Investors Slash Stablecoin Holdings: Bybit Reveals Where the Cash Flowed in Q3

Stablecoin exodus triggers major portfolio reshuffle—Bybit's Q3 data shows exactly where the smart money moved.

Capital Rotation Accelerates

Investors aren't just rebalancing—they're executing a full-scale strategic pivot away from stablecoin safety nets. The flight to yield is on, with institutional players leading the charge into risk-on assets.

Altcoin Allocation Surges

Capital didn't just disappear—it flooded into emerging altcoins and DeFi protocols offering real yield opportunities. The 'safe' play became the losing strategy as traders chased alpha in volatile markets.

Institutional FOMO Returns

Whale movements suggest traditional finance players are finally understanding what crypto natives knew all along—stablecoins are parking spots, not investment vehicles. The quarterly shift reveals sophisticated money positioning for the next cycle.

Because nothing says 'prudent risk management' like chasing 20% APY while pretending it's a calculated investment thesis.

Stablecoin Holdings Collapse as Solana and XRP Climb the Ranks

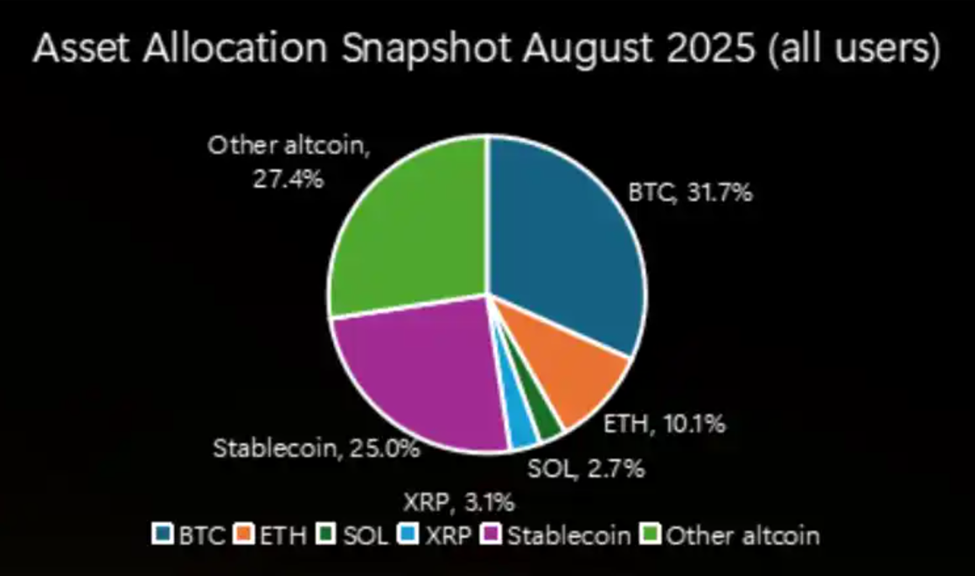

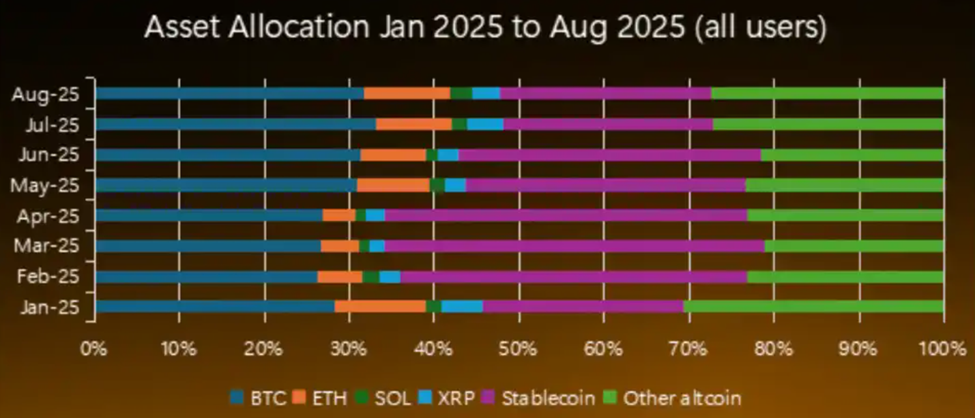

Bybit data shows that stablecoin holdings dropped from 42.7% in April to just 25% in August, a steep decline of over 20% in four months.

Institutions were the most aggressive in reallocating. Stablecoins accounted for only 17.2% of institutional portfolios, compared to 55.7% among retail traders.

“Institutions are clearly positioning to capture momentum,” the report noted.

Further, the decline in cash levels aligns with both treasury strategies applied to Bitcoin and Ethereum and whale accumulation in spot ETFs.

Of the reallocated capital, only 4% went into BTC and ETH. The vast majority was directed toward altcoins, with Solana, XRP, and decentralized exchange (DEX) tokens among the biggest winners.

According to the report, solana holdings reached their highest level in 2025. The surge came as investors anticipated that treasury strategies and institutional frameworks applied to BTC and ETH would extend to SOL.

For example, Forward Industries, a Nasdaq-listed manufacturing company, raised $1.65 billion for the Solana treasury push. Others include Sharps Technology, with the list likely to grow.

