Bitcoin Short-Term Holders Hit Panic Button: 60,000 BTC Floods Exchanges at Massive Loss

Short-term Bitcoin holders just triggered a capitulation event that's shaking crypto markets.

The Great Unloading

Approximately 60,000 BTC moved to exchanges as sellers swallowed losses—classic panic behavior from traders who bought high and can't stomach the volatility. This massive transfer represents one of the largest loss-taking events this quarter.

Market Mechanics at Work

When weak hands fold, stronger investors typically scoop up discounted assets. The exchange inflow metric screams distribution phase, potentially setting the stage for the next accumulation cycle. History shows these flush-outs often precede significant price movements.

Wall Street's Favorite Drama

Traditional finance analysts will undoubtedly spin this as 'proof' of crypto instability—conveniently ignoring that their own markets have bailout hotlines on speed dial. Meanwhile, Bitcoin's network continues processing transactions exactly as designed.

The crypto ecosystem just performed its natural selection process. Again.

Bitcoin Short-Term Holders Are Participating In Loss-Taking

In a new post on X, CryptoQuant community analyst Maartunn has talked about the reaction to the recent Bitcoin price decline from the short-term holders (STHs).

The STHs refer to the BTC holders who purchased their coins within the past 155 days. Statistically, the longer an investor holds their coins, the less likely they become to sell them in the future. As such, the STHs with their relatively low amount of holding time are considered to represent the weak hands of the market.

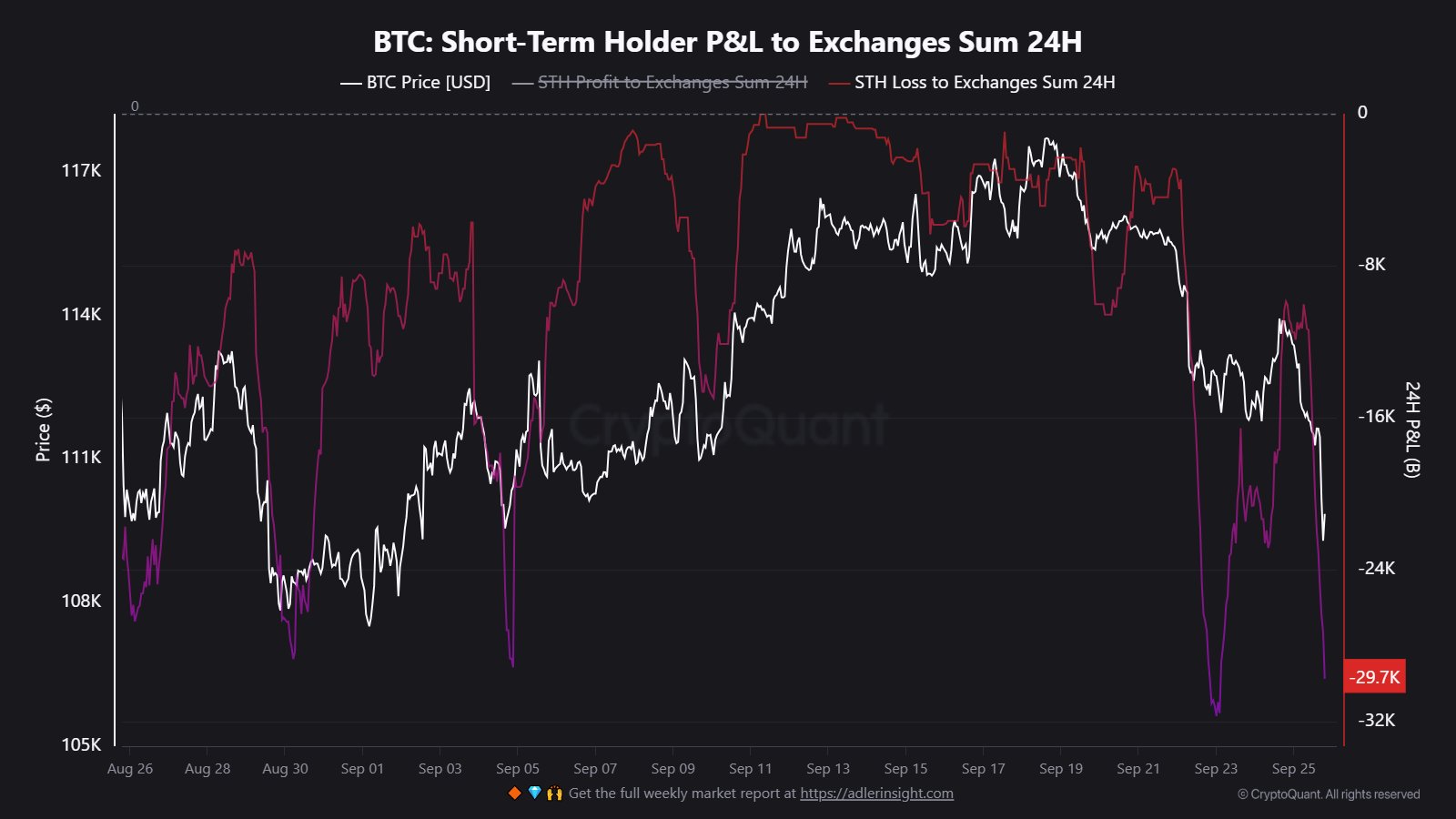

Like usual, this cohort has also panicked in the face of the latest price volatility. Below is the chart shared by Maartunn that shows the trend in the loss transactions made by the cohort’s members to wallets connected with centralized exchanges.

