Perp DEX: The Next Big Bet for Future DeFi’s Liquidity Revolution

Perpetual decentralized exchanges are rewriting DeFi's liquidity playbook—and traditional finance isn't ready.

Liquidity Reimagined

Forget order books. Perp DEXes leverage virtual automated market makers to create deep, sustainable liquidity pools without massive capital lockups. They slash impermanent loss risks while offering leveraged exposure to any asset.

The Architecture Shift

Hybrid models blend off-chain price feeds with on-chain execution. Oracle-free designs now challenge the status quo—bypassing middlemen entirely. Zero slippage mechanisms attract institutional flow that once avoided DeFi.

Yield Wars Escalate

Liquidity providers earn fees from leveraged positions instead of simple swaps. Annual yields hit triple digits during volatility spikes—making traditional savings accounts look like financial artifacts.

Regulatory Shadowboxing

Watch regulators scramble to categorize what isn't technically a 'security' but prints money like one. The usual suspects already draft bills that'll be obsolete before ink dries.

DeFi's next liquidity tsunami won't come from incremental upgrades—it'll erupt from perpetual contracts eating traditional derivatives' lunch. Wall Street's loss is our alpha.

Big Players Give the “Green Light”

The rise of perp DEXs is no longer just an internal DeFi community story — it seems to be turning into a key strategic move across the entire industry. Binance CEO CZ recently mentioned Aster, a next-generation perp DEX, directly creating a Ripple effect among his 8 million followers.

Previously, Changpeng Zhao proposed a dark pool-style DEX for perpetual futures to combat front-running and enhance trade privacy. Besides, TRON founder Justin Sun actively promoted SunPerp, leveraging the Tron ecosystem to bring the product to millions of users.

These moves are not just marketing plays. They clearly signal that Perp DEXs are mature enough to become strategic destinations for major liquidity flows. When leading ecosystems step in, they bring capital and retail investor confidence, paving the way for mass adoption. This could push perp DEXs beyond their “niche” status and closer to becoming a standard liquidity venue in the broader crypto market.

