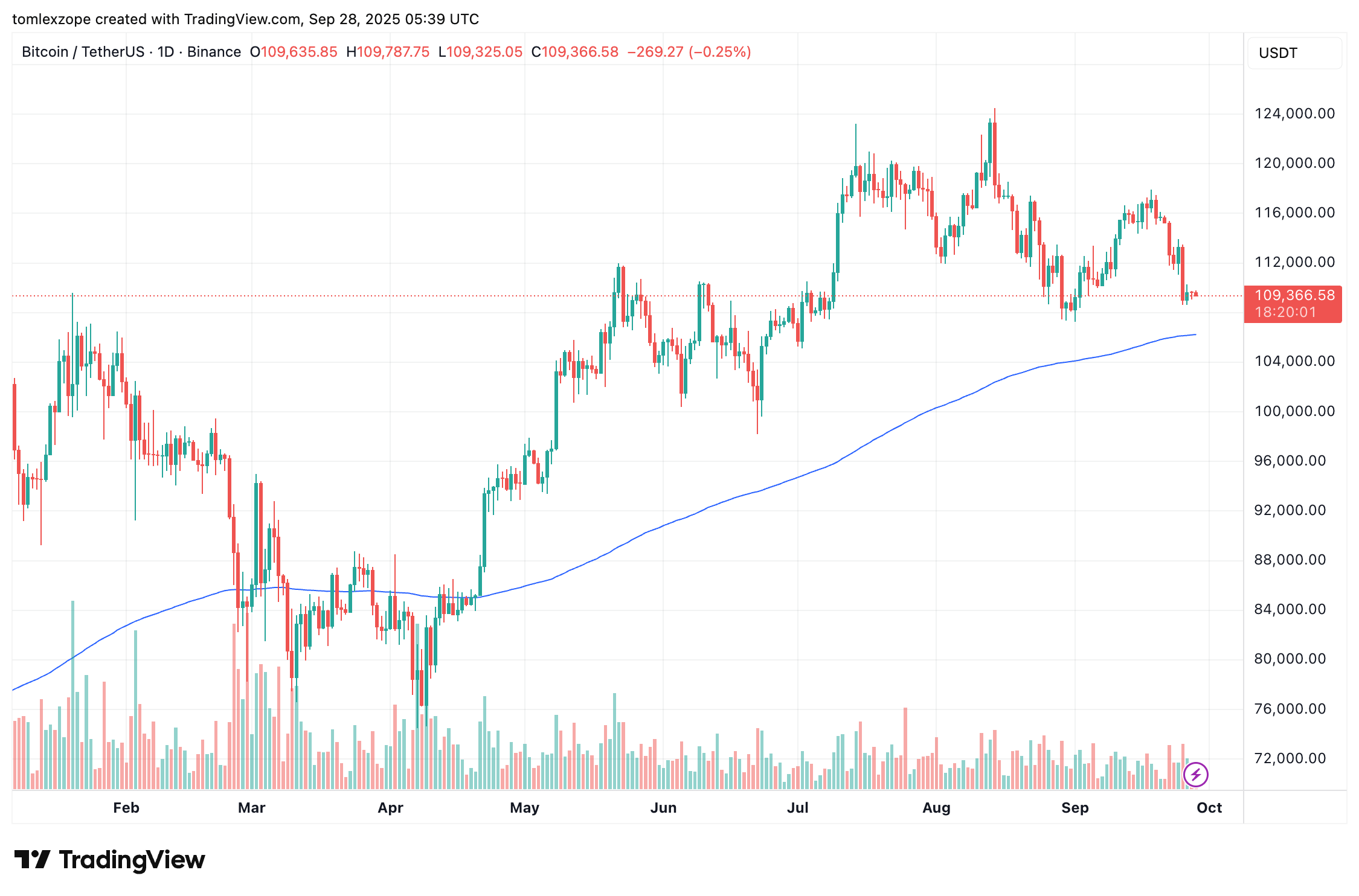

As of this writing, Bitcoin is trading within a volatile market just above the week’s swing low of $108,500. However, the experienced investors seem not to be in a rush to sell off their holdings. Instead of continuing to sell, the long-term holders seem to have started preserving their coins again.

“This decline in coin day destruction activity suggests that many experienced investors are choosing to hold their positions, waiting for stronger market moves,” the analytics firm said.

Historically, this type of behavior among the cryptocurrency’s earliest holders has preceded periods of accumulation, where the confidence of these investors offers stability in the market, preventing further decline in price.

If history is anything to go by, the reduced CDD Multiple could be a sign that the groundwork for Bitcoin’s next big expansion is being laid. Moves around the last swing low should therefore be watched closely, alongside CDD activity, before investment decisions are made.

At the time of writing, Bitcoin is worth about $109,630, reflecting no significant movement in the past 24 hours.