From the graph, it’s apparent that the bitcoin STHs deposited nearly 32,000 BTC at a loss to exchanges during the crash from earlier in the week. Generally, holders transfer their coins to exchanges when they want to make use of one of the services that they provide, which can include selling.

Considering the nature of the STHs, these loss deposits were likely made with distribution in mind. Thus, these investors reacted to the plummet by capitulating.

The latest decline in BTC’s price to levels under $109,000 has been met with a similar reaction, with the 24-hour value of the metric hitting the 29,700 tokens mark.

In total, the STHs have participated in capitulation of more than 60,000 BTC, worth a whopping $6.5 billion, across these two loss-taking waves. “That’s a clear sign of heavy stress across the market,” notes the analyst.

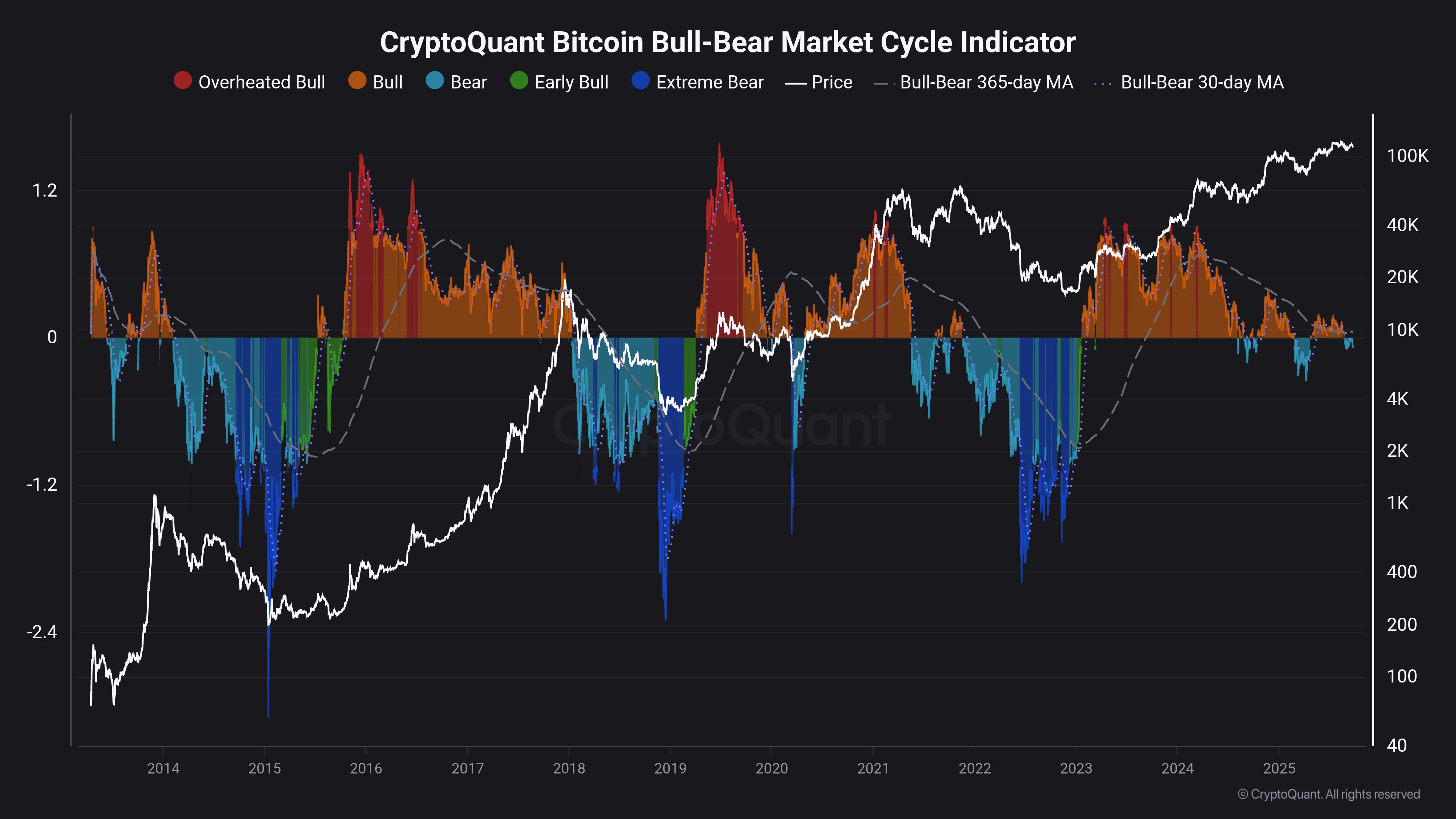

In some other news, CryptoQuant’s Bitcoin Bull-Bear Market Cycle Indicator is flashing a “bear” signal for the cryptocurrency, as Maartunn has pointed out in another X post.

The Bitcoin Bull-Bear Market Cycle Indicator uses the data of several popular on-chain metrics to determine what phase of the cycle the asset is currently in. According to the indicator, BTC is in a bearish phase at the moment.

The 365-day moving average (MA) of the metric has also been on the way down for a while now, which also doesn’t tend to be a positive signal. “Historically, most BTC gains happen when this metric is rising, not falling,” explains the analyst.

BTC Price

Bitcoin has come down to the $108,900 level following a decline of more than 5.5%.