Perp DEXs: DeFi’s “Secret Weapon” in the Post-CEX Era

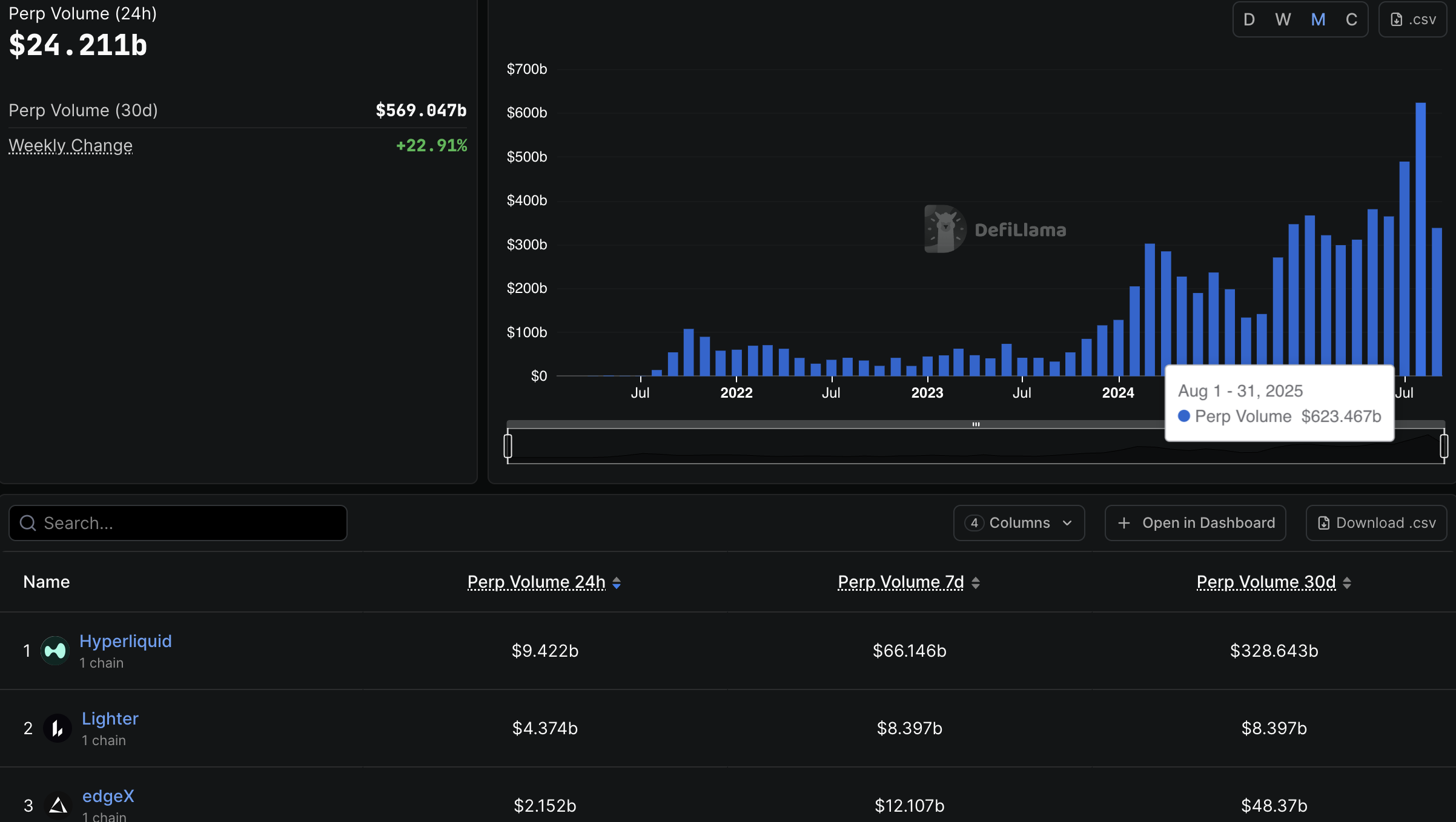

The growth trajectory of perp DEXs is nothing short of impressive. Data from DefiLlama shows that perpetual futures trading volume over the past 30 days surged to $569 billion. Total monthly volume in August reached more than $623 billion, the highest since 2022. Hyperliquid (HYPE) continues to dominate with over $329 billion in 30-day trading volume, capturing 57.8% market share.

