ETH, SOL, and XRP Whales Go on Feeding Frenzy After Fed’s 0.25% Rate Cut

Whale Watching: Big Money Makes Big Moves Post-Fed Decision

The 0.25% cut triggered instant action across crypto's blue chips. Ethereum whales stacked more, Solana's big players doubled down on DeFi positions, and XRP's heavy hitters repositioned for regulatory clarity.

ETH Accumulation Accelerates

Smart money flooded into Ethereum within hours of the announcement. Whales aren't just holding—they're actively accumulating at levels not seen since the last bull cycle.

SOL's DeFi Dominance

Solana's ecosystem saw massive whale activity flowing into lending protocols and perpetual exchanges. The 0.25% cut apparently wasn't enough for traditional finance yields, so they went hunting alpha in DeFi.

XRP's Strategic Shuffle

Ripple's token saw sophisticated repositioning rather than outright accumulation. Whales moved between exchanges and private wallets—classic behavior before major regulatory developments.

Because when the Fed gives you cheaper money, you buy assets that actually appreciate—unlike those 0.25% 'high-yield' savings accounts banks are still peddling.

ETH Whale Deploys $112 Million Post-Fed Cut

Just hours after the Fed announced its quarter-point cut, on-chain trackers flagged a staggering Ethereum purchase.

Whale address 0xd8d0 spent $112.34 million USDC to acquire 25,000 ETH at $4,493, according to Lookonchain.

After the Fed cut rates by 25bps, OTC whale 0xd8d0 spent 112.34M $USDC to buy 25,000 $ETH at $4,493.https://t.co/7eUZQPGfRO pic.twitter.com/Vf55M9te9e

— Lookonchain (@lookonchain) September 18, 2025The aggressive accumulation reflects renewed confidence that lower borrowing costs and a softer dollar could channel liquidity into risk assets.

Already buoyed by anticipation of staking demand and scaling upgrades, Ethereum saw an immediate uptick in whale activity. This suggests institutions are front-running a broader rally.

Another whale, address 0x96F4, separately withdrew 15,200 ETH, worth approximately $70.44 million, from the Binance exchange within two hours. This adds to speculation that accumulation is intensifying among deep-pocketed players.

Institutions Keep Stacking Solana

Solana has been no less active. Institutional brokerage FalconX withdrew 118,190 SOL worth $28.39 million from Binance, marking yet another sign of institutional confidence.

Lookonchain data shows six strategic reserve entities now hold over 1 million SOL each.

Forward Industries is in the lead, having a massive 6.82 million SOL portfolio worth $1.58 billion at an average cost of $232.

There are now 6 strategic $SOL reserve entities that each hold over 1M $SOL.

Among them, Forward Industries holds a massive 6,822,000 $SOL($1.58B), with an average purchase cost of $232. pic.twitter.com/YXs6AZmfdR

With solana futures volume hitting $22.3 billion in recent weeks, and SOL now among the assets eligible for ETF listing under the SEC’s new generic standards, demand from both institutions and whales appears positioned to strengthen.

XRP Whale Moves $50 Million to Coinbase

XRP’s activity took a different form. A whale shifted 16.4 million XRP worth over $50 million to the Coinbse exchange, which traders interpret as either profit-taking or positioning ahead of new derivatives markets.

The transfer coincided with another milestone for XRP, whose holder base hit 6.99 million in September 2025, a new all-time high (ATH).

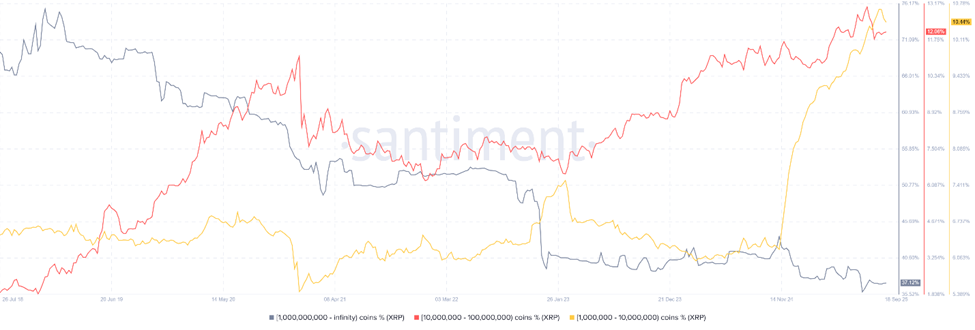

However, beneath the surface, distribution is changing. The share of supply in wallets holding over 1 billion XRP has declined, while mid-sized holders with 1 million to 1 billion XRP have surged.

This signals a structural shift from concentrated whale holdings toward broader retail participation.

XRP’s Expanding Institutional Profile

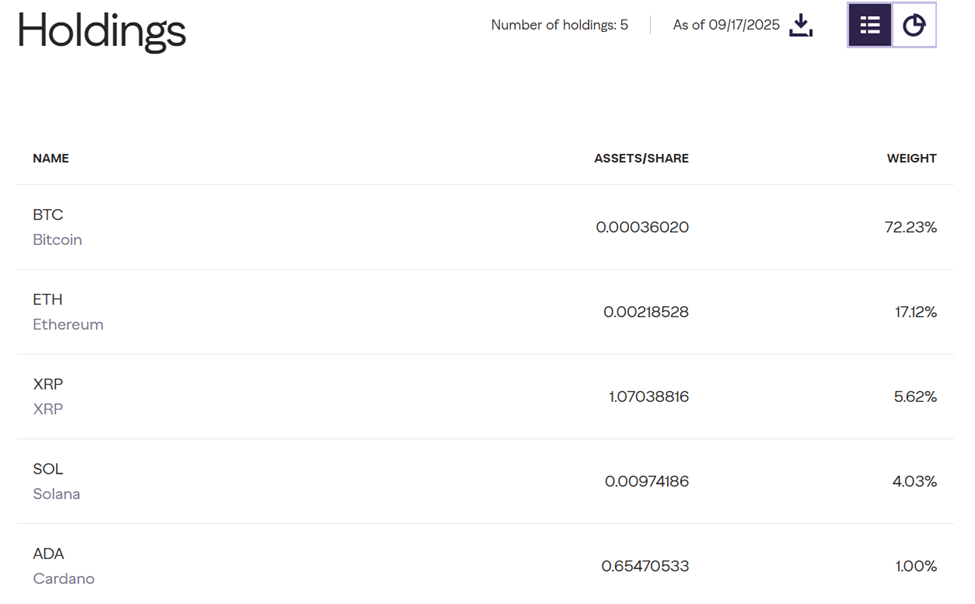

Notwithstanding, XRP continues to punch above its weight in institutional markets. It now holds the third-largest allocation in Grayscale’s Digital Large Cap Fund, recently approved under the SEC’s generic ETF listing standards.

“Grayscale Digital Large Cap Fund $GDLC was just approved for trading along with the Generic Listing Standards. The Grayscale team is working expeditiously to bring the FIRST multi-crypto asset ETP to market with Bitcoin, Ethereum, XRP, Solana, and Cardano,” wrote Grayscale CEO Peter Mintzberg.

At the same time, the CME plans to launch futures on XRP, with options debuting on October 13 pending regulatory approval.

FalconX and DRW are among the firms backing the launch, which could unlock deeper hedging tools and fresh demand from institutions. Already, XRP futures have reached $1 billion in open interest, highlighting strong liquidity.

The convergence of whale repositioning, shifting supply distribution, and expanding derivatives access paints a bullish medium-term picture.

While XRP’s short-term price remains muted, the market structure suggests a foundation is being laid for broader adoption and investor confidence.