🚨BREAKING: Sharps Technology (Nasdaq: STSS) announced a $400M+ private placement, expected to close Aug 28, to establish the largest Solana treasury. The Co. signed an LOI with @Solana Foundation for a $50M $SOL purchase at a 15% discount. pic.twitter.com/5ibQ3I3o3j

— SolanaFloor (@SolanaFloor) August 25, 2025Gurufin’s analysis, shared exclusively with BeInCrypto, helps explain this trend.

With tokenization demand projected to hit $30 trillion by 2034, the firm argues that Solana and other high-throughput chains could capture outsized flows, particularly for real-world assets denominated in local currencies.

This follows Solana’s growing footprint in both ETF eligibility and derivatives markets, which have seen record trading volumes.

Meanwhile, XRP emerged as the third-largest non-stablecoin asset held on Bybit, trailing only Bitcoin and Ethereum.

Its institutional profile has strengthened this year, thanks to futures and options launches on the CME and inclusion in Grayscale’s newly approved Digital Large Cap Fund (GDLC).

Grayscale Digital Large Cap Fund $GDLC was just approved for trading along with the Generic Listing Standards. The Grayscale team is working expeditiously to bring the *FIRST* multi #crypto asset ETP to market with Bitcoin, Ethereum, XRP, Solana, and Cardano#BTC #ETH $XRP $SOL…

— Peter Mintzberg (@PeterMintzberg) September 17, 2025Meanwhile, Gurufin sees XRP’s traction as part of a broader push toward non-USD settlement rails, particularly in Asia-Pacific economies looking to diversify financial infrastructure.

Bybit data suggests investors are diversifying into XRP as part of broader altcoin allocations.

BTC and ETH Concentration Dips as Small Market-Cap Altcoins See Big Gains

Bitcoin remains the largest holding on Bybit, making up 31.7% of total assets in August, barely changed from May.

Ethereum, however, staged a notable comeback. Its share of holdings jumped 20% quarter-on-quarter (QoQ), rising from 8.4% in May to 10.1% in August.

Still, overall concentration in BTC and ETH fell from 58.8% of non-stablecoin tokens in May to 55.7% in August, reflecting a tilt toward altcoins.

Gurufin’s research adds global context. Asian regulators are laying the groundwork for local stablecoins that could underpin RWA tokenization.

“The speed and effectiveness with which APAC countries launch and regulate their own stablecoins will be crucial in shaping a decentralized digital future,” the report said.

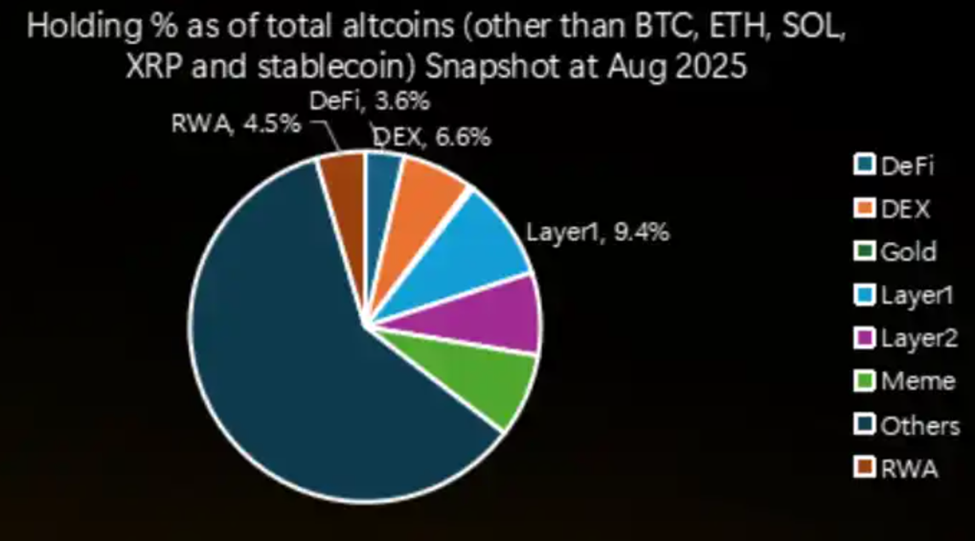

The reallocation trend benefited multiple categories beyond the top Layer-1 (L1) blockchain tokens.

DEX tokens saw their holding percentage quadruple, from 0.4% in June to 1.8% in August, making them the strongest Q3 performer of Q3.

Institutional investors were the primary drivers, increasing their exposure by 7x in just two months.

Layer-2 (L2) tokens nearly tripled their share, from 0.8% in June to 2.1% in August, while (RWA)-backed tokens also gained traction.

In contrast, meme tokens showed little movement, and tokenized Gold remained marginal despite record highs in traditional markets.

Taken together, Bybit’s Q3 report highlights a maturing allocation strategy. While bitcoin and Ethereum remain anchors, institutions cut cash reserves to diversify into higher-growth assets.

The rise of Solana, XRP, and DEX tokens reflects both confidence in the depth of the altcoin market and anticipation of regulatory green lights for ETFs and derivatives.

If stablecoin reserves remain under pressure, Q4 could see even stronger capital rotation into altcoins.