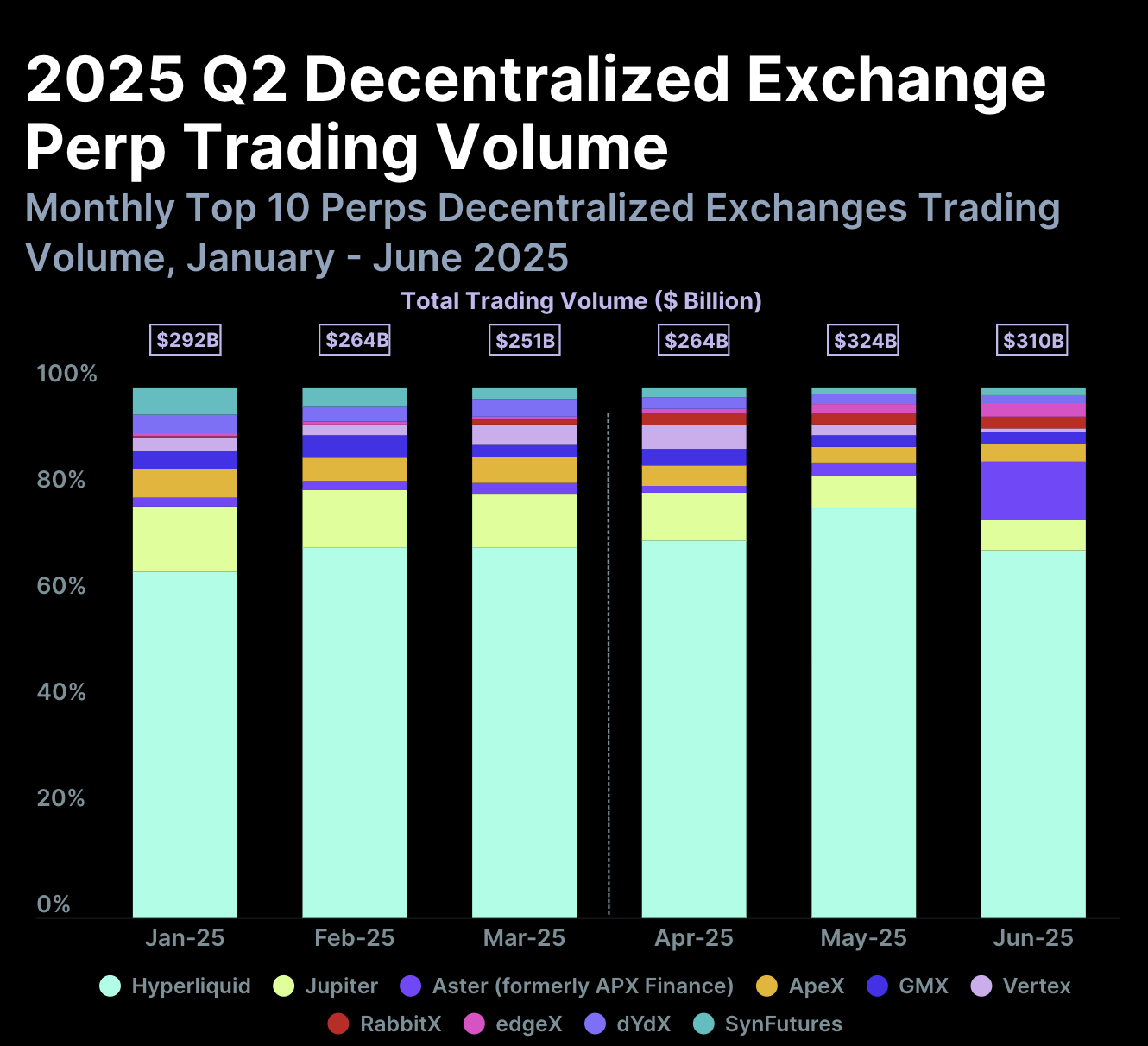

In another analysis by CoinGecko, perpetual trading volume on decentralized exchanges reached a new all-time high of $898 billion in Q2 2025. The DEX/CEX volume ratio also hit a record 0.23, reflecting a broader shift toward decentralization.

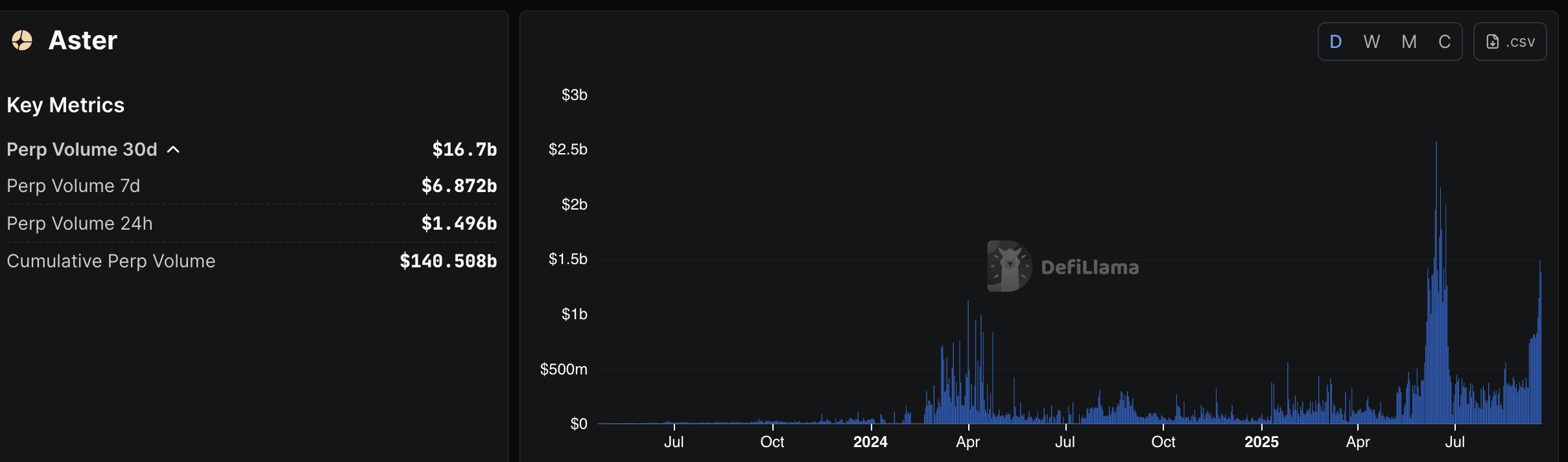

According to Dune Analytics, Hyperliquid remains the market king with a 48.7% share, recording $2.725 trillion in cumulative trading volume. Meanwhile, Aster is emerging as a notable challenger, with $140 billion in cumulative trading.

What makes perp DEXs so attractive isn’t just the growth numbers and their mechanics: low fees, high leverage, and user reward airdrops. Above all, the ability to self-custody assets on perp DEXs becomes a decisive advantage in a post-FTX world where trust in centralized exchanges has eroded.