$8B Altcoin Open Interest Crash Reveals Deeper Market Stress Beyond Bitcoin

Altcoin markets just got a brutal reality check—open interest plummeted by a staggering $8 billion as leveraged positions evaporated overnight.

The Domino Effect Hits Alternative Assets

While Bitcoin typically dominates volatility discussions, this massive OI wipeout exposes systemic fragility across secondary crypto assets. Trading desks report margin calls triggering cascade liquidations that spread faster than a meme coin hype cycle.

Derivatives Markets Flash Red

Perpetual swaps funding rates turned negative across major exchanges as longs got decimated. The velocity of the collapse suggests algorithmic trading amplified the sell-off—because nothing says 'decentralized future' like bots panic-selling digital assets at 3 AM.

Market makers widened spreads to emergency levels, creating liquidity conditions reminiscent of 2008 bank windows—just with more Elon Musk tweets and fewer suits.

Beyond the Bitcoin Bubble

This alt-specific hemorrhage reveals how quickly 'diversification' narratives crumble when real stress hits. The $8 billion evaporation proves counterparty risk remains crypto's original sin—wrapped in blockchain but still tied to the same leverage addiction that tanks traditional markets.

Maybe the real 'altcoin season' was the friends we liquidated along the way.

Altcoin Open Interest Wipeout

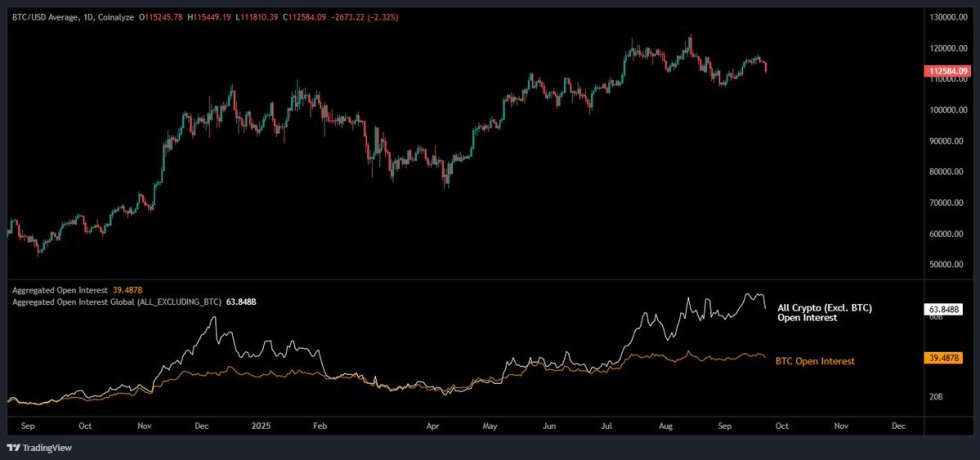

According to data shared by top analyst Maartunn, altcoins faced one of their most severe flushes in months as $8.0 billion in open interest was wiped out in a matter of hours. By comparison, Bitcoin saw a much smaller reduction of around $1.5 billion, highlighting the disproportionate impact the selloff had on altcoins. This means that traders, many of whom were highly leveraged, bore the brunt of the liquidation event.

The scale of the wipeout is telling. Altcoin open interest losses were more than five times greater than Bitcoin’s, suggesting that speculative positions in the sector were far riskier and more vulnerable to sharp downside moves. While bitcoin remains the market’s anchor, the gap between Bitcoin and the broader altcoin market is beginning to close, reflecting a shift in positioning and risk exposure.

For investors, this raises important questions. On one hand, such a dramatic flush often clears excess leverage from the system, paving the way for healthier price action in the medium term. On the other hand, the sheer scale of the altcoin losses could signal lingering fragility and the potential for further volatility if confidence does not return quickly.

The coming days will be decisive. Analysts are watching closely to see whether altcoins can stabilize around key support levels or whether bearish pressure will drive another leg lower. With Bitcoin showing relative resilience, altcoins must now prove they can withstand the shock and rebuild momentum in a market still reeling from billions in liquidations.

Total Market Cap Excluding Top 10 Analysis

The chart of the total crypto market cap excluding the top 10 coins shows that the altcoin sector is at a decisive moment. Currently valued at around $305 billion, the market has recovered significantly from the lows of 2022 and 2023 but remains far from its historical peak above $600 billion.

Price action highlights that after a prolonged consolidation, altcoins have established a steady uptrend, supported by the 50-day and 100-day moving averages, which are now sloping upward. The 200-day moving average has flattened and begun to turn positive, further signaling improving structure in the broader market. Still, the recent rejection NEAR the $320 billion resistance shows sellers remain active at higher levels.

The market’s ability to sustain above $280 billion will be critical for maintaining bullish momentum. A break below could trigger deeper retracements, but holding above this zone suggests strength and potential for expansion.

Excluding top assets like Bitcoin and Ethereum, this index reflects rising investor appetite for smaller-cap projects. The resilience of this sector despite recent volatility signals that risk appetite is returning. If broader conditions improve, altcoins outside the top 10 could lead the next phase of market growth.

Featured image from Dall-E, chart from TradingView